Chinese Markets Suffer Heavy Losses: Indices Drop Over 7% Today

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Chinese Markets Suffer Heavy Losses: Indices Plunge Over 7% in a Single Day

Shockwaves ripple through global markets as Chinese indices experience their worst day in years, fueling concerns about economic slowdown and global instability.

Monday's trading session saw a dramatic plunge in Chinese markets, leaving investors reeling and sparking anxieties about the global economic outlook. Major indices experienced losses exceeding 7%, marking one of the most significant single-day declines in recent memory. The Shanghai Composite Index, a key barometer of China's economy, plummeted, along with the Shenzhen Component and other significant benchmarks. This sharp downturn has sent ripples throughout global financial markets, highlighting the interconnectedness of the world economy and the growing influence of China's economic performance.

What Triggered the Market Crash?

While pinpointing a single cause for such a dramatic drop is complex, several factors contributed to the market's severe downturn. Analysts point to a confluence of issues, including:

-

Weakening Economic Data: Recent economic indicators, such as manufacturing PMI (Purchasing Managers' Index) and retail sales figures, have painted a concerning picture of slowing growth within the Chinese economy. This underperformance fueled fears of a deeper, more prolonged slowdown.

-

Real Estate Sector Concerns: The ongoing crisis in China's real estate sector, particularly the struggles of major developers, continues to cast a long shadow. The lingering uncertainty surrounding property values and the financial health of these developers significantly impacts investor confidence.

-

Geopolitical Tensions: Rising geopolitical tensions, both regionally and globally, contribute to investor uncertainty. The complex interplay of international relations and their impact on the Chinese economy adds another layer of volatility.

-

Regulatory Uncertainty: Continued regulatory crackdowns in various sectors, impacting everything from technology to education, create an environment of uncertainty for businesses and investors alike. This unpredictable regulatory landscape makes long-term investment planning challenging.

Global Implications and Investor Sentiment:

The dramatic fall in Chinese markets has sent shockwaves across the globe. International investors are reassessing their exposure to Chinese assets, leading to a broader sell-off in Asian markets and a sense of unease in other major global markets. The interconnectedness of the global financial system means that a significant downturn in China can have far-reaching consequences.

Looking Ahead: Potential Recovery and Future Outlook:

The immediate outlook remains uncertain. While some analysts believe this represents a temporary correction, others express more serious concerns about the potential for a more prolonged slowdown. The Chinese government's response and potential policy interventions will be crucial in determining the trajectory of the market in the coming weeks and months. Further economic data releases and any announcements regarding government stimulus packages will closely be watched by investors worldwide. The coming days and weeks will be critical in assessing the full impact of this significant market event and its lasting consequences on the global economy. Monitoring key economic indicators and government policy will be paramount for investors navigating this period of uncertainty. The situation underscores the need for diversified investment strategies and careful risk management in an increasingly volatile global market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Chinese Markets Suffer Heavy Losses: Indices Drop Over 7% Today. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

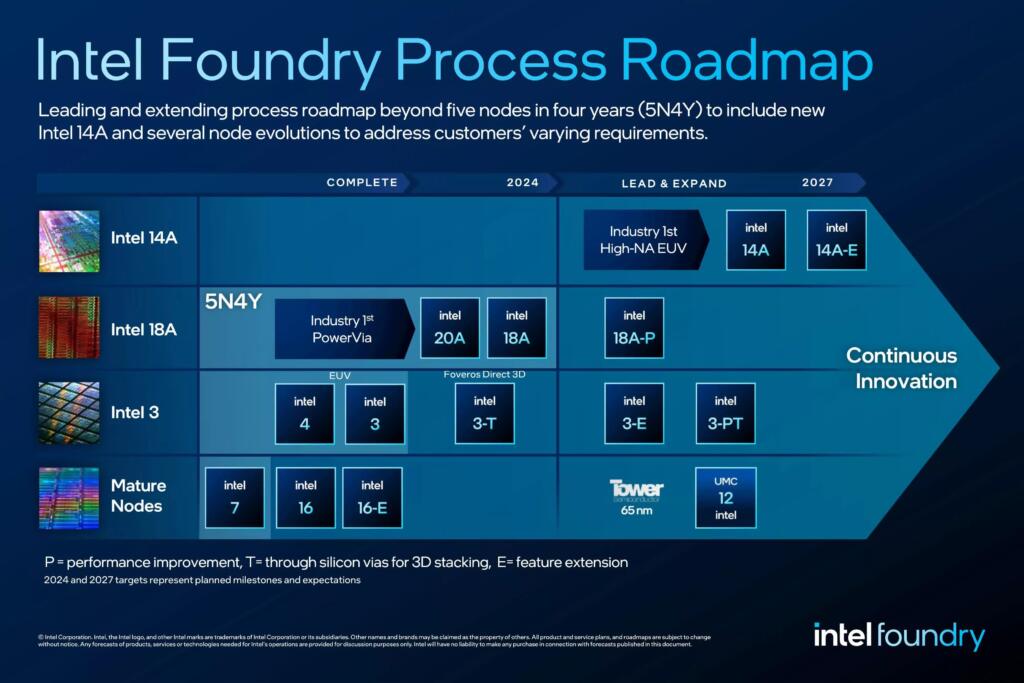

Intel 18 A Chips Production Ramp Up And The Path To Market Dominance

Apr 07, 2025

Intel 18 A Chips Production Ramp Up And The Path To Market Dominance

Apr 07, 2025 -

Leilua Leads Sea Eagles Charge Against Storm Hughes Return Boosts Manlys Hopes

Apr 07, 2025

Leilua Leads Sea Eagles Charge Against Storm Hughes Return Boosts Manlys Hopes

Apr 07, 2025 -

Bulldogs Team Lineup Confirmed Nrl Round 5 Accor Stadium Clash

Apr 07, 2025

Bulldogs Team Lineup Confirmed Nrl Round 5 Accor Stadium Clash

Apr 07, 2025 -

When You Cant Win You Must Take A Point Diabys Takeaway From Intense Sea Derby

Apr 07, 2025

When You Cant Win You Must Take A Point Diabys Takeaway From Intense Sea Derby

Apr 07, 2025 -

Saldo Dana Gratis Rp250 000 Tips And Trik Mendapatkan Saldo Tambahan

Apr 07, 2025

Saldo Dana Gratis Rp250 000 Tips And Trik Mendapatkan Saldo Tambahan

Apr 07, 2025