Coinbase-Deribit Merger: How The $2.9B Acquisition Reshapes The Crypto Derivatives Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Coinbase-Deribit Merger: How the $2.9B Acquisition Reshapes the Crypto Derivatives Market

The cryptocurrency world is buzzing with the news of a potential seismic shift: a rumored $2.9 billion acquisition of Deribit, a leading cryptocurrency derivatives exchange, by Coinbase, the largest US-based cryptocurrency exchange. While neither company has officially confirmed the deal, the speculation alone has sent ripples through the market, prompting crucial questions about the future of crypto derivatives trading and the competitive landscape. This article explores the potential implications of this monumental merger.

The Allure of Deribit for Coinbase:

Coinbase's rumored pursuit of Deribit isn't surprising. Deribit boasts a strong reputation for its advanced trading platform, high liquidity, and robust security measures. Acquiring Deribit would instantly catapult Coinbase into a dominant position in the rapidly growing crypto derivatives market. Currently, Coinbase's offerings in this space are relatively limited, while Deribit enjoys a significant market share, particularly among institutional investors seeking sophisticated trading tools.

- Increased Market Share: This acquisition would give Coinbase a substantial edge against competitors like Binance and Kraken, broadening its user base and significantly increasing trading volume.

- Access to Institutional Investors: Deribit's established institutional client base provides Coinbase with a ready-made avenue for expansion into the high-value institutional trading sector.

- Enhanced Product Offerings: Integrating Deribit's advanced trading platform and product suite would enrich Coinbase's overall offerings, attracting both retail and institutional traders.

- Synergistic Growth: Combining Coinbase's extensive user base with Deribit's technical expertise promises significant synergistic growth opportunities.

Potential Impacts on the Crypto Derivatives Market:

The potential Coinbase-Deribit merger presents both opportunities and challenges for the broader cryptocurrency derivatives market:

- Increased Competition: While strengthening Coinbase's position, this merger could trigger a wave of consolidation within the crypto derivatives market, as competitors scramble to maintain their market share.

- Regulatory Scrutiny: A combined entity of this magnitude will undoubtedly face increased regulatory scrutiny, potentially leading to stricter compliance requirements and oversight.

- Price Volatility: The market reaction to the confirmed merger (should it happen) could cause significant price volatility for various cryptocurrencies, particularly those heavily traded on Deribit.

- Innovation: The combined resources and expertise of both companies could accelerate innovation in the crypto derivatives space, leading to new and improved trading products and services.

What Happens Next?

The future remains uncertain until both Coinbase and Deribit officially comment. However, the very possibility of this merger underscores the ongoing consolidation and maturation of the cryptocurrency market. The crypto derivatives market, once a niche segment, is now a significant force, and this acquisition would represent a major landmark in its evolution. We will continue to monitor the situation and provide updates as more information becomes available. Stay tuned for further developments in this exciting chapter of the cryptocurrency story. Remember to always do your own research (DYOR) before investing in any cryptocurrency or derivative product.

Keywords: Coinbase, Deribit, Cryptocurrency, Derivatives, Merger, Acquisition, Crypto Exchange, Bitcoin, Ethereum, Trading, Institutional Investors, Market Share, Regulatory Scrutiny, Crypto Market, Blockchain, Volatility, Fintech.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Coinbase-Deribit Merger: How The $2.9B Acquisition Reshapes The Crypto Derivatives Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

100 000 Bitcoin Market Reaction And Implications For Cryptocurrency Investors

May 10, 2025

100 000 Bitcoin Market Reaction And Implications For Cryptocurrency Investors

May 10, 2025 -

Nintendo Switch 2 Pre Order Status And Top Retailers To Watch

May 10, 2025

Nintendo Switch 2 Pre Order Status And Top Retailers To Watch

May 10, 2025 -

Unexpected Resignation Glyn Davis Exits As Australias Top Public Servant

May 10, 2025

Unexpected Resignation Glyn Davis Exits As Australias Top Public Servant

May 10, 2025 -

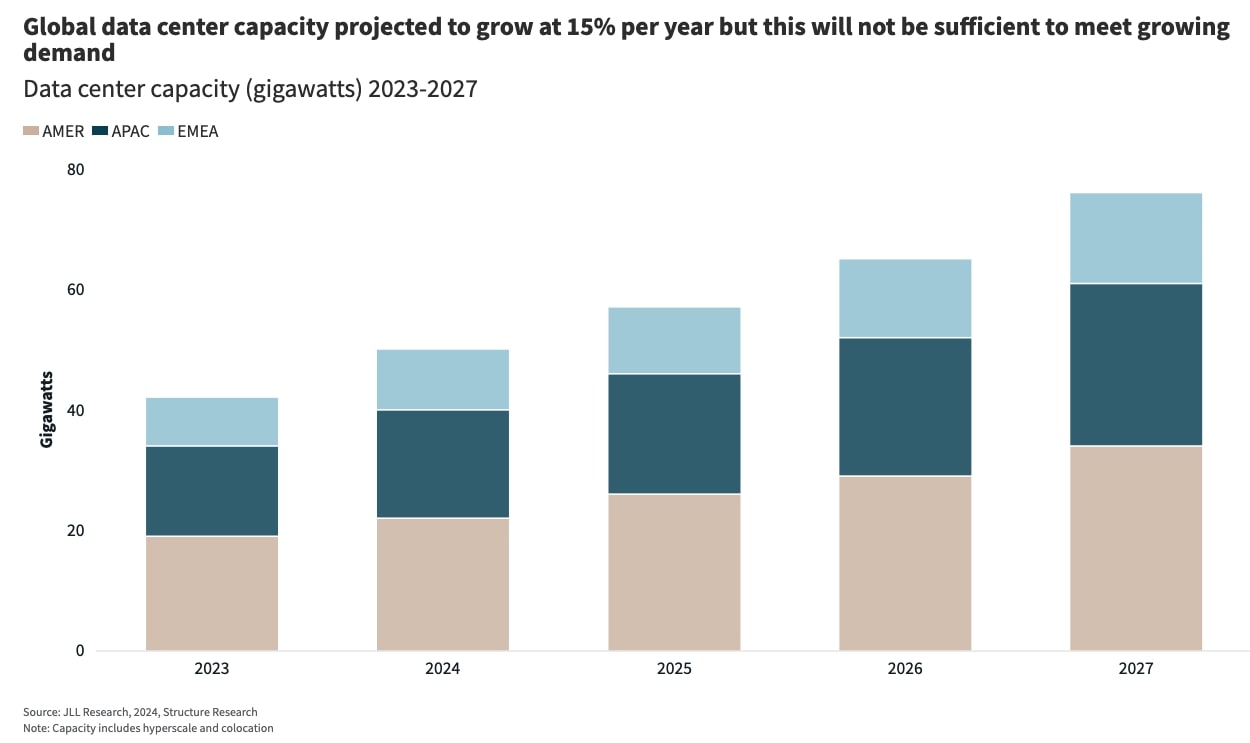

The Unstoppable Rise Of Global Ai Data Centers New Trends And Challenges

May 10, 2025

The Unstoppable Rise Of Global Ai Data Centers New Trends And Challenges

May 10, 2025 -

Unfiltered Jimmy Butlers Honest Assessment Of Game 1 Against Golden State Warriors

May 10, 2025

Unfiltered Jimmy Butlers Honest Assessment Of Game 1 Against Golden State Warriors

May 10, 2025

Latest Posts

-

Post Game Controversy Gordon Challenges Thunders Physicality And Referees Performance After Jokics Big Night

May 10, 2025

Post Game Controversy Gordon Challenges Thunders Physicality And Referees Performance After Jokics Big Night

May 10, 2025 -

Game 7 Awaits Browns Crucial Contribution Extends Bruins Playoff Run

May 10, 2025

Game 7 Awaits Browns Crucial Contribution Extends Bruins Playoff Run

May 10, 2025 -

Viewers Divided After Naga Munchettys Intense Interview On Bbc Breakfast

May 10, 2025

Viewers Divided After Naga Munchettys Intense Interview On Bbc Breakfast

May 10, 2025 -

Automated Malware Removal The Future Of Cybersecurity Protection

May 10, 2025

Automated Malware Removal The Future Of Cybersecurity Protection

May 10, 2025 -

Nations Call Pm Modi Seeks Veterans Counsel In Crucial Times

May 10, 2025

Nations Call Pm Modi Seeks Veterans Counsel In Crucial Times

May 10, 2025