Chee Hong Tat On GST Hike: A Necessary Evil For Singapore's Future?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chee Hong Tat on GST Hike: A Necessary Evil for Singapore's Future?

Singapore's Finance Minister, Chee Hong Tat, recently defended the upcoming Goods and Services Tax (GST) hike, framing it as a crucial measure to secure the nation's long-term prosperity. The increase, set to rise from 7% to 8% in 2023 and further to 9% in 2024, has sparked considerable debate amongst Singaporeans, with many questioning its necessity and impact on their cost of living. But is it truly a necessary evil, as the Minister suggests? Let's delve into the arguments.

The Government's Rationale: Securing Singapore's Future

Chee Hong Tat has consistently emphasized the need for increased government revenue to fund crucial social programs and infrastructure projects. The aging population, rising healthcare costs, and the need for continuous investment in infrastructure are key factors driving the GST hike. The government argues that the current tax revenue is insufficient to meet these burgeoning demands, leaving Singapore vulnerable to future economic shocks.

- Aging Population: Singapore faces a rapidly aging population, placing increasing strain on healthcare and social security systems. The GST hike is presented as a means to ensure the sustainability of these vital services.

- Healthcare Costs: The cost of healthcare is escalating globally, and Singapore is no exception. The government needs substantial funding to maintain and upgrade its healthcare infrastructure and ensure affordable healthcare for its citizens.

- Infrastructure Development: Continuous investment in infrastructure is essential for Singapore's economic competitiveness. This includes upgrading public transport, building new housing, and investing in digital infrastructure.

Public Concerns: The Squeeze on Household Budgets

The GST hike, however, has been met with significant public concern. Many Singaporeans are already feeling the pinch of rising living costs, and the additional tax burden is seen as exacerbating an already challenging situation.

- Increased Cost of Living: The GST applies to a wide range of goods and services, meaning the increase will directly impact household budgets, particularly for lower-income families.

- Inflationary Pressures: The GST hike is expected to contribute to inflationary pressures, further squeezing consumer spending and potentially slowing down economic growth.

- Impact on Vulnerable Groups: The government has announced various assistance packages to mitigate the impact on lower-income households, but concerns remain about the effectiveness and adequacy of these measures.

The Debate Continues: Finding a Balance

The debate surrounding the GST hike highlights the complex balancing act faced by the Singaporean government. While the need for increased revenue to fund essential services is undeniable, the potential negative impact on the cost of living and economic growth cannot be ignored. The government's commitment to providing support for vulnerable groups is crucial, and the effectiveness of these measures will be closely scrutinized in the coming months and years.

Beyond the GST: Exploring Alternative Solutions

While the GST hike is presented as a necessary measure, some argue that the government should explore alternative revenue-raising options, such as:

- Revisiting Tax Policies for High-Income Earners: Some suggest that a more progressive tax system could be implemented, placing a greater tax burden on higher-income individuals and corporations.

- Strengthening Tax Collection Efforts: Improving tax collection efficiency could potentially alleviate the need for such a significant GST increase.

- Diversifying Revenue Streams: Exploring new revenue streams, such as increasing tourism revenue or attracting more foreign investment, could help reduce the reliance on GST.

The debate surrounding the GST hike in Singapore is far from over. The long-term consequences of this decision will continue to be debated and analyzed as its impact unfolds. Only time will tell if this increase truly proves to be a necessary evil or a significant misstep in Singapore's economic strategy. The conversation, however, is vital for ensuring Singapore's sustainable future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chee Hong Tat On GST Hike: A Necessary Evil For Singapore's Future?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ajax Vs Sparta Rotterdam Preview Predicted Lineups And Key Players

Apr 28, 2025

Ajax Vs Sparta Rotterdam Preview Predicted Lineups And Key Players

Apr 28, 2025 -

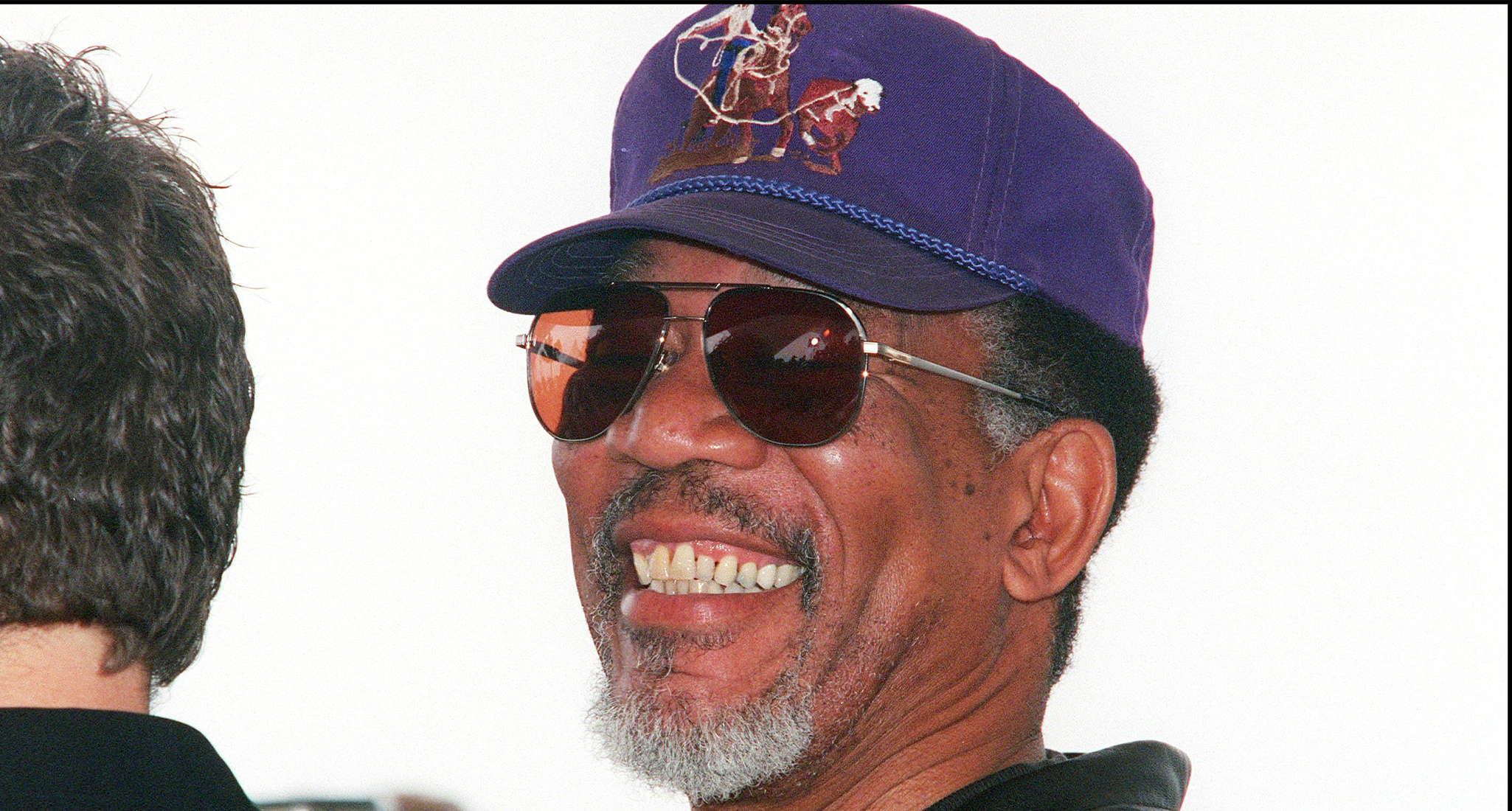

Sleepless Nights Guaranteed This Undiscovered Morgan Freeman Thriller On Netflix

Apr 28, 2025

Sleepless Nights Guaranteed This Undiscovered Morgan Freeman Thriller On Netflix

Apr 28, 2025 -

May 2024 Crypto Outlook 3 Altcoins To Watch Over Bitcoin

Apr 28, 2025

May 2024 Crypto Outlook 3 Altcoins To Watch Over Bitcoin

Apr 28, 2025 -

Cybersecurity Alert Lazarus Groups Latest Attack Via Shell Companies

Apr 28, 2025

Cybersecurity Alert Lazarus Groups Latest Attack Via Shell Companies

Apr 28, 2025 -

Discover The Hidden Gem A Gripping Morgan Freeman Thriller Streaming On Netflix

Apr 28, 2025

Discover The Hidden Gem A Gripping Morgan Freeman Thriller Streaming On Netflix

Apr 28, 2025

Latest Posts

-

Higgins Wins Nerve Wracking Championship Match

Apr 30, 2025

Higgins Wins Nerve Wracking Championship Match

Apr 30, 2025 -

Thunderbolts Post Credits Scene Leak Sparks Online Frenzy Critic Reviews In

Apr 30, 2025

Thunderbolts Post Credits Scene Leak Sparks Online Frenzy Critic Reviews In

Apr 30, 2025 -

Afc Champions League Semi Finals Five Things To Watch In Jeddah

Apr 30, 2025

Afc Champions League Semi Finals Five Things To Watch In Jeddah

Apr 30, 2025 -

Psgs Enrique No Worries About Arsenal Despite Nice Loss

Apr 30, 2025

Psgs Enrique No Worries About Arsenal Despite Nice Loss

Apr 30, 2025 -

Swiateks Calm Approach Leads To Madrid Quarterfinal Berth Following Power Cut

Apr 30, 2025

Swiateks Calm Approach Leads To Madrid Quarterfinal Berth Following Power Cut

Apr 30, 2025