CIBC's Best Energy Infrastructure And Power Investments For High Yield

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CIBC's Top Picks: Energy Infrastructure & Power Investments for High Yield

The energy sector is undergoing a dramatic transformation, presenting both challenges and significant opportunities for investors seeking high yield. Canadian Imperial Bank of Commerce (CIBC), a leading financial institution, has identified key areas within energy infrastructure and power generation offering potentially lucrative returns. This article delves into CIBC's best picks for investors looking to capitalize on this evolving landscape.

Why Invest in Energy Infrastructure and Power?

The global push for energy transition is driving substantial investment in renewable energy sources and the modernization of existing infrastructure. This creates a unique environment for high-yield opportunities. Unlike volatile energy commodities like oil and gas, energy infrastructure investments often provide more stable, predictable cash flows, making them attractive to income-focused investors. CIBC highlights several key factors contributing to this trend:

- Growing Demand for Renewable Energy: The shift away from fossil fuels fuels (pun intended!) significant investment in solar, wind, and hydroelectric power generation. This demand translates into strong returns for companies involved in building, operating, and maintaining these assets.

- Aging Infrastructure Upgrades: Existing energy infrastructure requires significant upgrades and modernization. This creates a pipeline of projects requiring substantial capital investment, offering opportunities for high-yield bonds and equity investments.

- Government Support and Incentives: Many governments are actively supporting the transition to cleaner energy through subsidies, tax breaks, and regulatory frameworks, further bolstering the attractiveness of these investments.

CIBC's Top Recommendations: (Note: Specific investment recommendations are subject to change and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.)

While CIBC doesn't publicly release a definitive "top picks" list in a readily accessible format, their analysts frequently highlight sectors and trends within their research reports. Based on their recent analysis and public statements, high-yield potential can be found in the following areas:

-

Renewable Energy Developers: Companies specializing in developing and operating large-scale renewable energy projects, such as wind farms and solar power plants, are likely to see strong growth and offer attractive returns. CIBC's research often points to the robust pipeline of projects in development as a key driver of profitability.

-

Energy Transmission and Distribution Companies: These companies own and operate the critical infrastructure that transports electricity from generation sources to consumers. Their relatively stable and predictable cash flows make them attractive for income-oriented investors. CIBC analysts often emphasize the long-term stability and regulated nature of this sector.

-

Sustainable Energy Infrastructure Funds: Investing in diversified funds specializing in sustainable energy infrastructure provides broad exposure to the sector and can mitigate risk. CIBC's investment strategists often recommend this approach for those seeking diversified exposure with reduced individual company risk.

Understanding the Risks:

While the potential for high yield is significant, it's crucial to understand the inherent risks associated with energy infrastructure and power investments. These can include:

- Regulatory Uncertainty: Changes in government policies and regulations can impact the profitability of energy projects.

- Interest Rate Risk: Rising interest rates can negatively affect the value of fixed-income investments.

- Geopolitical Risks: Global events and political instability can influence energy prices and investment returns.

Conclusion:

CIBC's analysis strongly suggests that carefully selected investments within the energy infrastructure and power generation sectors offer substantial potential for high yield. However, thorough due diligence, diversification, and professional financial advice are crucial before making any investment decisions. Investors should carefully consider their risk tolerance and long-term financial goals before venturing into this dynamic sector. Remember to always consult with a qualified financial advisor to determine the suitability of any investment strategy for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CIBC's Best Energy Infrastructure And Power Investments For High Yield. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Fifa Club World Cup Philadelphia Tickets Venues And More

May 25, 2025

2025 Fifa Club World Cup Philadelphia Tickets Venues And More

May 25, 2025 -

Dive Deeper Into Chrono Odyssey A Developer Interview Breakdown

May 25, 2025

Dive Deeper Into Chrono Odyssey A Developer Interview Breakdown

May 25, 2025 -

Untold Jenn Sterger Shares 5 Excluded Details About Brett Favre Scandal

May 25, 2025

Untold Jenn Sterger Shares 5 Excluded Details About Brett Favre Scandal

May 25, 2025 -

Police Involved Shooting Woman Killed Man Injured In South Melbourne Incident

May 25, 2025

Police Involved Shooting Woman Killed Man Injured In South Melbourne Incident

May 25, 2025 -

Rtx 5060 Review Controversy What Went Wrong And What It Means

May 25, 2025

Rtx 5060 Review Controversy What Went Wrong And What It Means

May 25, 2025

Latest Posts

-

How Racing Bulls Achieved Success At The Monaco Grand Prix

May 25, 2025

How Racing Bulls Achieved Success At The Monaco Grand Prix

May 25, 2025 -

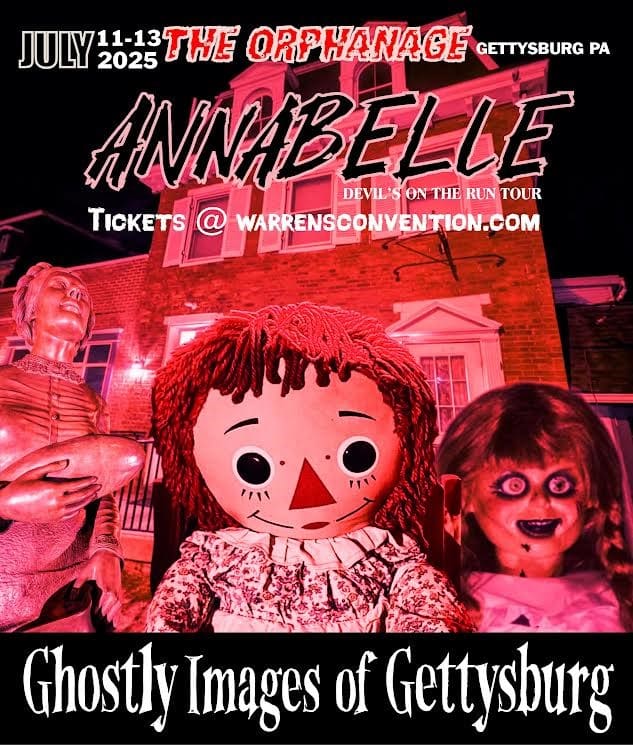

July 11th Annabelles Gettysburg Ghost Hunt Book Your Spot Now

May 25, 2025

July 11th Annabelles Gettysburg Ghost Hunt Book Your Spot Now

May 25, 2025 -

Live Score Gujarat Titans Vs Chennai Super Kings Ipl 2025 Dhonis Farewell

May 25, 2025

Live Score Gujarat Titans Vs Chennai Super Kings Ipl 2025 Dhonis Farewell

May 25, 2025 -

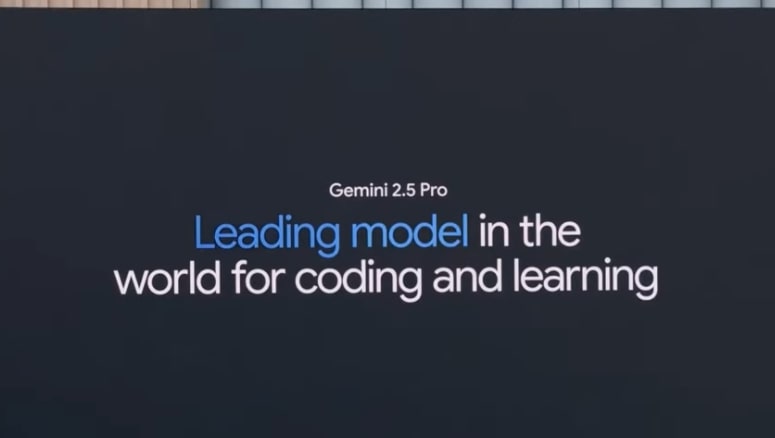

I O 2025 Analyzing Googles Latest Innovations And Developments

May 25, 2025

I O 2025 Analyzing Googles Latest Innovations And Developments

May 25, 2025 -

Moto2 Grand Prix Senna Agius Unforgettable Last Lap Triumph

May 25, 2025

Moto2 Grand Prix Senna Agius Unforgettable Last Lap Triumph

May 25, 2025