Cheaper After Nasdaq Drop: Palo Alto Networks Stock Or Nvidia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cheaper After Nasdaq Drop: Palo Alto Networks Stock or Nvidia?

The recent Nasdaq dip has left many investors wondering which tech giants offer the best value. Two prominent names, Palo Alto Networks (PANW) and Nvidia (NVDA), have both experienced price corrections, presenting a compelling opportunity for savvy investors. But which stock offers a more compelling entry point after this market downturn? Let's delve into a comparison to help you make an informed decision.

The Nasdaq Dip and its Impact:

The recent decline in the Nasdaq Composite Index has created ripples across the tech sector, impacting even industry leaders like Palo Alto Networks and Nvidia. While both companies remain fundamentally strong, the market correction has lowered their share prices, making them potentially more attractive to buyers seeking long-term growth. Understanding the specific reasons behind the drop for each company is crucial for evaluating their current value.

Palo Alto Networks (PANW): Cybersecurity Strength Amidst Uncertainty

Palo Alto Networks, a leader in cybersecurity solutions, offers a robust and diversified product portfolio. Their focus on cloud security, network security, and endpoint protection positions them well for continued growth in the ever-expanding cybersecurity market.

- Strengths: Strong market position, recurring revenue model, expanding product offerings, and consistent growth in cloud security subscriptions.

- Weaknesses: High valuation compared to some competitors, dependence on enterprise spending, and potential competition from emerging players.

- Post-Nasdaq Drop Opportunity: The recent price drop presents an opportunity to acquire a stake in a company with a strong track record and a promising future in the crucial cybersecurity sector.

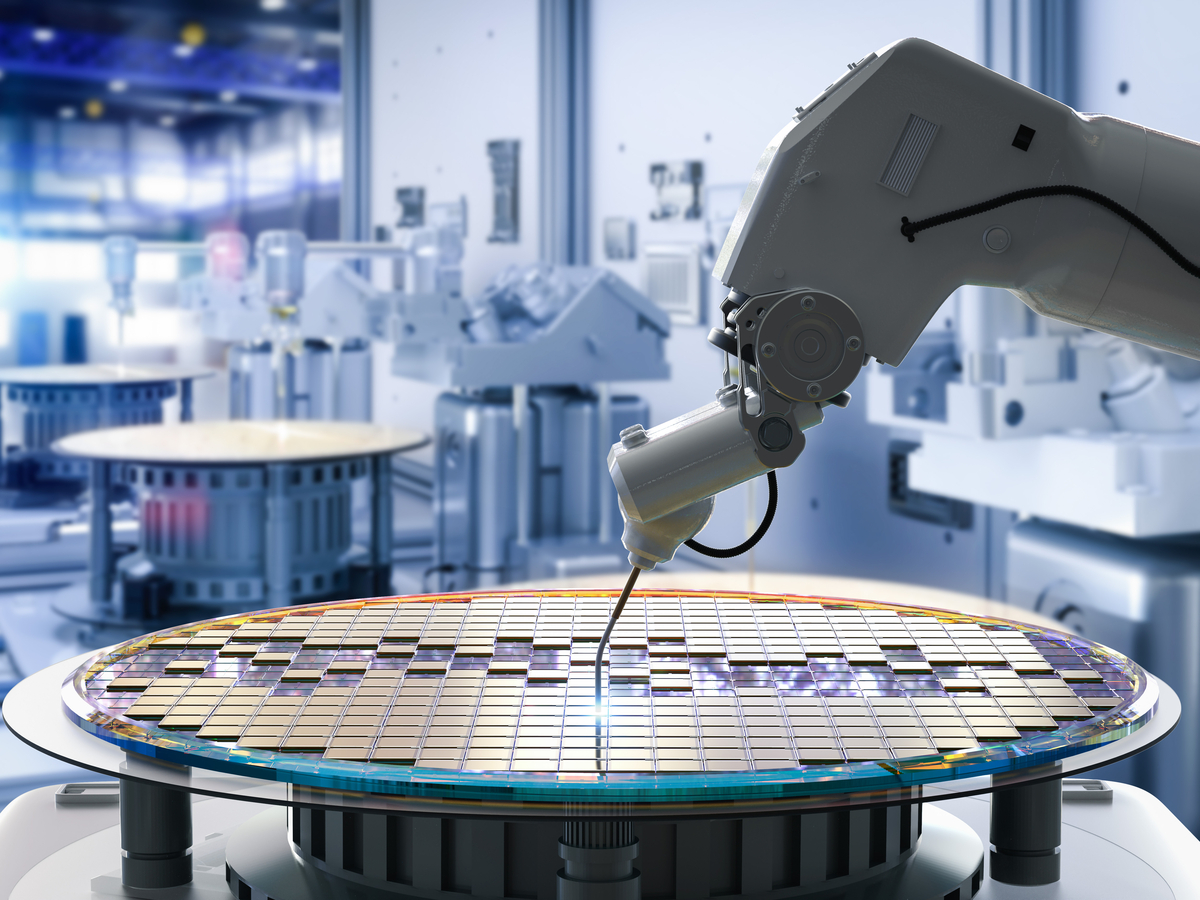

Nvidia (NVDA): A Dominant Force in AI and Gaming

Nvidia, a powerhouse in the graphics processing unit (GPU) market, dominates the gaming and artificial intelligence (AI) landscapes. Their high-performance GPUs are essential for AI development, data centers, and gaming systems, creating a strong foundation for continued growth.

- Strengths: Dominant market share in GPUs, crucial role in the booming AI sector, strong brand recognition, and consistent innovation.

- Weaknesses: Dependence on the semiconductor industry, potential supply chain disruptions, and vulnerability to macroeconomic factors.

- Post-Nasdaq Drop Opportunity: The recent price correction might offer a chance to acquire shares in a company at a potentially more attractive valuation, given its leading position in AI and gaming.

Head-to-Head Comparison: PANW vs. NVDA

Choosing between Palo Alto Networks and Nvidia depends on your individual investment strategy and risk tolerance.

| Feature | Palo Alto Networks (PANW) | Nvidia (NVDA) |

|---|---|---|

| Sector | Cybersecurity | Semiconductor, AI |

| Growth Potential | High, but potentially slower than NVDA | Very High, but potentially more volatile |

| Risk | Moderate | Higher |

| Valuation | Relatively High | Potentially more attractive post-correction |

Conclusion: Making the Right Choice

Both Palo Alto Networks and Nvidia present intriguing investment opportunities following the Nasdaq dip. However, Nvidia's higher growth potential comes with higher risk, while Palo Alto Networks offers a more stable, albeit potentially slower-growth, investment.

Investors seeking higher potential returns but with a higher risk tolerance may lean towards Nvidia. Those prioritizing stability and less volatility might prefer Palo Alto Networks. Ultimately, conducting thorough due diligence, considering your own investment goals, and consulting with a financial advisor are crucial steps before making any investment decisions. Remember, past performance is not indicative of future results. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cheaper After Nasdaq Drop: Palo Alto Networks Stock Or Nvidia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cold Message Wbc Rejects Bivols Lawyers Plea To Surrender Championship

Apr 08, 2025

Cold Message Wbc Rejects Bivols Lawyers Plea To Surrender Championship

Apr 08, 2025 -

La Angels Offense Unleashed Crushing Victory Against Cleveland Guardians

Apr 08, 2025

La Angels Offense Unleashed Crushing Victory Against Cleveland Guardians

Apr 08, 2025 -

Three Games Three Home Runs Mike Trouts Power On Full Display

Apr 08, 2025

Three Games Three Home Runs Mike Trouts Power On Full Display

Apr 08, 2025 -

Cutting The Cord Can A Single Streaming App Replace Everything

Apr 08, 2025

Cutting The Cord Can A Single Streaming App Replace Everything

Apr 08, 2025 -

Mary Berry Worthy Cakes My Experience At A Charming Seaside Tearoom

Apr 08, 2025

Mary Berry Worthy Cakes My Experience At A Charming Seaside Tearoom

Apr 08, 2025