CICC's Positive Outlook: POP MART Price Target Raised To $220 On Robust Q1 Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CICC's Positive Outlook: POP MART Price Target Raised to $220 on Robust Q1 Performance

Investment bank CICC boosts its price target for Pop Mart International Group, the popular Chinese designer toy company, to $220, reflecting a strong belief in the company's continued growth trajectory following a robust first-quarter performance. This significant upward revision underscores the market's confidence in Pop Mart's ability to navigate the evolving consumer landscape and maintain its leading position in the collectible toy market.

The move comes on the heels of Pop Mart's impressive Q1 2024 earnings report, which exceeded analysts' expectations. The company showcased significant growth across key performance indicators, demonstrating the enduring appeal of its collectible figurines and the effectiveness of its diversified business strategy. This positive momentum has fueled investor enthusiasm, driving a surge in Pop Mart's share price.

Key Factors Behind CICC's Upgraded Forecast

CICC's decision to raise its price target wasn't arbitrary. Several key factors contributed to this optimistic outlook:

-

Strong Q1 Revenue Growth: Pop Mart reported significantly higher-than-anticipated revenue growth in Q1 2024, exceeding market consensus. This strong performance highlights the continued demand for its products and the success of its expansion strategies.

-

Successful Product Diversification: The company's commitment to introducing new IP (Intellectual Property) and expanding its product lines has paid off. This diversification mitigates risk and ensures a steady stream of revenue from various sources, appealing to a wider consumer base.

-

Robust Online and Offline Sales: Pop Mart's omnichannel strategy, encompassing both robust online presence and a network of physical stores, is proving highly effective. This strategic approach maximizes reach and caters to diverse consumer preferences.

-

Growing International Expansion: Pop Mart's foray into international markets is showing promising results. Its strategic expansion into new territories contributes significantly to revenue growth and solidifies its position as a global player in the designer toy industry.

-

Effective Marketing and Brand Building: Pop Mart's innovative marketing campaigns and strong brand recognition have been instrumental in driving sales and building customer loyalty.

What This Means for Investors

CICC's increased price target signals a strong vote of confidence in Pop Mart's future prospects. For investors, this presents a potentially lucrative opportunity. However, it's crucial to remember that investment decisions should always be based on thorough due diligence and individual risk tolerance.

While the outlook appears positive, potential investors should carefully consider the inherent risks associated with the stock market, including market volatility and geopolitical factors that could influence the company's performance.

The Future of Pop Mart

Pop Mart's success is a testament to its ability to tap into a growing market for collectible toys and its savvy business strategies. The company's ongoing commitment to innovation, expansion, and brand building positions it for continued growth in the years to come. CICC's bullish prediction further strengthens the narrative of Pop Mart's long-term potential. The next few quarters will be key to observing whether the company can continue to meet and exceed market expectations, solidifying its position as a leading player in the global designer toy market. Investors will be keenly watching for further updates on its expansion plans and new product launches.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CICC's Positive Outlook: POP MART Price Target Raised To $220 On Robust Q1 Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bradley Coopers Cheesesteak Recipe And Review

Apr 26, 2025

Bradley Coopers Cheesesteak Recipe And Review

Apr 26, 2025 -

Review Jewel Thief The Heist Begins Delivers Edge Of Your Seat Action

Apr 26, 2025

Review Jewel Thief The Heist Begins Delivers Edge Of Your Seat Action

Apr 26, 2025 -

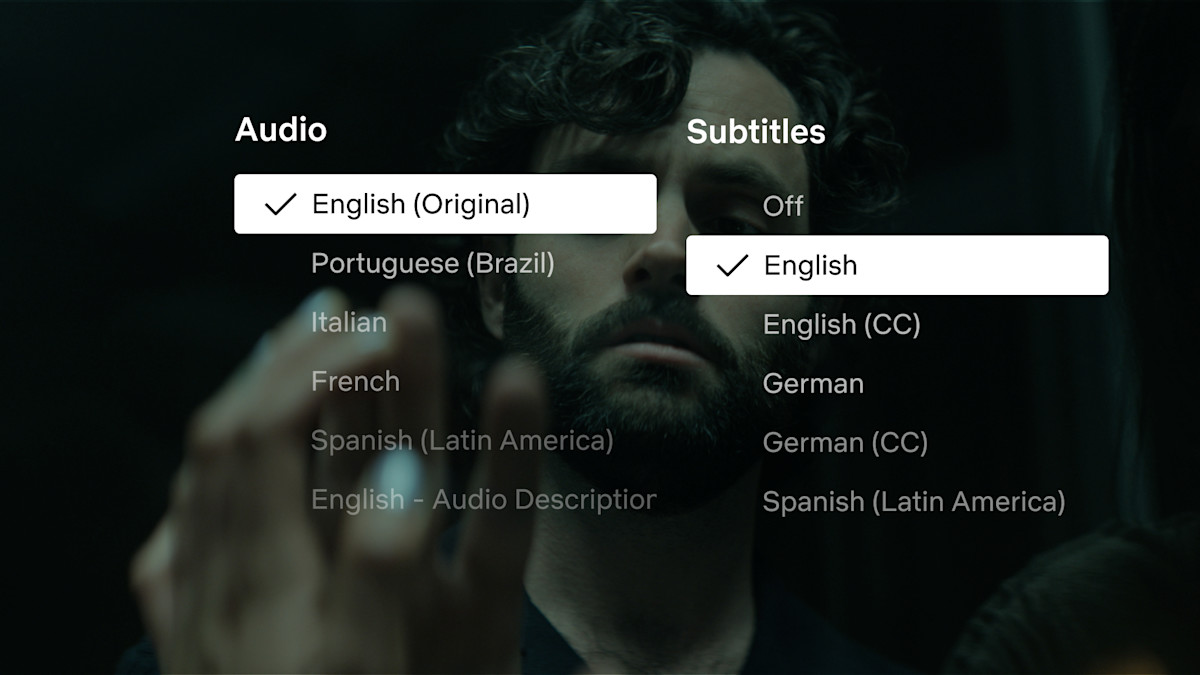

Netflix Improves Streaming Experience You Season 5 With The Update

Apr 26, 2025

Netflix Improves Streaming Experience You Season 5 With The Update

Apr 26, 2025 -

Finales De Copa Del Rey Del Real Madrid Un Repaso A Sus Victorias

Apr 26, 2025

Finales De Copa Del Rey Del Real Madrid Un Repaso A Sus Victorias

Apr 26, 2025 -

Controversy Erupts At Cdl Agm Over Director Appointments

Apr 26, 2025

Controversy Erupts At Cdl Agm Over Director Appointments

Apr 26, 2025