Comparing Palo Alto Networks And Nvidia: Post-Nasdaq Sell-Off Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Palo Alto Networks vs. Nvidia: A Post-Nasdaq Sell-Off Investment Deep Dive

The recent Nasdaq sell-off has left many investors wondering where to put their money. Two tech giants, Palo Alto Networks and Nvidia, have emerged as compelling, albeit distinct, investment options. Both companies boast impressive growth trajectories, but their approaches to the tech landscape differ significantly. This analysis compares Palo Alto Networks and Nvidia, examining their post-sell-off potential and helping investors navigate this turbulent market.

Understanding the Post-Sell-Off Landscape

The recent market downturn has presented both opportunities and challenges. While valuations have adjusted, the underlying strength of many tech companies remains. For investors with a long-term perspective, this period of volatility can be a strategic time to acquire shares at potentially discounted prices. However, careful due diligence is crucial, particularly when comparing companies with vastly different business models like Palo Alto Networks and Nvidia.

Palo Alto Networks: Cybersecurity's Steady Hand

Palo Alto Networks (PANW) is a leading cybersecurity company providing a comprehensive suite of network security solutions. Their focus on cloud security, threat prevention, and advanced threat intelligence positions them well in a landscape increasingly dominated by remote work and cloud-based applications.

Strengths:

- Strong Market Position: PANW enjoys a significant market share in the enterprise cybersecurity sector, a market expected to continue robust growth.

- Recurring Revenue Model: A substantial portion of PANW's revenue comes from subscriptions, providing predictable income streams and greater financial stability.

- Consistent Innovation: The company consistently invests in research and development, staying ahead of evolving cyber threats and maintaining a competitive edge.

Weaknesses:

- Price Sensitivity: Like many tech stocks, PANW's share price can be volatile and susceptible to broader market fluctuations.

- Competition: The cybersecurity market is highly competitive, with numerous established and emerging players vying for market share.

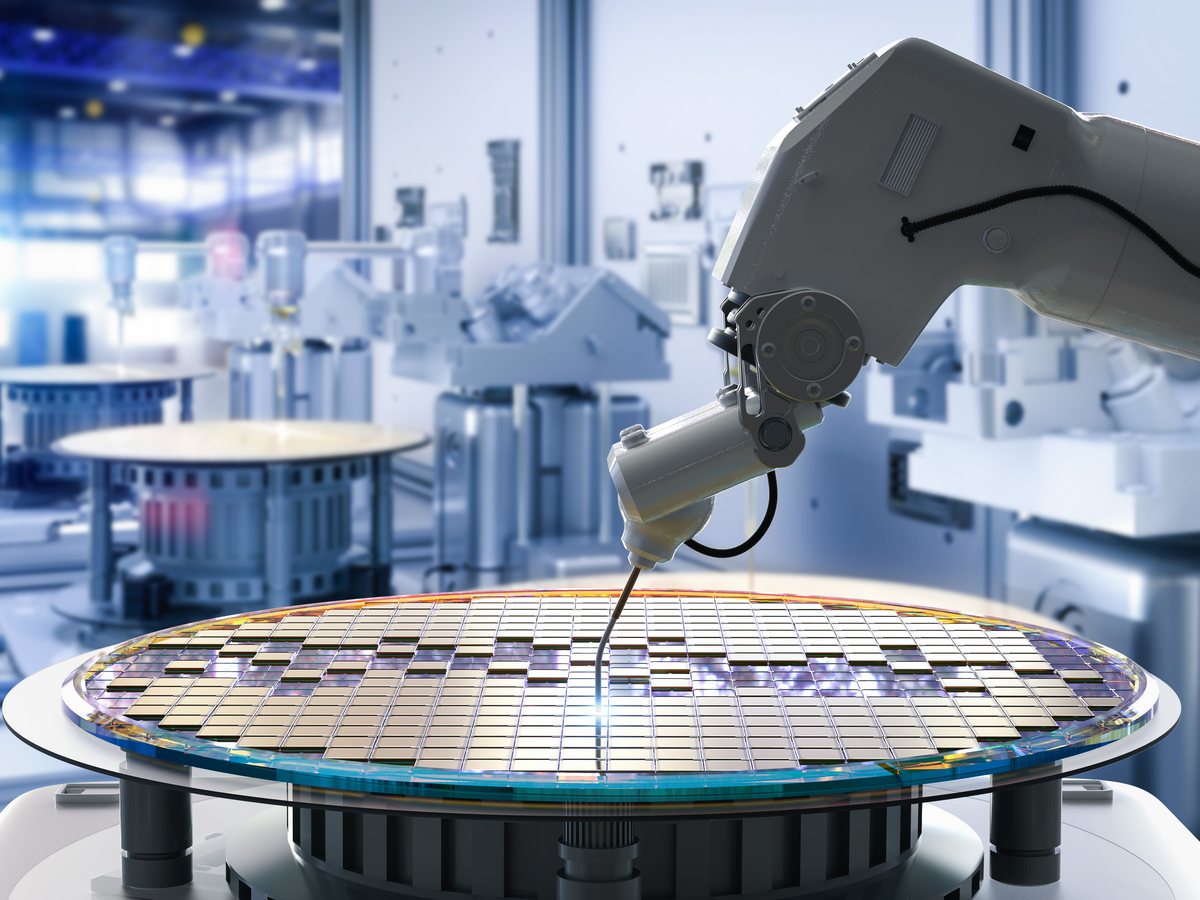

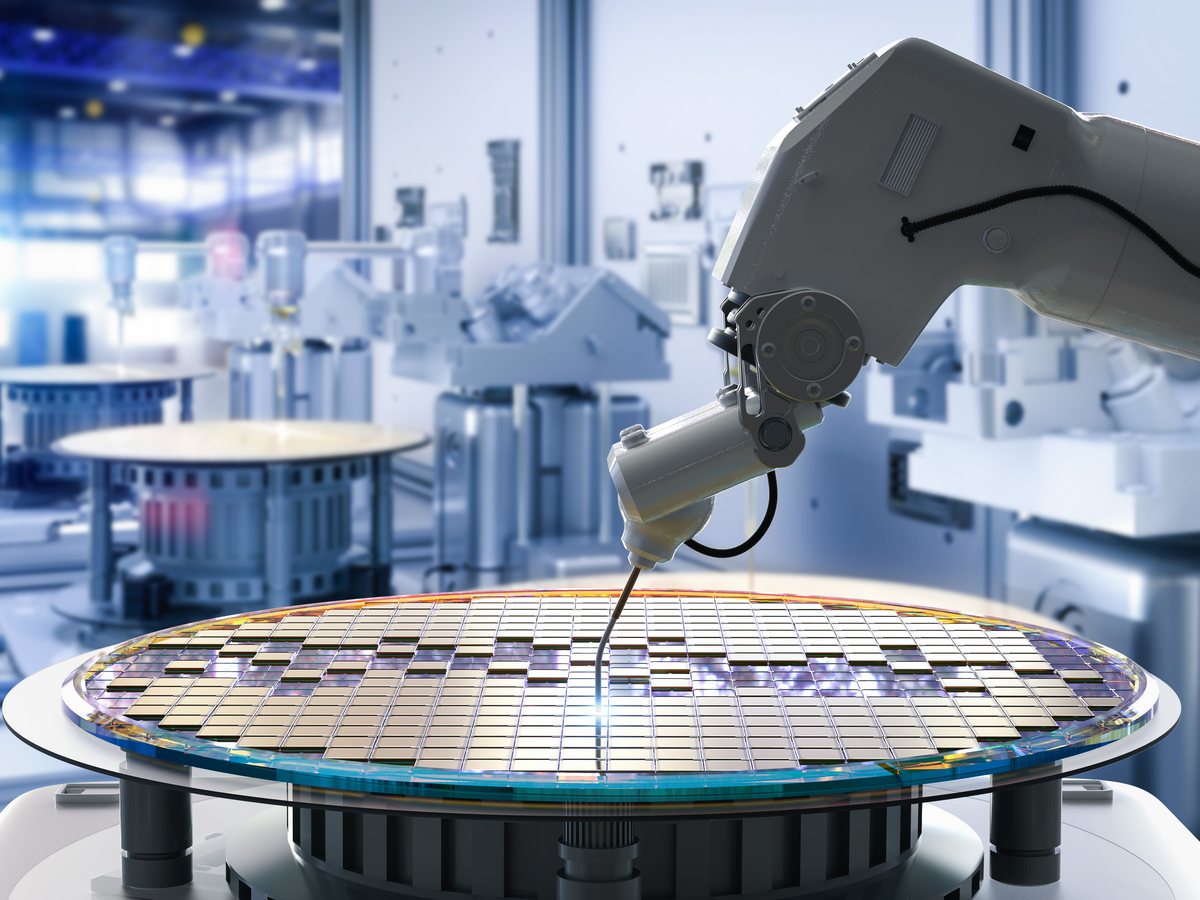

Nvidia: The AI Revolution's Engine

Nvidia (NVDA) is a dominant player in the graphics processing unit (GPU) market, but its influence extends far beyond gaming. Nvidia GPUs are critical to the advancement of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). This positions NVDA at the forefront of several rapidly expanding technological frontiers.

Strengths:

- AI Dominance: Nvidia's GPUs are the preferred choice for AI development and deployment, giving them a significant advantage in this explosive market.

- Data Center Growth: The increasing demand for data center infrastructure fuels NVDA's growth, driven by the expansion of cloud computing and AI applications.

- High Growth Potential: The AI revolution is still in its early stages, suggesting significant long-term growth potential for NVDA.

Weaknesses:

- High Valuation: NVDA's share price reflects its high growth potential, potentially making it vulnerable to corrections in a volatile market.

- Geopolitical Risks: Global trade tensions and regulatory scrutiny could impact NVDA's operations and growth trajectory.

Investment Considerations: PANW vs. NVDA

Choosing between Palo Alto Networks and Nvidia depends heavily on your investment goals and risk tolerance.

-

Lower Risk, Steady Growth: Investors seeking relatively lower risk and consistent growth might favor Palo Alto Networks. Its established market position and recurring revenue model offer a degree of stability.

-

Higher Risk, High Reward: Investors with a higher risk tolerance and a long-term perspective might prefer Nvidia. Its exposure to the burgeoning AI market offers significant potential for substantial returns, but also carries greater volatility.

Ultimately, thorough research and consideration of your individual investment strategy are paramount. Consulting a financial advisor is recommended before making any investment decisions. The post-Nasdaq sell-off presents an interesting opportunity, but a careful evaluation of both Palo Alto Networks and Nvidia is crucial for maximizing potential returns while mitigating risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Comparing Palo Alto Networks And Nvidia: Post-Nasdaq Sell-Off Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gemma Atkinson And Gorka Marquez Wedding Update And Married Feeling

Apr 07, 2025

Gemma Atkinson And Gorka Marquez Wedding Update And Married Feeling

Apr 07, 2025 -

Wiliame Appointed Head Coach Of Bulldogs Nrlw Team

Apr 07, 2025

Wiliame Appointed Head Coach Of Bulldogs Nrlw Team

Apr 07, 2025 -

Sub 17 Brasil Elimina Equador E Conquista Vaga No Mundial

Apr 07, 2025

Sub 17 Brasil Elimina Equador E Conquista Vaga No Mundial

Apr 07, 2025 -

Irs To Reinstate Fired Probationary Employees By Mid April

Apr 07, 2025

Irs To Reinstate Fired Probationary Employees By Mid April

Apr 07, 2025 -

Smaller Cheaper Smarter Amazon Echo Show Challenges Googles Smart Display Dominance

Apr 07, 2025

Smaller Cheaper Smarter Amazon Echo Show Challenges Googles Smart Display Dominance

Apr 07, 2025