China's Stock Market Crash: Indices Plummet More Than 7%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China's Stock Market Crash: Indices Plummet More Than 7%, Sending Global Shockwaves

China's stock market experienced a dramatic crash today, with major indices plummeting more than 7%, triggering concerns about global economic stability and prompting urgent responses from authorities. The unprecedented fall, the worst single-day drop in years, wiped billions off market capitalization and sent ripples through international markets. Experts are scrambling to understand the underlying causes and predict the potential fallout.

This sudden and sharp decline marks a significant escalation in the ongoing anxieties surrounding the Chinese economy. While concerns about property sector woes and slowing growth have been simmering for months, today's plunge represents a stark acceleration of those fears. The speed and severity of the drop have left investors reeling and analysts questioning the resilience of the Chinese financial system.

What Caused the Crash?

Pinpointing the exact trigger for such a dramatic market crash is complex, but several factors are likely contributing:

-

Property Sector Crisis: The ongoing crisis in China's real estate sector continues to be a major drag on investor confidence. The default of major developers and concerns about widespread contagion remain significant headwinds. The sector's struggles represent a substantial portion of China's economy, making its instability highly contagious.

-

Slowing Economic Growth: China's economic growth has been slowing for some time, falling short of expectations. Weakening consumer demand and persistent supply chain disruptions are contributing to this deceleration, further eroding investor sentiment.

-

Geopolitical Tensions: Increased geopolitical tensions, including strained relations with the West, add to the uncertainty surrounding the Chinese economy. These external pressures amplify existing domestic vulnerabilities.

-

Regulatory Uncertainty: Ongoing regulatory crackdowns in various sectors, including technology and finance, have created an environment of uncertainty that discourages investment. The unpredictable nature of government interventions leaves investors hesitant to commit capital.

Global Impact and Market Reactions

The Chinese stock market crash is not an isolated event. Global markets reacted swiftly, with significant drops observed in several major indices worldwide. This interconnectedness highlights the increasingly globalized nature of financial markets and the potential for contagion. The implications for international trade and investment are substantial, particularly for countries heavily reliant on the Chinese market.

International investors are closely monitoring the situation, assessing the potential for further declines and the broader implications for their portfolios. Many are seeking safe-haven assets, leading to increased demand for gold and government bonds.

Government Response and Future Outlook

The Chinese government is likely to respond with measures aimed at stabilizing the market and boosting investor confidence. These measures could include:

- Interest Rate Cuts: Lowering interest rates to stimulate borrowing and investment.

- Increased Fiscal Spending: Boosting government spending on infrastructure projects to create jobs and stimulate economic activity.

- Regulatory Easing: Relaxing some of the recent regulatory measures to ease uncertainty and encourage investment.

However, the effectiveness of these interventions remains uncertain. The depth and complexity of the current crisis necessitate a comprehensive and coordinated response. The coming weeks will be crucial in determining the trajectory of the Chinese economy and the wider global impact of this significant market crash. The situation remains fluid and requires ongoing monitoring. Experts predict volatility in the coming days and weeks as investors grapple with the uncertainty. The long-term consequences of this crash are still unfolding, and a watchful eye is essential for navigating this volatile period.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China's Stock Market Crash: Indices Plummet More Than 7%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Braket Om Malmoependeln Malmoe Stad Tar Oever Ansvaret

Apr 08, 2025

Braket Om Malmoependeln Malmoe Stad Tar Oever Ansvaret

Apr 08, 2025 -

Global Trade War A New Era Of Protectionism

Apr 08, 2025

Global Trade War A New Era Of Protectionism

Apr 08, 2025 -

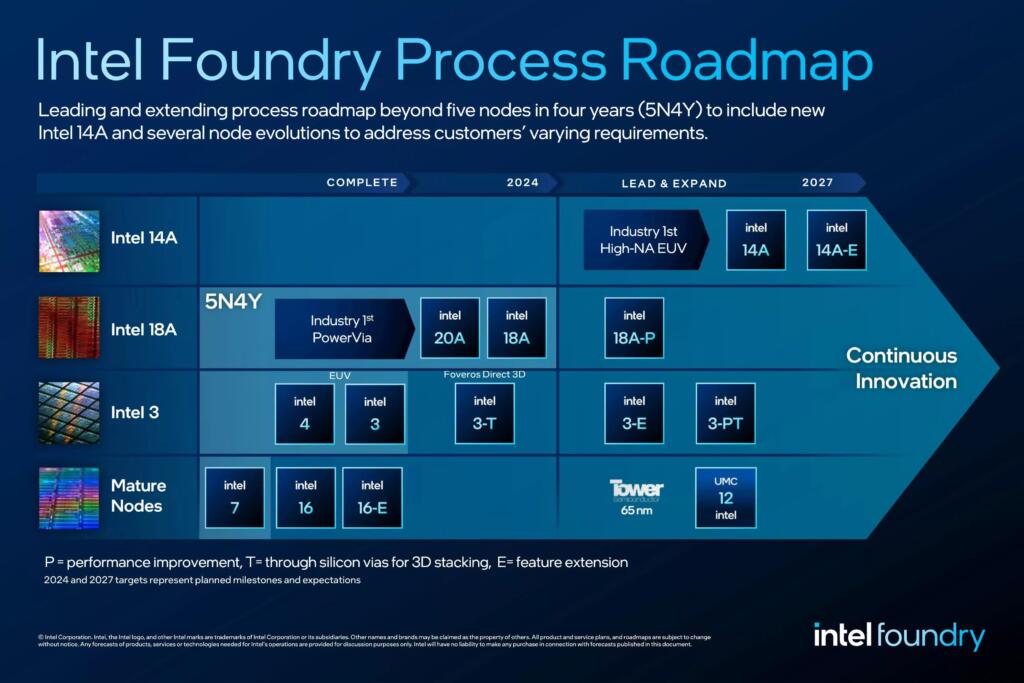

2025 Intels 18 Angstrom Chips Poised For Mass Production Launch

Apr 08, 2025

2025 Intels 18 Angstrom Chips Poised For Mass Production Launch

Apr 08, 2025 -

Dominican Republic Club Roof Failure Leaves 13 Dead Scores Hospitalized

Apr 08, 2025

Dominican Republic Club Roof Failure Leaves 13 Dead Scores Hospitalized

Apr 08, 2025 -

Risk Off Sentiment Grips Asia Pacific Hong Kong Stocks Suffer Sharp Losses

Apr 08, 2025

Risk Off Sentiment Grips Asia Pacific Hong Kong Stocks Suffer Sharp Losses

Apr 08, 2025