Chainlink (LINK) Price Under Pressure: 300,000+ Exchange Inflows Spark Concerns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chainlink (LINK) Price Under Pressure: 300,000+ Exchange Inflows Spark Concerns

The price of Chainlink (LINK), a prominent decentralized oracle network, is facing significant downward pressure following a substantial influx of tokens into cryptocurrency exchanges. Data reveals over 300,000 LINK tokens have flowed into exchanges, triggering concerns among investors about potential selling pressure and a further price decline. This influx raises questions about the future trajectory of LINK's price and the overall health of the Chainlink ecosystem.

A Significant Influx: The Numbers Tell a Story

On-chain data from prominent blockchain analytics platforms showcases a considerable increase in LINK tokens deposited on major cryptocurrency exchanges. This surge, exceeding 300,000 LINK, represents a notable percentage of the total circulating supply and has understandably fueled speculation within the crypto community. While not all deposited tokens are necessarily destined for immediate sale, the sheer volume raises the likelihood of increased selling pressure in the near future. This influx is a significant development that warrants close monitoring by LINK investors and analysts alike.

What's Driving the Exchange Inflows? Possible Explanations

Several factors could be contributing to this significant increase in LINK exchange inflows. These include:

- Profit-Taking: After a period of relative price stability or modest gains, some investors might be choosing to secure profits by selling a portion of their LINK holdings.

- Market Sentiment: A broader bearish sentiment within the cryptocurrency market could be prompting investors to diversify their portfolios, leading to the sale of LINK tokens.

- Upcoming Events: Anticipation of upcoming developments, whether positive or negative, concerning Chainlink's technology or partnerships could influence investor behavior. Uncertainty often leads to cautious selling.

- Technical Analysis: Some traders might be utilizing technical analysis indicators suggesting a potential price downturn, prompting them to sell their LINK holdings preemptively.

The Impact on LINK's Price

The impact of these substantial exchange inflows on LINK's price is already visible. We've seen a noticeable dip in the token's value, underscoring the direct correlation between increased supply on exchanges and potential selling pressure. The magnitude of the price drop will depend on several factors, including the pace of selling, overall market conditions, and the strength of buying pressure from other investors.

Looking Ahead: Uncertainty and Potential Scenarios

The current situation surrounding LINK highlights the inherent volatility within the cryptocurrency market. While the large exchange inflows are cause for concern, it's crucial to avoid panic selling. The long-term prospects of Chainlink depend on several factors beyond immediate price fluctuations, including the adoption of its oracle technology by various applications and projects.

Conclusion: Monitoring the Situation is Key

The significant influx of LINK tokens into exchanges is a developing story that requires careful observation. While the immediate outlook appears bearish, it's too early to definitively predict the long-term implications. Investors are advised to monitor the situation closely, conduct thorough research, and make informed decisions based on their individual risk tolerance. The next few days and weeks will be crucial in determining the ultimate impact of these inflows on Chainlink's price and market position. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chainlink (LINK) Price Under Pressure: 300,000+ Exchange Inflows Spark Concerns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chainlink Link Price Plunges Exchange Inflows Surge Past 300 K 10 Support Threatened

May 21, 2025

Chainlink Link Price Plunges Exchange Inflows Surge Past 300 K 10 Support Threatened

May 21, 2025 -

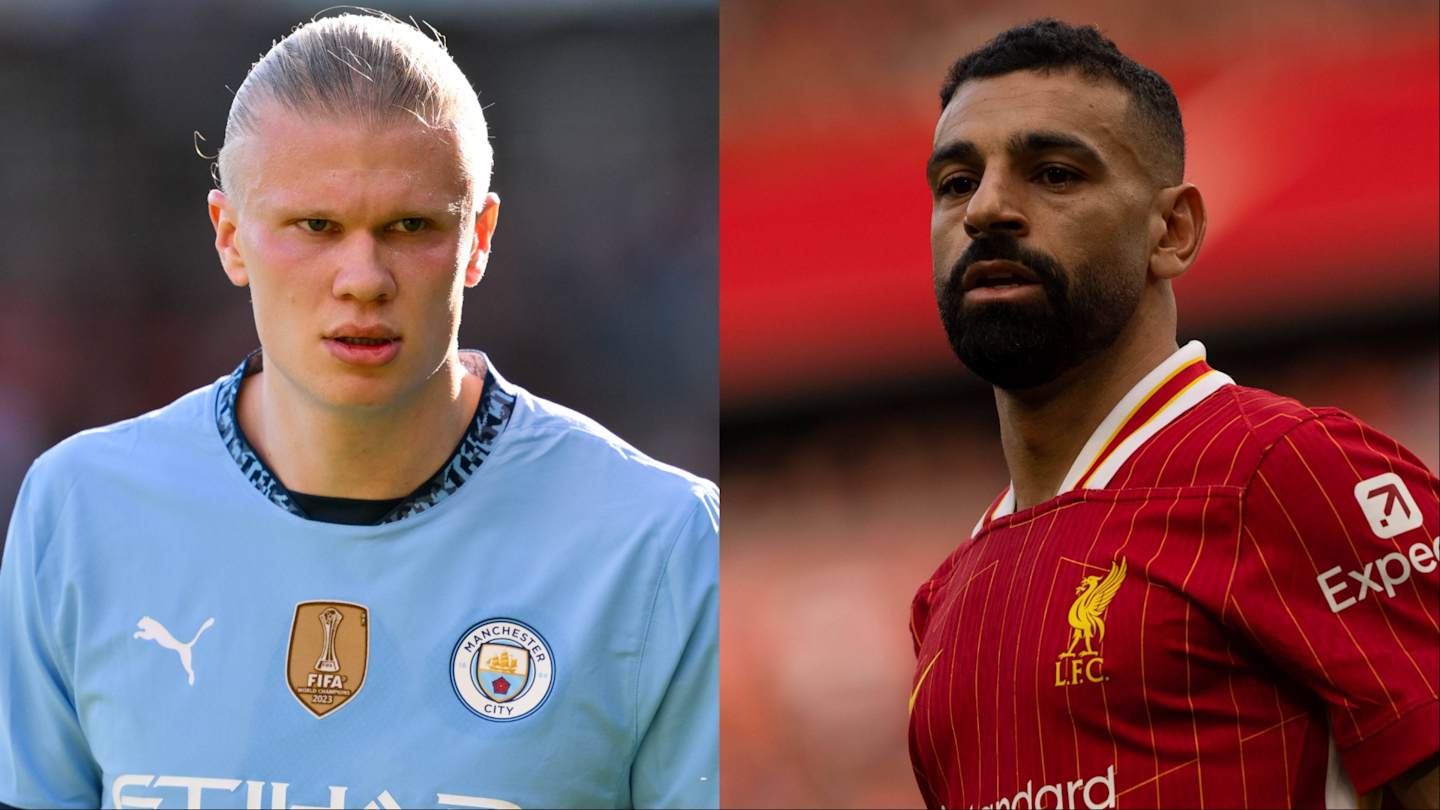

Premier League Golden Boot Latest Scores Standings And Predictions

May 21, 2025

Premier League Golden Boot Latest Scores Standings And Predictions

May 21, 2025 -

Crystal Palace Extends Winning Run Ezes Goal The Highlight

May 21, 2025

Crystal Palace Extends Winning Run Ezes Goal The Highlight

May 21, 2025 -

Red Sox And Astros Trade Rumors Is A Deal For Roman Anthony Realistic

May 21, 2025

Red Sox And Astros Trade Rumors Is A Deal For Roman Anthony Realistic

May 21, 2025 -

Sia Engineerings S 1 3 Billion Deal A Boost For Singapores Aviation Sector

May 21, 2025

Sia Engineerings S 1 3 Billion Deal A Boost For Singapores Aviation Sector

May 21, 2025