Cheap Nasdaq Stocks: Comparing Palo Alto Networks And Nvidia After The Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cheap Nasdaq Stocks: Palo Alto Networks vs. Nvidia After the Recent Sell-Off

The recent market downturn has presented investors with a unique opportunity: acquiring high-growth tech stocks at discounted prices. Two prominent names among the cheaper Nasdaq stocks currently attracting attention are Palo Alto Networks (PANW) and Nvidia (NVDA). Both companies, while still commanding significant market capitalization, have experienced sell-offs, leaving many wondering which presents the better investment opportunity. This analysis compares Palo Alto Networks and Nvidia, examining their post-sell-off valuations and future growth prospects.

The Sell-Off: A Deeper Dive

Both PANW and NVDA have seen their stock prices decline in recent months, driven by a confluence of factors including broader market volatility, concerns about rising interest rates, and sector-specific headwinds. However, the reasons behind the sell-off differ subtly for each company. For Nvidia, concerns around slowing demand for gaming GPUs and potential competition in the AI chip market played a role. Palo Alto Networks, meanwhile, faced scrutiny related to its valuation relative to its growth trajectory.

Palo Alto Networks (PANW): Cybersecurity Strength

Palo Alto Networks is a leading cybersecurity firm offering a comprehensive suite of products and services protecting businesses from evolving cyber threats. The company's strong market position, consistent revenue growth, and expanding customer base make it a compelling investment.

- Strengths: Dominant market share in next-generation firewalls, strong recurring revenue stream through subscriptions, and a robust product portfolio catering to diverse cybersecurity needs.

- Weaknesses: High valuation (even after the sell-off), potential competition from smaller, more agile cybersecurity players, and dependence on enterprise spending.

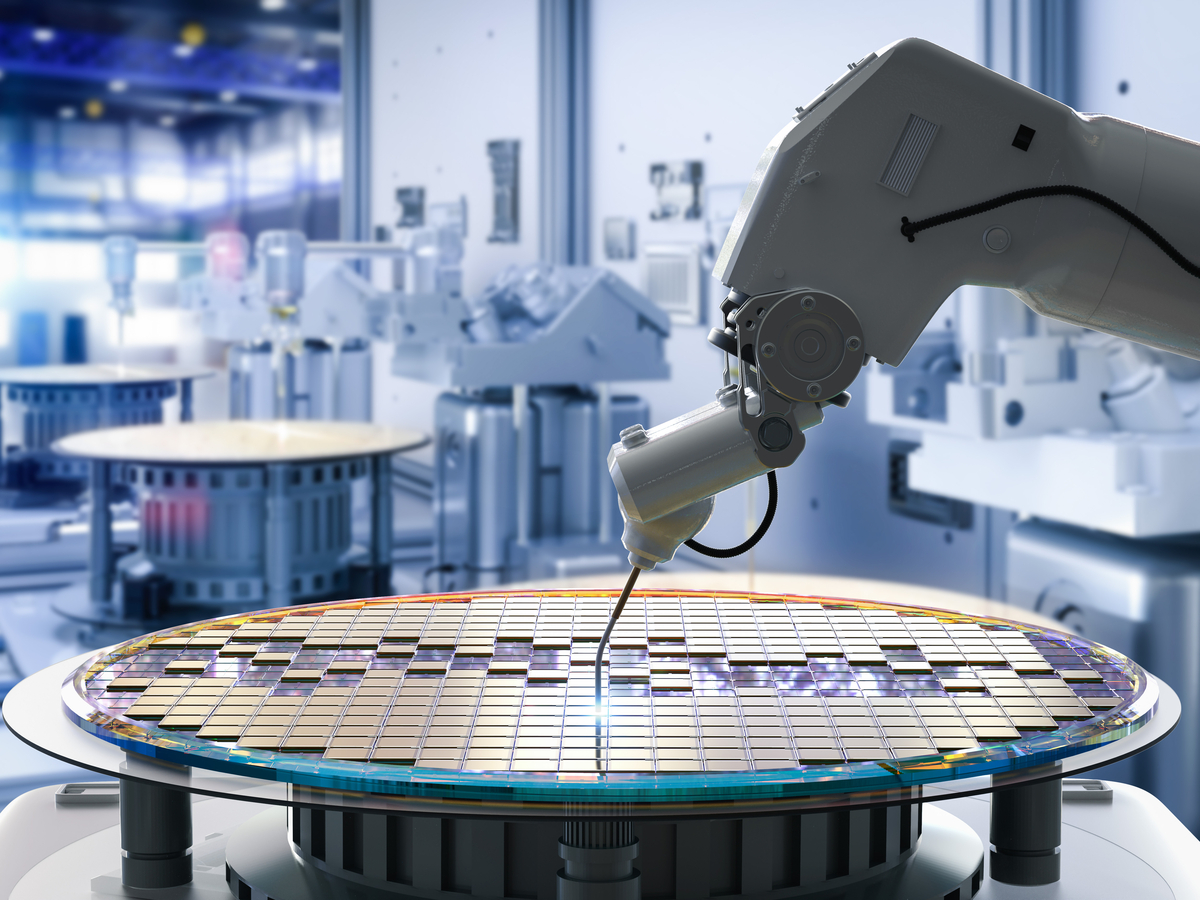

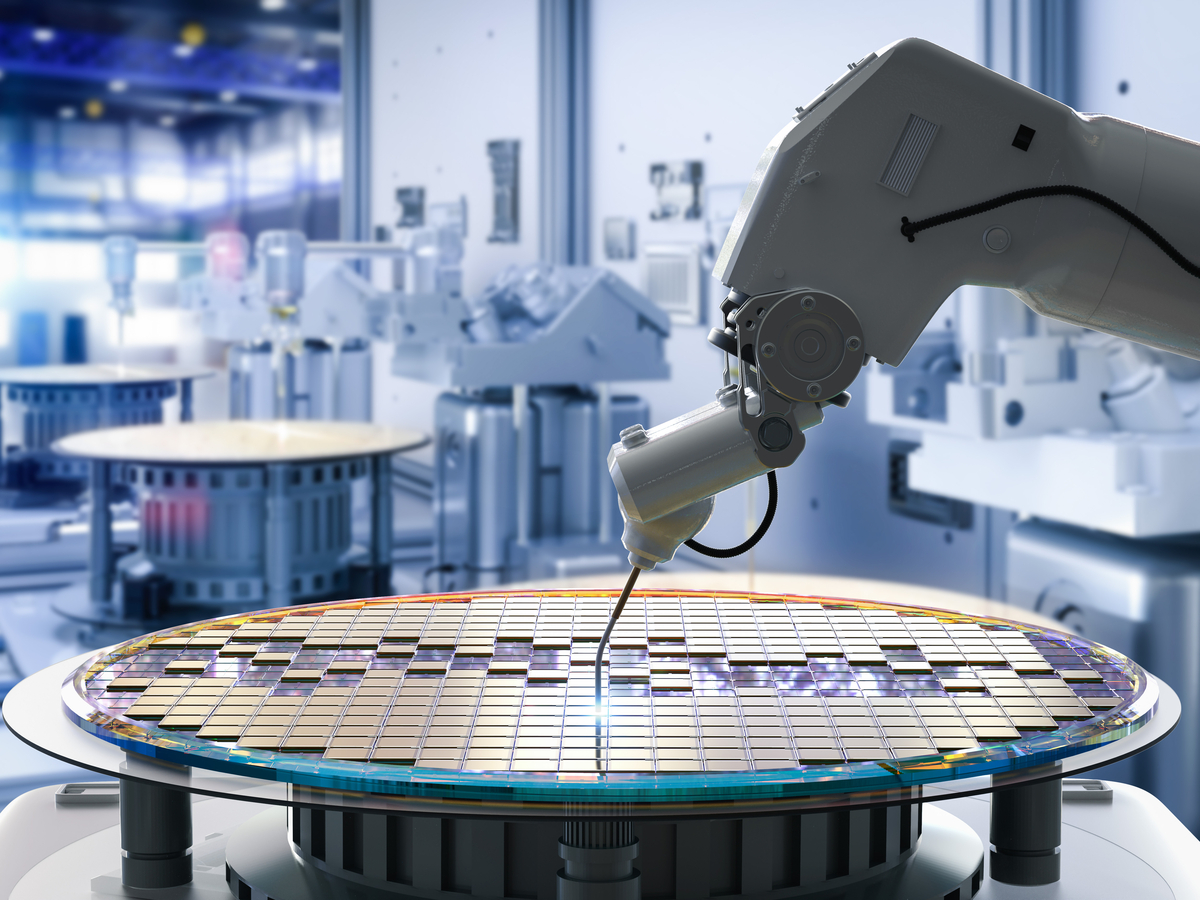

Nvidia (NVDA): The AI Powerhouse

Nvidia, a titan in the graphics processing unit (GPU) market, is increasingly recognized as a key player in the burgeoning field of artificial intelligence. Its GPUs are crucial for training and deploying AI models, driving substantial demand and growth.

- Strengths: Dominant market share in high-performance computing (HPC) and gaming GPUs, pivotal role in the AI revolution, and significant potential for future growth in AI-related applications.

- Weaknesses: Vulnerability to fluctuations in gaming market demand, intense competition in the GPU market, and dependence on specific industries for revenue.

Comparing the Two: Which is Cheaper?

While both stocks have experienced price corrections, determining which is truly "cheaper" requires a deeper analysis than simply looking at the current share price. Key metrics like Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and projected future growth rates need to be considered. It's crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Currently, both stocks present potentially attractive entry points for long-term investors, though the optimal choice will depend on individual risk tolerance and investment goals.

The Long-Term Outlook: A Cautious Optimism

Both Palo Alto Networks and Nvidia are strong companies with promising long-term growth potential. While short-term market fluctuations are inevitable, the fundamental strengths of both companies remain intact. The current sell-off offers a potentially compelling opportunity for investors with a longer-term perspective and a high risk tolerance. However, it's vital to remember that no investment is without risk. The technology sector is inherently volatile, and both PANW and NVDA are susceptible to macroeconomic shifts and competitive pressures.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cheap Nasdaq Stocks: Comparing Palo Alto Networks And Nvidia After The Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sea Derby Thriller Benzemas Dramatic Equalizer Steals Point

Apr 08, 2025

Sea Derby Thriller Benzemas Dramatic Equalizer Steals Point

Apr 08, 2025 -

Hama Tikus Di Ikn Ancaman Terhadap Pembangunan Ibu Kota Negara Baru

Apr 08, 2025

Hama Tikus Di Ikn Ancaman Terhadap Pembangunan Ibu Kota Negara Baru

Apr 08, 2025 -

Space Xs Super Heavy Booster 14 Preparations For Flight 9 Relaunch

Apr 08, 2025

Space Xs Super Heavy Booster 14 Preparations For Flight 9 Relaunch

Apr 08, 2025 -

Louisa Lytton Speaks Out The Truth Behind Her East Enders Departure

Apr 08, 2025

Louisa Lytton Speaks Out The Truth Behind Her East Enders Departure

Apr 08, 2025 -

Negotiating A Way Out Resolving The Impact Of Trumps Penguin And Vaccine Tariffs

Apr 08, 2025

Negotiating A Way Out Resolving The Impact Of Trumps Penguin And Vaccine Tariffs

Apr 08, 2025