CIBC's Best Bets: High-Yield Energy Infrastructure And Power

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CIBC's Best Bets: High-Yield Energy Infrastructure and Power – A Smart Investment Strategy?

The Canadian Imperial Bank of Commerce (CIBC), a leading Canadian financial institution, recently highlighted energy infrastructure and power as top investment sectors for high-yield returns. This bullish prediction comes at a time of significant global energy transition and growing demand for reliable energy sources. But is this a smart investment strategy for everyday investors? Let's delve into the details.

Why CIBC is Betting Big on Energy Infrastructure and Power

CIBC's positive outlook stems from several key factors:

-

Increased Demand: The global energy landscape is undergoing a massive transformation. While the shift towards renewable energy sources is undeniable, the immediate future still requires significant reliance on traditional energy sources. This translates into robust demand for infrastructure to support the production, transportation, and distribution of energy, creating lucrative investment opportunities.

-

Inflation Hedge: Energy infrastructure assets often provide a natural hedge against inflation. As the cost of goods and services rises, so does the value of the underlying assets in these sectors. This stability makes them an attractive option for investors seeking to protect their portfolios from inflationary pressures. This is especially important in the current economic climate.

-

Sustainable Growth Potential: While fossil fuels remain a key component, the energy transition itself presents growth opportunities. Investment in renewable energy infrastructure, such as wind farms and solar power plants, offers significant long-term potential. CIBC's strategy likely encompasses a diversified approach, including both traditional and renewable energy infrastructure.

What Specific Opportunities are CIBC Highlighting?

While CIBC hasn't released a granular breakdown of all their specific recommendations, their emphasis on high-yield opportunities suggests a focus on:

-

Midstream Energy: This sector encompasses pipelines, storage facilities, and processing plants. These assets generate stable cash flows, making them attractive for investors seeking predictable income streams.

-

Utilities: Electric and gas utilities are another key area of focus. The consistent demand for electricity and gas provides a stable foundation for investment returns. These companies often have regulated rates, offering a degree of protection from market volatility.

-

Renewable Energy Projects: Investments in renewable energy infrastructure, such as wind and solar farms, offer both high-yield potential and the appeal of Environmental, Social, and Governance (ESG) investing.

Risks to Consider

While the outlook appears positive, it’s crucial to acknowledge potential risks:

-

Regulatory Changes: Government regulations and policies play a significant role in the energy sector. Changes in environmental regulations or energy policies could impact the profitability of certain investments.

-

Geopolitical Instability: Global events and geopolitical tensions can significantly influence energy prices and investment returns. Investors need to carefully assess these risks.

-

Interest Rate Hikes: Rising interest rates can impact the attractiveness of high-yield investments, potentially reducing their overall return.

Is it Right for You?

CIBC's optimistic view on energy infrastructure and power presents an interesting opportunity. However, it's crucial to remember that all investments carry risk. Before investing in this sector, conduct thorough research, consider your personal risk tolerance, and perhaps consult with a qualified financial advisor. Diversification is key to mitigating risk, and not putting all your eggs in one basket is vital for long-term success. Consider this strategy as one component of a well-diversified portfolio.

Keywords: CIBC, High-Yield Investments, Energy Infrastructure, Power Sector, Investment Strategy, Renewable Energy, Midstream Energy, Utilities, Inflation Hedge, ESG Investing, Investment Risk, Financial Advice, Canadian Investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CIBC's Best Bets: High-Yield Energy Infrastructure And Power. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Justice Department Controversy Gibson Gun Permit Denial Leads To Firing

May 24, 2025

Justice Department Controversy Gibson Gun Permit Denial Leads To Firing

May 24, 2025 -

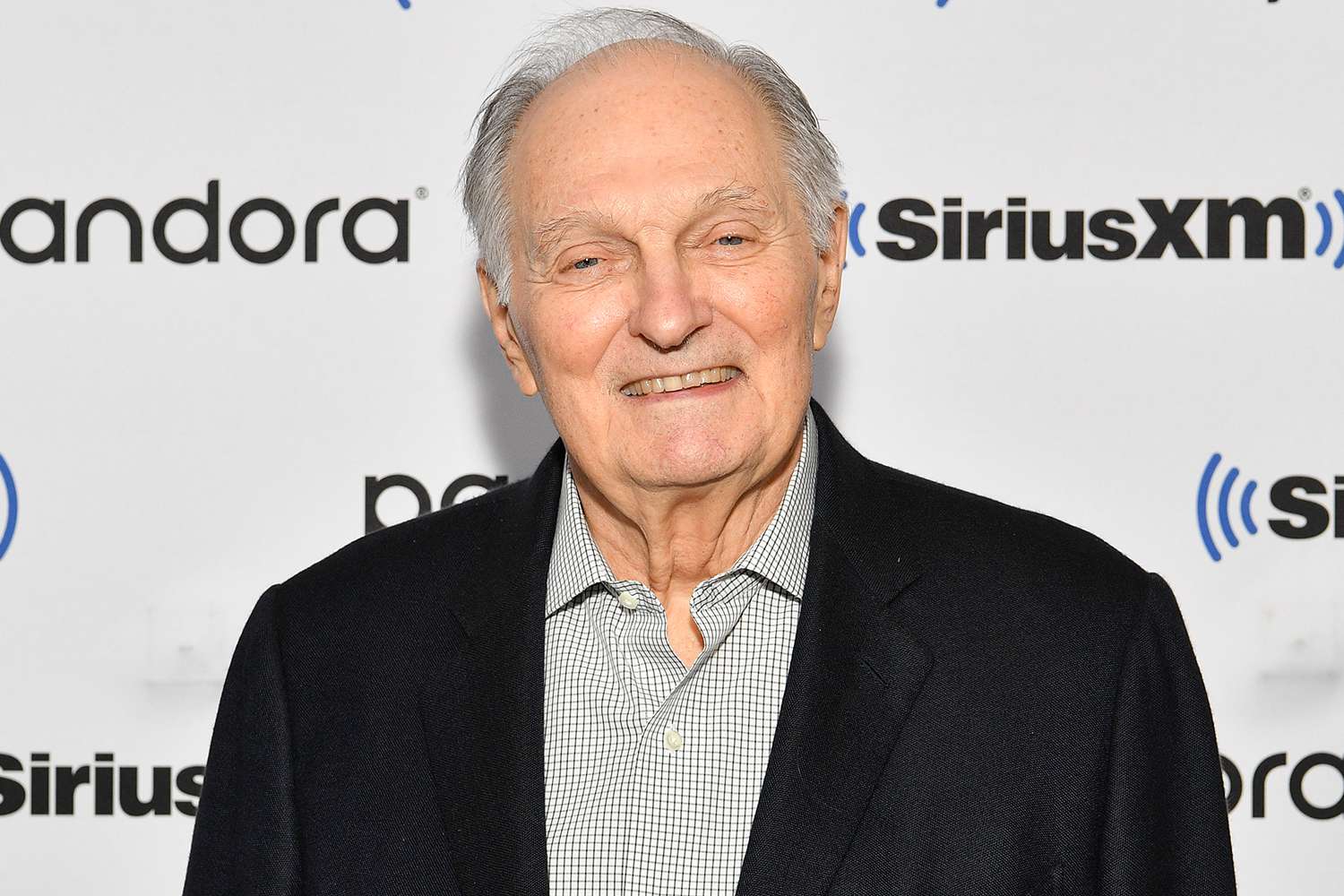

Alan Alda At 89 Parkinsons Diagnosis Challenges And Enduring Optimism

May 24, 2025

Alan Alda At 89 Parkinsons Diagnosis Challenges And Enduring Optimism

May 24, 2025 -

Brett Favres Controversies Untold Stories Explored

May 24, 2025

Brett Favres Controversies Untold Stories Explored

May 24, 2025 -

Drone Technology Offers New Perspective On Oklahoma Tornado Destruction

May 24, 2025

Drone Technology Offers New Perspective On Oklahoma Tornado Destruction

May 24, 2025 -

Amanda Bynes Unveils Drastic Hair Change And Tattoo After Only Fans Launch

May 24, 2025

Amanda Bynes Unveils Drastic Hair Change And Tattoo After Only Fans Launch

May 24, 2025