Claim Your $1,400: Compliance Deadline For U.S. Expats Approaching

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Claim Your $1,400: Compliance Deadline for U.S. Expats Approaching

Don't miss out! The deadline to claim your portion of the 2021 Economic Impact Payment (EIP) is fast approaching for American citizens living abroad. Many U.S. expats are unaware they may be eligible for a significant portion, or even all, of the $1,400 stimulus payment. Missing this deadline could mean forfeiting hundreds, or even thousands, of dollars.

The 2021 stimulus package, officially known as the American Rescue Plan Act, provided eligible individuals with a $1,400 payment. While many received their payments automatically, many U.S. citizens residing overseas were overlooked due to complexities in international tax laws and reporting requirements. This oversight has left many eligible expats without their rightful share of the financial aid.

What You Need to Know:

The IRS has extended a grace period for claiming these missed payments, but this deadline is rapidly approaching. Failure to act before the deadline means you likely won't receive your money. This is crucial for expats struggling with the rising cost of living abroad or facing financial hardship.

Who is Eligible?

Eligibility criteria largely mirror those for domestic recipients:

- U.S. Citizenship: You must be a U.S. citizen or resident alien.

- Foreign Income: Your foreign income shouldn't exceed certain limits (specific details can be found on the IRS website).

- Filing Status: You must have filed your 2020 or 2021 tax return. If you haven't filed yet, do so immediately!

- Dependent Status: If you have dependents, they may also be eligible for payments.

How to Claim Your Payment:

Claiming your $1,400 stimulus payment requires filing an amended tax return using Form 1040-X. This is a crucial step and requires careful attention to detail. We strongly advise you to:

- Consult a Tax Professional: Navigating international tax laws can be complicated. A qualified tax advisor specializing in expat taxation can provide invaluable guidance and ensure you complete the process correctly.

- Gather Necessary Documents: You'll need your passport, tax identification number, proof of foreign residency, and other relevant documents.

- File Electronically: Filing electronically is often faster and more efficient.

- Allow Ample Time: Don't wait until the last minute. Give yourself plenty of time to gather the required documents and complete the form accurately.

Don't Delay, Act Now!

This is not merely about the money; it's about ensuring you receive what you're rightfully entitled to. Missing the deadline could mean a significant financial loss. The IRS provides resources to help you understand the process, but seeking expert advice from a tax professional specializing in international tax laws is highly recommended.

Keywords: $1400 stimulus check, stimulus payment, Economic Impact Payment (EIP), American Rescue Plan Act, expat, US expat, overseas, foreign income, tax return, amended tax return, Form 1040-X, IRS, tax professional, international tax, deadline, compliance.

Disclaimer: This article provides general information and should not be considered professional tax advice. Consult with a qualified tax professional for advice tailored to your specific situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Claim Your $1,400: Compliance Deadline For U.S. Expats Approaching. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Prospects For Success Analyzing The Firebirds Road Ahead

May 08, 2025

Prospects For Success Analyzing The Firebirds Road Ahead

May 08, 2025 -

Mini Pc Price Vs Performance Is Modular Design Worth The Cost

May 08, 2025

Mini Pc Price Vs Performance Is Modular Design Worth The Cost

May 08, 2025 -

Ticketmaster And Crown Resorts Strengthen Ties With New Partnership Agreement

May 08, 2025

Ticketmaster And Crown Resorts Strengthen Ties With New Partnership Agreement

May 08, 2025 -

Op Sindoor And Terrorism Uk Anchors Confrontation With Shehbaz Sharifs Minister

May 08, 2025

Op Sindoor And Terrorism Uk Anchors Confrontation With Shehbaz Sharifs Minister

May 08, 2025 -

Week 3 Of Crypto Inflows Billions Fuel Markets Strong Performance

May 08, 2025

Week 3 Of Crypto Inflows Billions Fuel Markets Strong Performance

May 08, 2025

Latest Posts

-

Tngde Tamil Nadu 12th Results 2025 Direct Link To Check Plus Two Scores And Pass Percentage

May 08, 2025

Tngde Tamil Nadu 12th Results 2025 Direct Link To Check Plus Two Scores And Pass Percentage

May 08, 2025 -

Market Reaction Dbs Shares Rally Following Positive Earnings Report

May 08, 2025

Market Reaction Dbs Shares Rally Following Positive Earnings Report

May 08, 2025 -

Programas De Tempo Compartilhado Casas Na Praia E Campo Com Baixo Investimento

May 08, 2025

Programas De Tempo Compartilhado Casas Na Praia E Campo Com Baixo Investimento

May 08, 2025 -

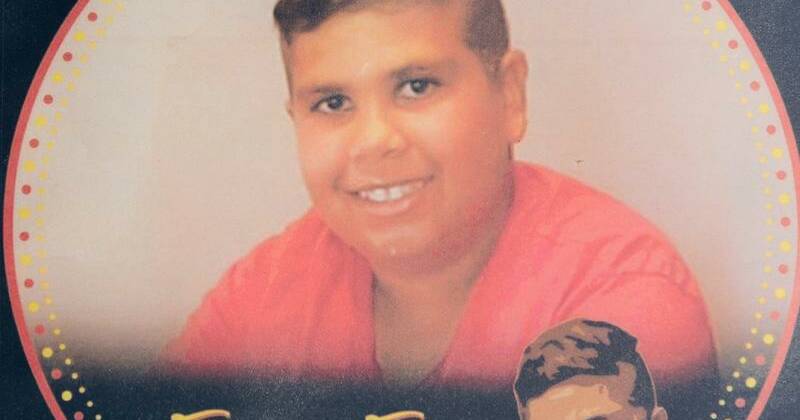

Guilty Verdict In High Profile Indigenous Teen Murder Case

May 08, 2025

Guilty Verdict In High Profile Indigenous Teen Murder Case

May 08, 2025 -

Tattle Aali Bloodshed Five Dead In Retaliation Killing

May 08, 2025

Tattle Aali Bloodshed Five Dead In Retaliation Killing

May 08, 2025