Cheaper After Nasdaq Drop: Palo Alto Networks Or Nvidia? A Stock Comparison

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cheaper After Nasdaq Drop: Palo Alto Networks or Nvidia? A Stock Comparison

The recent Nasdaq drop has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks (PANW) and Nvidia (NVDA), have seen significant price corrections, presenting a potential buying opportunity. But which stock offers the better value proposition after this market downturn? This comparison analyzes both companies, considering their fundamentals, growth prospects, and current valuations to help you make an informed investment decision.

Understanding the Market Dip: The recent decline in the Nasdaq, driven by factors like rising interest rates and concerns about inflation, has impacted even the most robust tech companies. While both PANW and NVDA experienced drops, their underlying businesses remain strong, making this a potentially attractive time for long-term investors.

Palo Alto Networks (PANW): Cybersecurity Strength

Palo Alto Networks is a leading cybersecurity company providing a comprehensive suite of security solutions for businesses of all sizes. Their strong position in the rapidly expanding cybersecurity market is a key driver of their growth.

Strengths of PANW:

- Market Leader: PANW holds a significant market share in the enterprise cybersecurity sector.

- Recurring Revenue: A large portion of their revenue comes from recurring subscriptions, providing predictable and stable income streams.

- Innovation: The company consistently invests in research and development, leading to innovative solutions and maintaining its competitive edge.

- Strong Financials: PANW generally demonstrates solid financial performance, with consistent revenue growth and profitability.

Weaknesses of PANW:

- High Valuation: Even after the recent drop, PANW's valuation might still be considered high compared to some competitors.

- Competition: The cybersecurity market is competitive, with several established players and emerging startups vying for market share.

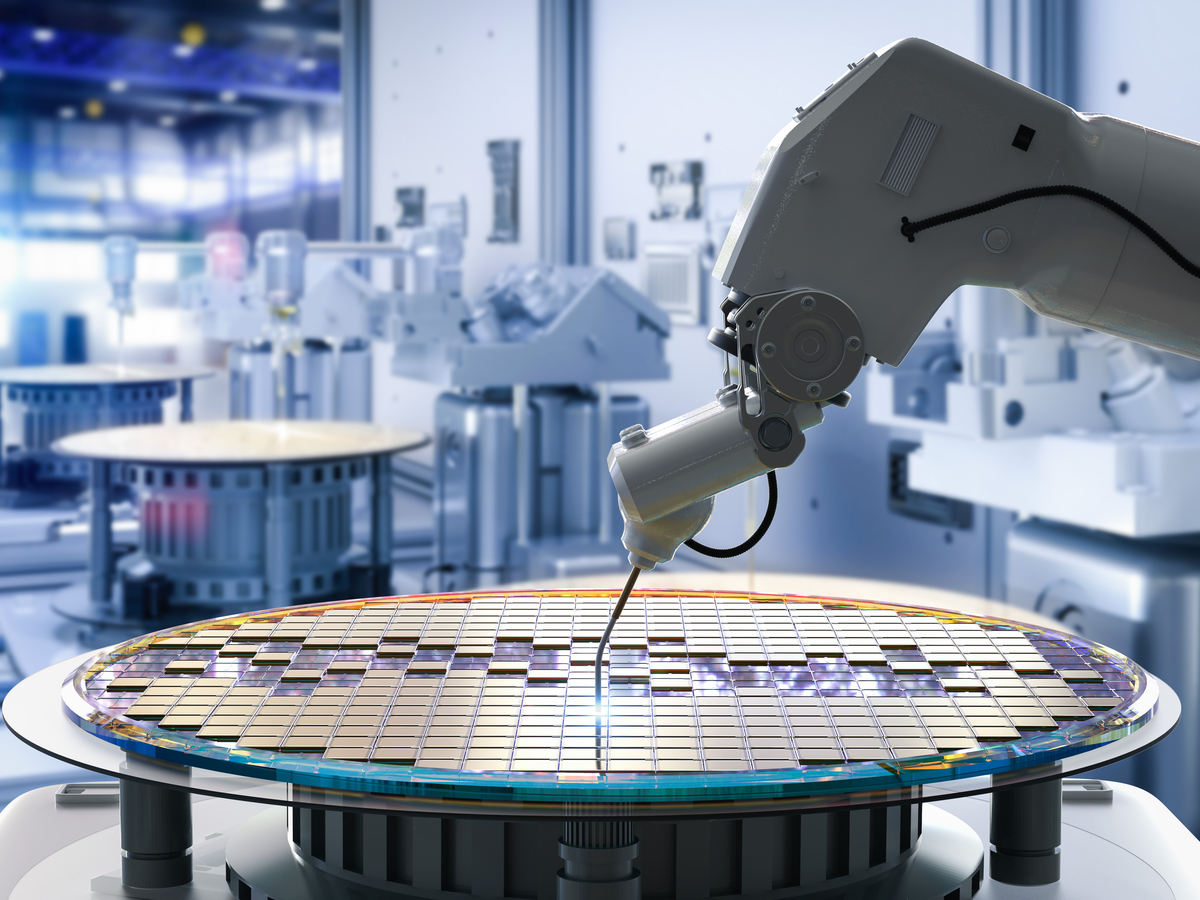

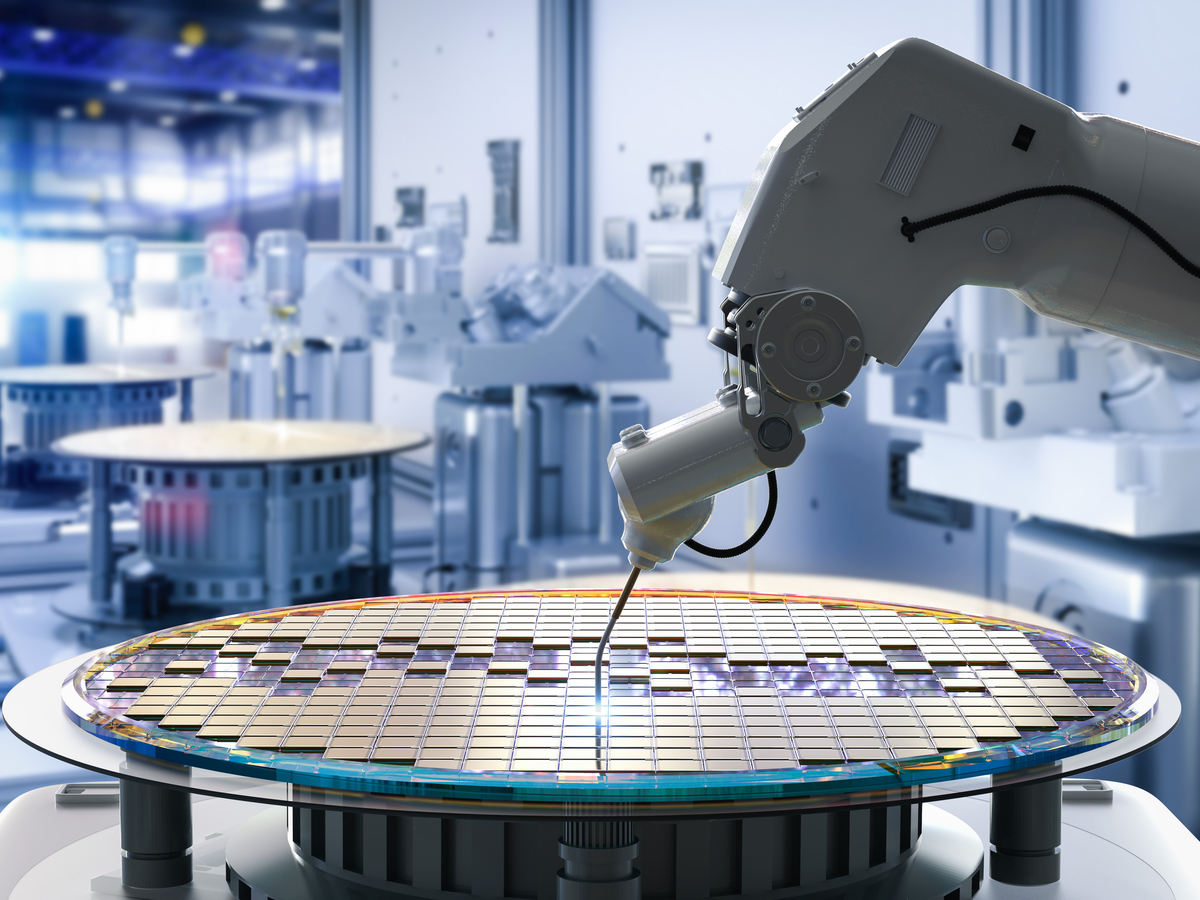

Nvidia (NVDA): The AI Powerhouse

Nvidia is a dominant player in the graphic processing unit (GPU) market, crucial for artificial intelligence (AI), gaming, and data centers. The explosive growth of AI is a major catalyst for NVDA's future potential.

Strengths of NVDA:

- AI Dominance: NVDA's GPUs are essential for training and deploying AI models, making them a key beneficiary of the AI boom.

- Data Center Growth: The increasing demand for data center infrastructure significantly fuels NVDA's revenue growth.

- High Growth Potential: The long-term growth prospects for AI are immense, suggesting significant potential for NVDA's future.

Weaknesses of NVDA:

- High Volatility: NVDA's stock price is known for its volatility, influenced by the ever-changing AI landscape and market sentiment.

- Dependence on AI: NVDA's success is heavily reliant on the continued growth of the AI market. Any slowdown in AI adoption could negatively impact the company.

The Verdict: PANW vs. NVDA After the Nasdaq Drop

Choosing between PANW and NVDA after the Nasdaq dip depends on your risk tolerance and investment horizon.

-

For conservative investors seeking relative stability and predictable growth: Palo Alto Networks (PANW) presents a compelling case. Its strong market position in a crucial sector, combined with recurring revenue streams, offers a more defensive investment strategy.

-

For investors with a higher risk tolerance and a longer-term perspective seeking potentially higher returns: Nvidia (NVDA) remains an attractive option, capitalizing on the explosive potential of the AI revolution. However, be prepared for greater price volatility.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. The stock market involves inherent risks, and investors may lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cheaper After Nasdaq Drop: Palo Alto Networks Or Nvidia? A Stock Comparison. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jacques Villeneuve Observes Uncharacteristic Change In F1 Drivers Behavior

Apr 07, 2025

Jacques Villeneuve Observes Uncharacteristic Change In F1 Drivers Behavior

Apr 07, 2025 -

Trumps Tariffs Trigger Stock Market Crash Erasing Rs 20 16 Lakh Crore

Apr 07, 2025

Trumps Tariffs Trigger Stock Market Crash Erasing Rs 20 16 Lakh Crore

Apr 07, 2025 -

Team Name Vs Power Tactical Analysis And Team Selection Strategy

Apr 07, 2025

Team Name Vs Power Tactical Analysis And Team Selection Strategy

Apr 07, 2025 -

Substantial Risks To Australian Economic Growth Amidst Global Trade Tensions

Apr 07, 2025

Substantial Risks To Australian Economic Growth Amidst Global Trade Tensions

Apr 07, 2025 -

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025

Analysis Bitcoin Btc Market Cooling 100 K Milestone In Jeopardy

Apr 07, 2025