Commonwealth Bank Predicts RBA Interest Rate Cut: A Done Deal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Commonwealth Bank Predicts RBA Interest Rate Cut: A Done Deal?

The Australian economy is bracing itself for a potential interest rate cut, with the Commonwealth Bank (CBA), Australia's largest lender, predicting the Reserve Bank of Australia (RBA) will lower the cash rate. This bold prediction has sent ripples through the financial markets, leaving many Australians wondering: is an RBA interest rate cut a done deal?

The CBA's forecast, released [insert date of release], anticipates a 25 basis point cut to the official cash rate, bringing it down to [insert predicted rate]. This follows a period of relatively stable interest rates, and comes amidst growing concerns about slowing economic growth and stubbornly high inflation.

Why is the CBA Predicting an RBA Rate Cut?

Several factors contribute to the CBA's confident prediction. The bank points to a confluence of economic indicators suggesting a need for monetary easing. These include:

- Slowing Economic Growth: Recent data reveals a slowdown in key economic sectors, hinting at a potential recessionary environment. This decreased economic activity is a significant driver behind the call for lower interest rates.

- High Unemployment: While not catastrophically high, the unemployment rate remains a concern, suggesting the RBA may need to stimulate the job market through lower borrowing costs.

- Global Economic Uncertainty: The global economic landscape is far from rosy, with ongoing geopolitical tensions and inflationary pressures impacting Australia's economic performance. A rate cut could help buffer Australia against external shocks.

- Inflation Concerns: While inflation remains a significant challenge, the CBA's prediction suggests the bank believes a rate cut won't significantly exacerbate the issue and is necessary to stimulate the struggling economy. The strategy is a calculated risk, balancing the need to control inflation against the need to boost economic growth.

What Does This Mean for Australian Homeowners and Borrowers?

A rate cut would likely translate into lower mortgage repayments for many Australian homeowners, providing some much-needed relief. However, the impact won't be uniform, with the benefits potentially varying depending on individual loan structures and lender policies.

Businesses could also benefit from lower borrowing costs, potentially stimulating investment and job creation. However, the overall effect on businesses will depend on a variety of factors including their specific financial situation and the broader economic climate.

Is it a Done Deal? Analyzing the Uncertainty

While the CBA's prediction carries significant weight, it's crucial to remember that it's not a guarantee. The RBA is an independent body and its decisions are based on a complex analysis of numerous economic factors. Several factors could still influence the RBA's final decision, including:

- Upcoming Economic Data Releases: Further economic data releases before the next RBA meeting could significantly alter the outlook.

- Inflation Trajectory: The RBA's primary mandate is to maintain price stability. If inflation remains stubbornly high, a rate cut might be less likely.

- Global Economic Developments: Unexpected global events could also sway the RBA's decision.

In conclusion, the CBA's prediction of an RBA interest rate cut is a significant development, but it's not a foregone conclusion. The coming weeks will be crucial in determining the RBA's next move, and Australians should closely follow economic indicators and RBA statements for further updates. The impact of a potential rate cut will be far-reaching, affecting homeowners, businesses, and the broader Australian economy. Stay informed and prepare for potential changes in the financial landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Commonwealth Bank Predicts RBA Interest Rate Cut: A Done Deal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

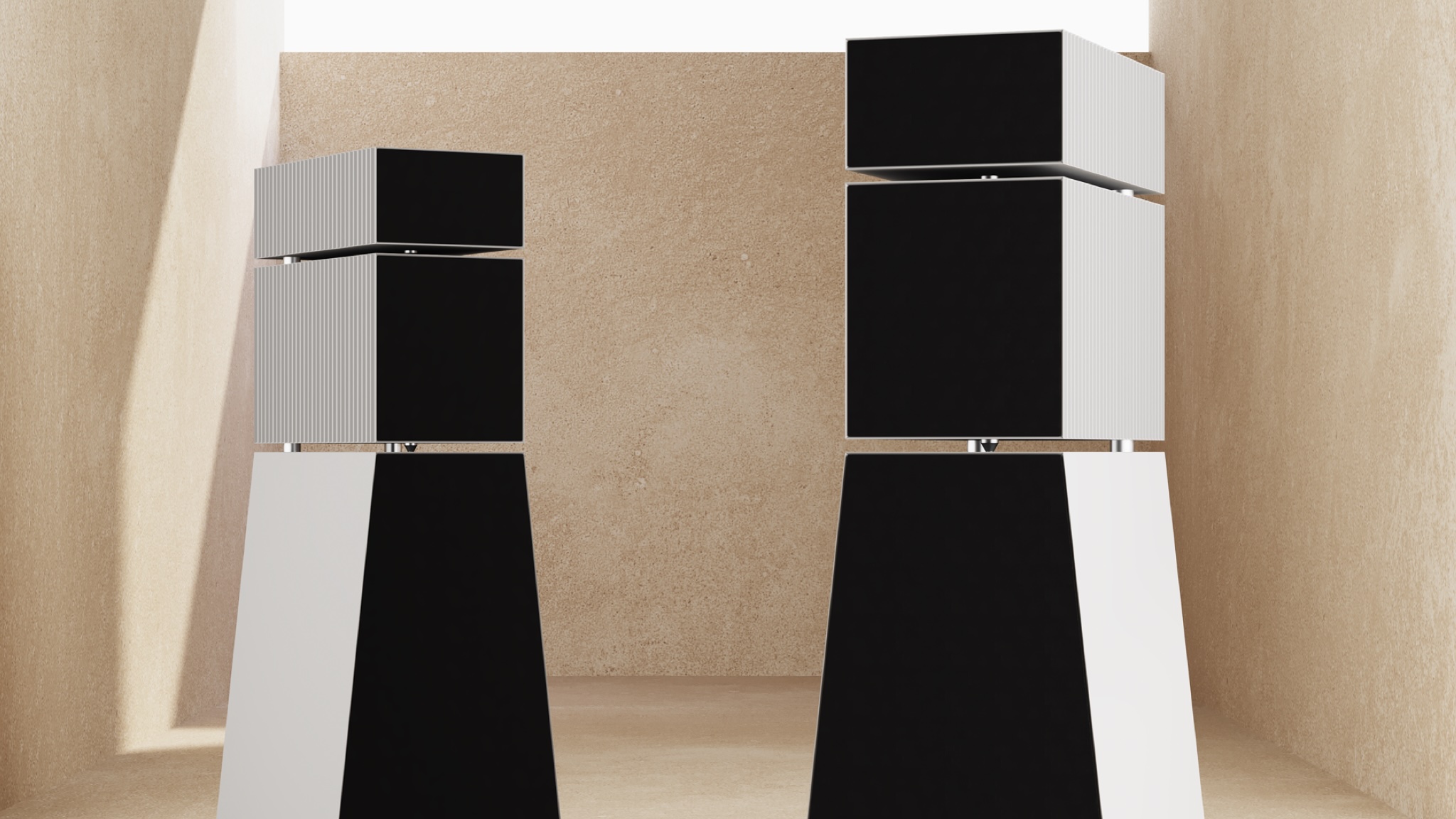

Luxury Speakers Doctor Who Inspired Design Meets Heavenly Sound

Apr 22, 2025

Luxury Speakers Doctor Who Inspired Design Meets Heavenly Sound

Apr 22, 2025 -

Playoff Battle Timberwolves Mc Daniels Fuels Game 1 Win Against Lakers

Apr 22, 2025

Playoff Battle Timberwolves Mc Daniels Fuels Game 1 Win Against Lakers

Apr 22, 2025 -

Unsung Hero Identifying The Edmonton Oilers Most Valuable Player

Apr 22, 2025

Unsung Hero Identifying The Edmonton Oilers Most Valuable Player

Apr 22, 2025 -

Pistons Vs Knicks Box Score And Recap April 21 2025 Game

Apr 22, 2025

Pistons Vs Knicks Box Score And Recap April 21 2025 Game

Apr 22, 2025 -

Everyday Drugs Unexpected Allies In Dementia Prevention

Apr 22, 2025

Everyday Drugs Unexpected Allies In Dementia Prevention

Apr 22, 2025