China's Tariff Response Delivers Harshest Blow To US Stocks Since COVID-19 Pandemic

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

China's Tariff Response Delivers Harshest Blow to US Stocks Since COVID-19 Pandemic

A wave of selling swept through US markets this week, marking the sharpest decline since the initial shock of the COVID-19 pandemic. The trigger? China's unexpected and aggressive response to newly imposed US tariffs. Investors, already grappling with inflation concerns and rising interest rates, were caught off guard by the breadth and depth of the Chinese retaliatory measures. This article delves into the specifics of the tariff war escalation and analyzes its significant impact on the US stock market.

China's Countermeasures: A Targeted Assault on US Exports

The latest round of US tariffs, targeting Chinese technology and manufacturing sectors, prompted an immediate and forceful response from Beijing. Instead of a tit-for-tat approach, China opted for a more strategic and arguably harsher retaliation. Key measures included:

- Significant Tariff Increases: China implemented substantial increases on a wide range of US goods, including agricultural products, automobiles, and electronics. These tariffs, significantly higher than anticipated, directly impacted major US corporations.

- Import Restrictions: Beyond tariffs, China also introduced new import restrictions on several US products, effectively limiting market access for American companies. This move signaled a shift towards a more protectionist stance.

- Targeting Specific Sectors: The Chinese response was notably targeted, focusing on sectors considered crucial to the US economy, thereby maximizing the economic impact. This strategic approach amplified the negative effects on the US stock market.

The Market's Violent Reaction: A Cascade of Losses

The news sent shockwaves through Wall Street. The Dow Jones Industrial Average experienced its largest single-day point drop since the initial COVID-19 market crash in March 2020. The S&P 500 and Nasdaq also suffered substantial losses, reflecting widespread investor anxiety.

- Tech Stocks Hit Hardest: Technology companies, already facing regulatory scrutiny and slowing growth, were particularly vulnerable to the renewed trade tensions. This sector saw some of the most significant losses.

- Agricultural Stocks Suffer: The increased tariffs on agricultural products led to a sharp decline in the agricultural sector, impacting farm incomes and related businesses.

- Broader Market Uncertainty: Beyond specific sectors, the overall market sentiment soured dramatically. The uncertainty surrounding the escalating trade conflict contributed to a broader sell-off across various asset classes.

Experts Weigh In: Analyzing the Long-Term Implications

Financial analysts warn that the current situation could have significant long-term consequences. The escalating trade war threatens to disrupt global supply chains, further fueling inflation and potentially triggering a global recession.

- Inflationary Pressures: The increased tariffs are likely to contribute to higher consumer prices, adding to the existing inflationary pressures.

- Supply Chain Disruptions: The trade conflict could lead to further disruptions in global supply chains, impacting businesses and consumers alike.

- Geopolitical Risks: The escalating tensions between the US and China raise serious geopolitical concerns, potentially impacting international relations and global stability.

Looking Ahead: Navigating Uncharted Waters

The current situation presents significant challenges for investors and policymakers alike. The unpredictable nature of the trade war makes it difficult to predict the future trajectory of the market. Experts advise investors to adopt a cautious approach and carefully assess their risk tolerance. Furthermore, the potential for further escalation necessitates a proactive and strategic response from both governments to mitigate the negative consequences of this ongoing trade dispute. The future remains uncertain, but one thing is clear: China's tariff response has dealt a significant blow to US stocks and global economic stability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on China's Tariff Response Delivers Harshest Blow To US Stocks Since COVID-19 Pandemic. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amadou Bagayokos Funeral Draws Thousands Celebrating A Life In Music

Apr 08, 2025

Amadou Bagayokos Funeral Draws Thousands Celebrating A Life In Music

Apr 08, 2025 -

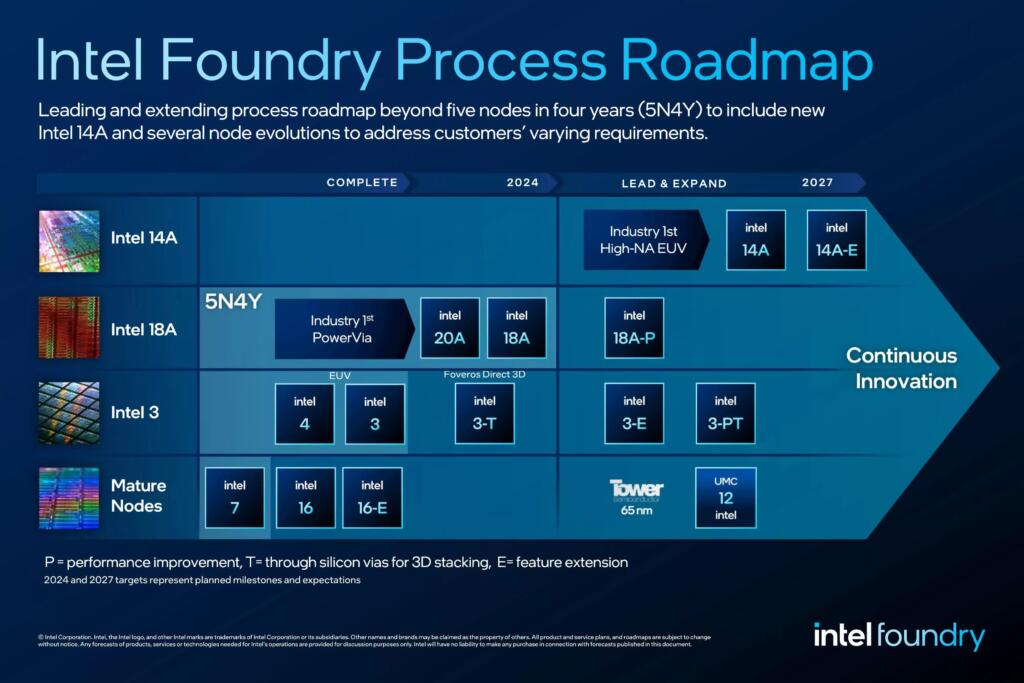

Intel 18 Angstrom A 2025 Production Launch And The Comeback Story

Apr 08, 2025

Intel 18 Angstrom A 2025 Production Launch And The Comeback Story

Apr 08, 2025 -

Delicious Seaside Cakes A Tearoom That Lives Up To The Hype

Apr 08, 2025

Delicious Seaside Cakes A Tearoom That Lives Up To The Hype

Apr 08, 2025 -

Expect Higher Streaming Bills Tariffs Driving Up Costs For Consumers

Apr 08, 2025

Expect Higher Streaming Bills Tariffs Driving Up Costs For Consumers

Apr 08, 2025 -

How To Watch The Bautista Agut Vs Nakashima Match 2025 Monte Carlo Masters

Apr 08, 2025

How To Watch The Bautista Agut Vs Nakashima Match 2025 Monte Carlo Masters

Apr 08, 2025