CIBC Analyst's Top Energy Infrastructure And Power Picks For High Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CIBC Analyst's Top Energy Infrastructure and Power Picks for High Yields: A Deep Dive

High yields are enticing investors, and the energy infrastructure and power sectors are brimming with opportunities. CIBC analyst, [Insert Analyst Name Here – if available, otherwise remove this sentence], has identified several top picks poised to deliver substantial returns. This isn't just about chasing high dividends; it's about strategically investing in stable, essential services with strong growth potential. Let's delve into the analyst's key recommendations and explore why they're considered prime candidates for high-yield portfolios.

Why Energy Infrastructure and Power?

The energy transition is reshaping the sector, but it's also creating significant opportunities. Renewable energy sources require substantial infrastructure investment – transmission lines, storage facilities, and smart grids. This ongoing build-out, coupled with the continued demand for reliable energy sources, positions energy infrastructure and power companies for robust growth. Furthermore, many of these companies boast stable, regulated revenue streams, providing a level of predictability that is appealing to income-seeking investors.

CIBC's Top Picks: A Closer Look

While specific company names and details may be subject to change based on market conditions and the analyst's latest research (always consult the most up-to-date CIBC reports), here's a general overview of the types of companies that typically make the list and the reasons behind their selection:

1. Utilities with Regulated Assets: These companies provide essential services like electricity and natural gas distribution, often operating under regulated tariffs. This regulated environment offers stability and predictability of earnings, supporting consistent dividend payouts. Look for companies with a history of dividend increases and strong balance sheets. Keywords: Utility stocks, regulated utilities, dividend aristocrats, high-yield utilities.

2. Midstream Energy Companies: These companies transport and store energy resources (oil, gas, etc.), playing a crucial role in the energy value chain. Their revenues are often tied to the volume of energy transported, providing a degree of insulation against price volatility. Look for companies with robust pipeline networks and efficient operations. Keywords: Midstream energy, pipeline stocks, energy infrastructure, MLPs (Master Limited Partnerships).

3. Renewable Energy Infrastructure: Investment in renewable energy projects, such as wind and solar farms, offers strong growth potential aligned with global sustainability goals. Companies involved in developing, owning, and operating these projects can offer attractive returns, although the risk profile might be slightly higher than established utilities. Keywords: Renewable energy, solar energy stocks, wind energy stocks, green energy infrastructure.

Factors to Consider Before Investing:

- Dividend Sustainability: Always examine the company's dividend payout ratio to assess its sustainability. A high payout ratio could indicate potential future dividend cuts.

- Debt Levels: High levels of debt can increase financial risk. Analyze the company's balance sheet to evaluate its financial health.

- Regulatory Environment: Regulatory changes can impact the profitability of energy companies. Stay informed about relevant regulations and their potential impact.

- Geopolitical Risks: The energy sector is susceptible to geopolitical events. Consider the potential risks associated with specific regions or projects.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. The information provided reflects the analyst's view at a specific point in time and is subject to change. Always refer to the latest CIBC research reports for the most up-to-date information. This article is not sponsored by CIBC.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CIBC Analyst's Top Energy Infrastructure And Power Picks For High Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Warren Buffetts Wisdom And Cryptocurrencies A Comparative Market Analysis

May 24, 2025

Warren Buffetts Wisdom And Cryptocurrencies A Comparative Market Analysis

May 24, 2025 -

Silverstone Moto Gp 2024 What You Might Have Missed

May 24, 2025

Silverstone Moto Gp 2024 What You Might Have Missed

May 24, 2025 -

Analyzing Game Stops Profitability 6 Billion Balance Sheet And Cryptocurrency Investments

May 24, 2025

Analyzing Game Stops Profitability 6 Billion Balance Sheet And Cryptocurrency Investments

May 24, 2025 -

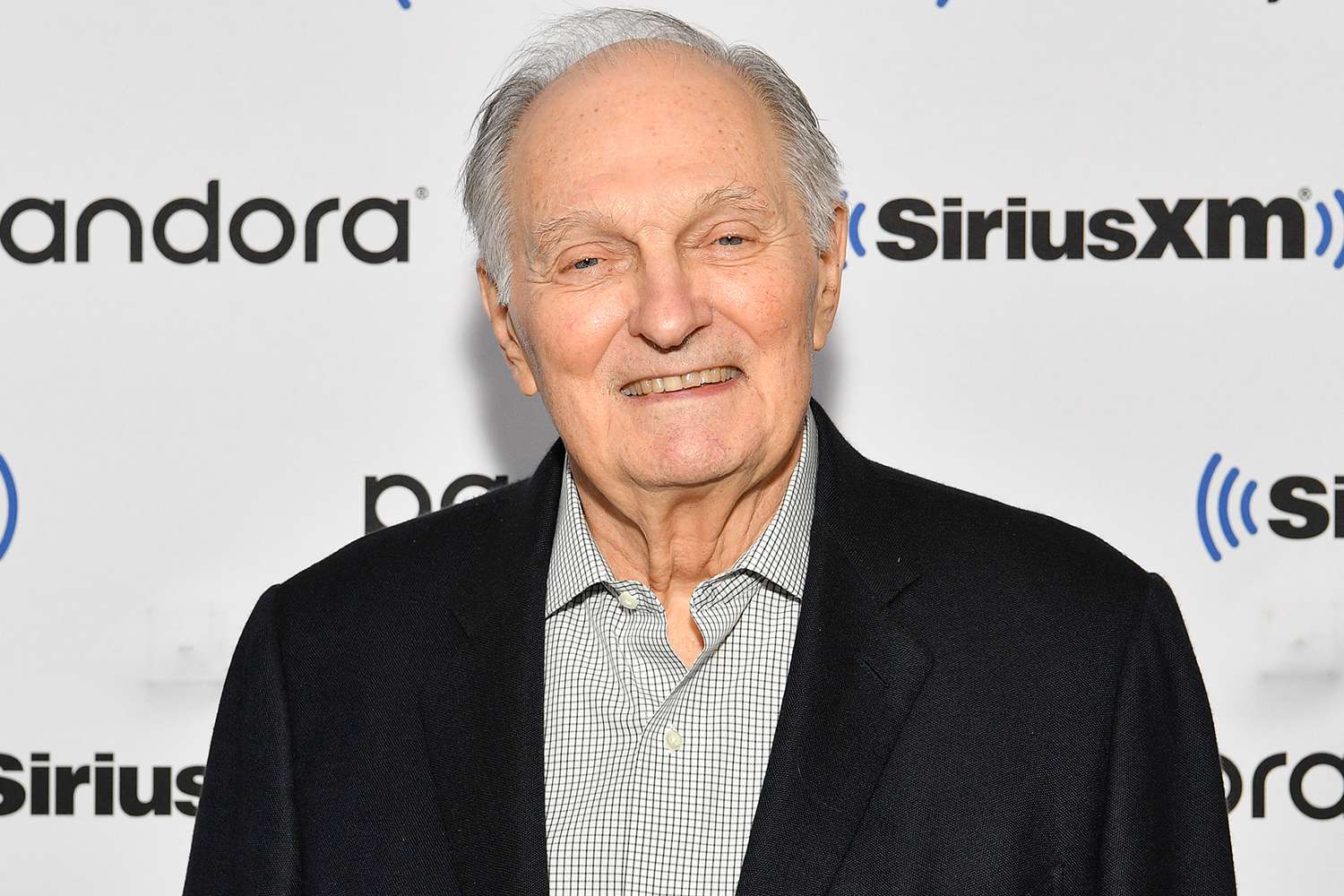

Almost A Full Time Job Alan Alda On Living With Parkinsons At 89

May 24, 2025

Almost A Full Time Job Alan Alda On Living With Parkinsons At 89

May 24, 2025 -

Luminar Ceo Resigns Amidst Speculation Linking Him To Robert Tesla Video Controversy

May 24, 2025

Luminar Ceo Resigns Amidst Speculation Linking Him To Robert Tesla Video Controversy

May 24, 2025