Chargeback Fraud To Cost Businesses $15 Billion By 2025: Mastercard's Urgent Warning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chargeback Fraud to Cost Businesses $15 Billion by 2025: Mastercard's Urgent Warning

Mastercard's stark prediction highlights the escalating threat of chargeback fraud, urging businesses to bolster their fraud prevention strategies.

The cost of chargeback fraud is set to skyrocket, with Mastercard issuing a dire warning that businesses could face a staggering $15 billion in losses by 2025. This alarming forecast underscores the urgent need for businesses of all sizes to strengthen their fraud prevention measures and adapt to the evolving tactics employed by cybercriminals. The sheer scale of the predicted losses highlights the significant impact this type of financial crime is having on the global economy.

The increasing sophistication of online fraud techniques is a major contributing factor to this projected surge. Cybercriminals are constantly developing new methods to exploit vulnerabilities in online payment systems, making it more difficult for businesses to identify and prevent fraudulent transactions. This includes everything from sophisticated phishing scams to the exploitation of vulnerabilities in e-commerce platforms.

Understanding the Chargeback Process and its Costs

A chargeback occurs when a cardholder disputes a transaction with their bank, resulting in the merchant losing the payment and potentially incurring additional fees. While legitimate chargebacks do occur, a significant portion are fraudulent, often stemming from:

- Friendly Fraud: Where the cardholder initiates a chargeback despite receiving the goods or services. This can be driven by buyer's remorse, a desire to avoid payment, or simply a misunderstanding.

- Stolen Card Fraud: Where a criminal uses a stolen credit card to make unauthorized purchases.

- Synthetic Identity Fraud: A more complex form involving the creation of fake identities to make fraudulent purchases.

These fraudulent chargebacks significantly impact a business's bottom line, leading to:

- Direct Financial Loss: The immediate loss of the transaction amount.

- Chargeback Fees: Fees levied by the card network for processing the chargeback.

- Administrative Costs: The time and resources spent investigating and responding to chargebacks.

- Reputational Damage: Repeated chargebacks can negatively impact a business's reputation and customer trust.

Mastercard's Recommendations for Mitigation

Mastercard's warning isn't just a prediction; it's a call to action. The company recommends businesses implement several key strategies to mitigate the risk of chargeback fraud:

- Robust Fraud Prevention Systems: Invest in advanced fraud detection tools that utilize machine learning and AI to identify suspicious transactions in real-time.

- Stronger Customer Authentication: Implement strong customer authentication (SCA) methods, such as 3D Secure, to verify the cardholder's identity.

- Thorough Order Verification: Implement strict order verification processes to minimize friendly fraud, including thorough address verification and order tracking.

- Clear Refund Policies: Establish clear and transparent refund policies to address legitimate customer disputes and reduce the likelihood of fraudulent chargebacks.

- Regular Security Audits: Conduct regular security audits to identify and address vulnerabilities in your payment processing systems.

- Employee Training: Train employees on best practices for handling sensitive customer information and identifying potentially fraudulent transactions.

The Future of Chargeback Fraud Prevention

The fight against chargeback fraud is an ongoing battle, requiring businesses to stay ahead of evolving criminal tactics. By proactively implementing robust security measures and staying informed about the latest threats, businesses can significantly reduce their risk and protect their bottom line. The $15 billion figure isn't just a statistic; it's a wake-up call. Ignoring this escalating threat could prove devastating for businesses in the years to come. Proactive investment in prevention is not merely a cost; it's a crucial investment in the future of your business.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chargeback Fraud To Cost Businesses $15 Billion By 2025: Mastercard's Urgent Warning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

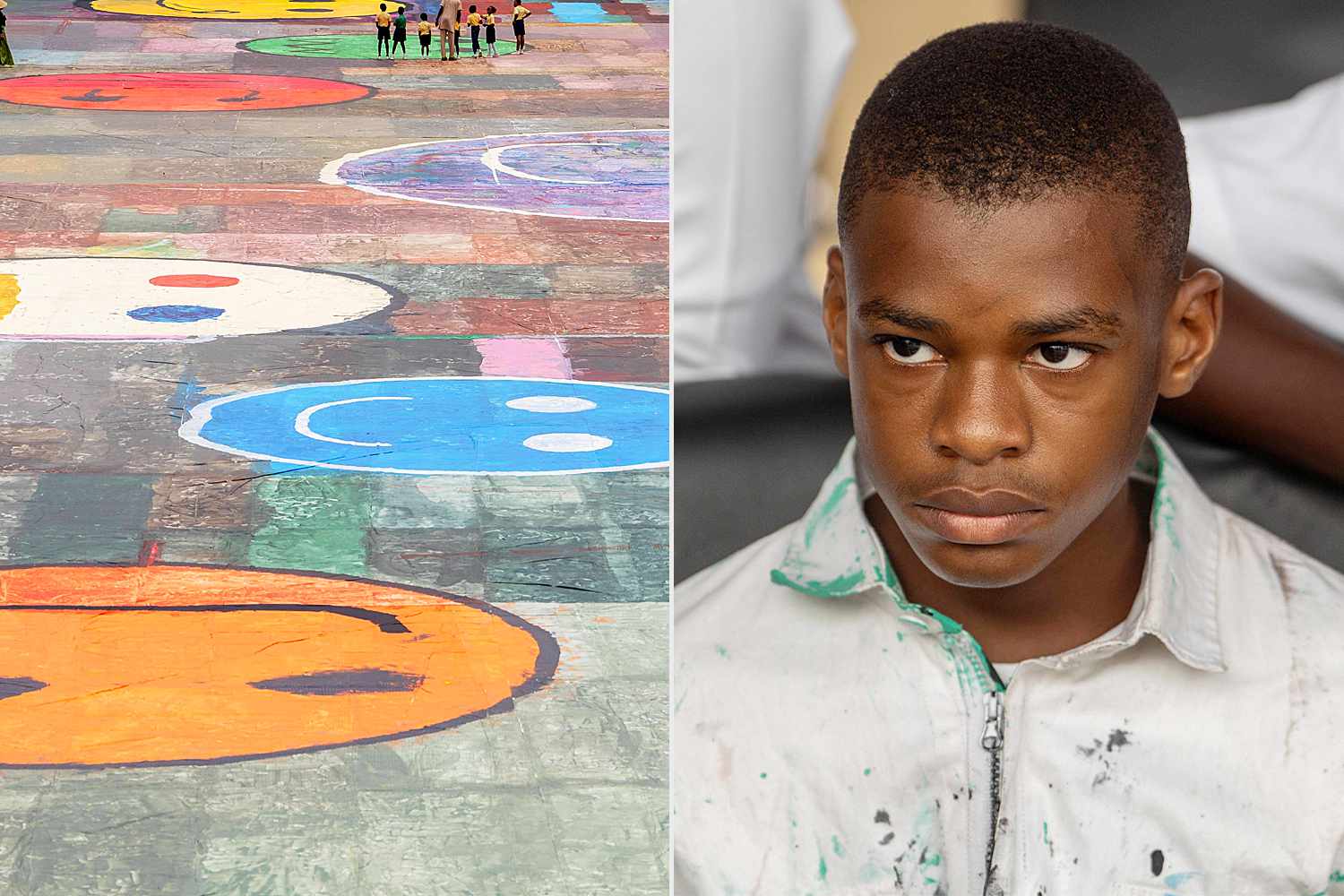

Guinness World Record Largest Canvas Painted By Autistic Teenager

May 05, 2025

Guinness World Record Largest Canvas Painted By Autistic Teenager

May 05, 2025 -

The All In One Smartphone Projector High Resolution Night Camera And More

May 05, 2025

The All In One Smartphone Projector High Resolution Night Camera And More

May 05, 2025 -

Olympic Ties The Defining Factor In Green And Pops Basketball Partnership

May 05, 2025

Olympic Ties The Defining Factor In Green And Pops Basketball Partnership

May 05, 2025 -

Wh 1000 Xm 6 New Leaks Suggest Price And Design Changes

May 05, 2025

Wh 1000 Xm 6 New Leaks Suggest Price And Design Changes

May 05, 2025 -

Who Killed Vron In Mob Land Conrads Claim Shakes The Underworld

May 05, 2025

Who Killed Vron In Mob Land Conrads Claim Shakes The Underworld

May 05, 2025