Circle Valuation: Experts Debate Ripple's $5 Billion Acquisition Bid

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Circle Valuation: Experts Debate Ripple's $5 Billion Acquisition Bid

The crypto world is abuzz with speculation following Ripple's reported $5 billion bid to acquire Circle, a prominent player in the stablecoin and USD Coin (USDC) market. This potential acquisition has sparked intense debate among industry experts, with opinions sharply divided on the valuation and the strategic implications of such a deal. The proposed acquisition price of $5 billion represents a significant premium on Circle's current valuation, leading many to question whether it's a fair price or an overestimation driven by the current market dynamics.

<h3>The Arguments for a $5 Billion Valuation</h3>

Proponents of the $5 billion valuation point to Circle's dominant position in the stablecoin market. USDC, Circle's flagship stablecoin, holds a significant market share, second only to Tether (USDT). This substantial market presence, coupled with Circle's expanding services in payments and blockchain infrastructure, fuels the argument that the company is worth the hefty price tag. Furthermore, the potential synergies between Ripple and Circle, particularly in cross-border payments, are seen as a strong justification for the acquisition. The combined power of Ripple's technology and Circle's stablecoin could create a formidable force in the global payments landscape. Some analysts believe the long-term potential for growth within the rapidly evolving digital asset space fully justifies the investment.

<h3>Concerns and Counterarguments</h3>

However, a wave of skepticism surrounds the valuation. Critics argue that $5 billion is too high, considering the current market downturn and the regulatory uncertainty surrounding stablecoins. The SEC's ongoing lawsuit against Ripple casts a long shadow over the deal, adding to the inherent risks. The potential for regulatory hurdles and the inherent volatility of the cryptocurrency market are cited as key factors that could significantly impact Circle's future profitability and justify a lower valuation. Some experts believe the bid reflects Ripple's eagerness to consolidate its position in the market rather than a purely rational assessment of Circle's intrinsic value.

<h3>Market Impact and Future Outlook</h3>

The potential acquisition carries significant implications for the broader cryptocurrency market. A successful acquisition could lead to increased consolidation within the stablecoin sector, potentially reshaping the competitive landscape. It could also accelerate the adoption of USDC and potentially influence the development of future stablecoin regulations. However, a failed bid could trigger uncertainty in the market and impact investor sentiment towards both Ripple and Circle.

The outcome of this potential acquisition remains uncertain. Several factors will play a crucial role in determining its success or failure, including regulatory approvals, the final negotiated price, and the overall market conditions. The debate over Circle's valuation highlights the complexities and challenges involved in navigating the rapidly evolving cryptocurrency ecosystem. The coming weeks and months will undoubtedly bring further clarity, shaping the future landscape of the digital asset industry.

<h3>Key Takeaways:</h3>

- High Valuation: Ripple's $5 billion bid represents a significant premium on Circle's perceived market value.

- Market Dominance: Circle's substantial market share in the stablecoin market is a key argument for its valuation.

- Regulatory Uncertainty: The SEC's lawsuit against Ripple and the general regulatory uncertainty surrounding stablecoins present significant challenges.

- Synergies and Potential: The potential synergies between Ripple and Circle in cross-border payments are seen as a major driver for the acquisition.

- Uncertain Future: The success or failure of the acquisition will heavily depend on regulatory approvals, the final price, and broader market conditions.

This situation demands close monitoring from anyone invested in the cryptocurrency market, as the outcome will significantly influence the future landscape of digital finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Circle Valuation: Experts Debate Ripple's $5 Billion Acquisition Bid. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Compartilhando Casas Vantagens E Desvantagens De Cotas Em Imoveis De Praia E Campo

May 20, 2025

Compartilhando Casas Vantagens E Desvantagens De Cotas Em Imoveis De Praia E Campo

May 20, 2025 -

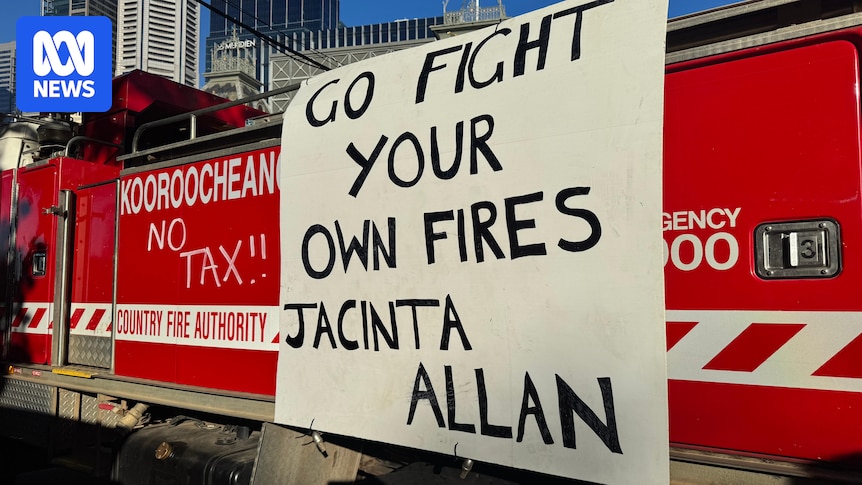

Budget Day Showdown Rural Victorians Rally Against Emergency Levy

May 20, 2025

Budget Day Showdown Rural Victorians Rally Against Emergency Levy

May 20, 2025 -

The Rivalry That Shaped Our View Of Mars Competing Cartographers And Planetary Perception

May 20, 2025

The Rivalry That Shaped Our View Of Mars Competing Cartographers And Planetary Perception

May 20, 2025 -

Humanitarian Crisis In Gaza Analysis Of The Latest Joint Donor Statement

May 20, 2025

Humanitarian Crisis In Gaza Analysis Of The Latest Joint Donor Statement

May 20, 2025 -

Nyt Connections May 19 2024 Complete Solution Guide Game 708

May 20, 2025

Nyt Connections May 19 2024 Complete Solution Guide Game 708

May 20, 2025