Consumer Sentiment Dips In May: Inflation Fears Rise Following Tariff Hikes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Consumer Sentiment Dips in May: Inflation Fears Rise Following Tariff Hikes

Inflation concerns and rising prices continue to weigh heavily on American consumers. The latest consumer sentiment data reveals a noticeable dip in May, fueled by anxieties surrounding increased tariffs and persistent inflationary pressures. This downturn signals a potential slowdown in consumer spending, a key driver of the US economy. Economists are closely watching this trend, as it could significantly impact economic growth in the coming months.

Key Findings from the May Consumer Sentiment Report:

The University of Michigan's Consumer Sentiment Index fell to its lowest point in several months, indicating a growing pessimism among consumers. Several factors contributed to this decline:

- Rising Inflation: The persistent increase in prices for everyday goods, from groceries to gasoline, is a major source of concern. Consumers are feeling the pinch of inflation, impacting their purchasing power and overall financial well-being.

- Tariff Hikes: The recent increase in tariffs on imported goods has exacerbated inflationary pressures, pushing up prices even further. This directly impacts consumer affordability, particularly for goods reliant on imported components.

- Uncertainty about the Future: A lack of clarity regarding future economic policy and the ongoing geopolitical landscape is adding to consumer uncertainty and apprehension. This hesitancy translates into reduced spending and investment.

Impact on the Economy:

The dip in consumer sentiment has significant implications for the broader economy. Consumer spending accounts for a substantial portion of US GDP, and any reduction in spending can lead to a slowdown in economic growth. Businesses may respond by reducing investment and hiring, creating a ripple effect throughout the economy.

What's Next?

The coming months will be crucial in determining the trajectory of consumer sentiment and the overall economy. Several factors will play a significant role:

- Federal Reserve Policy: The actions of the Federal Reserve, particularly regarding interest rate hikes, will be closely monitored. Aggressive interest rate increases could further dampen consumer spending.

- Government Intervention: Government policies aimed at mitigating inflation, such as targeted subsidies or tax cuts, could help alleviate some of the pressure on consumers.

- Global Economic Conditions: The ongoing war in Ukraine and global supply chain disruptions continue to contribute to uncertainty, posing ongoing risks to the economy.

Strategies for Consumers:

In the face of rising inflation and economic uncertainty, consumers can take several steps to manage their finances:

- Budgeting: Create and stick to a detailed budget to track expenses and identify areas for savings.

- Debt Management: Prioritize paying down high-interest debt to reduce financial burdens.

- Saving: Build an emergency fund to cushion against unexpected expenses.

- Investment Diversification: Diversify investment portfolios to mitigate risks.

Conclusion:

The dip in consumer sentiment in May serves as a stark reminder of the challenges facing the US economy. Inflation, tariff hikes, and global uncertainties are all contributing factors. Close monitoring of economic indicators and proactive financial management will be essential for both consumers and policymakers in navigating this period of economic volatility. The coming months will be critical in determining whether this dip represents a temporary setback or the start of a more significant economic downturn. Experts remain divided on the outlook, emphasizing the need for vigilance and adaptation to the changing economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Consumer Sentiment Dips In May: Inflation Fears Rise Following Tariff Hikes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

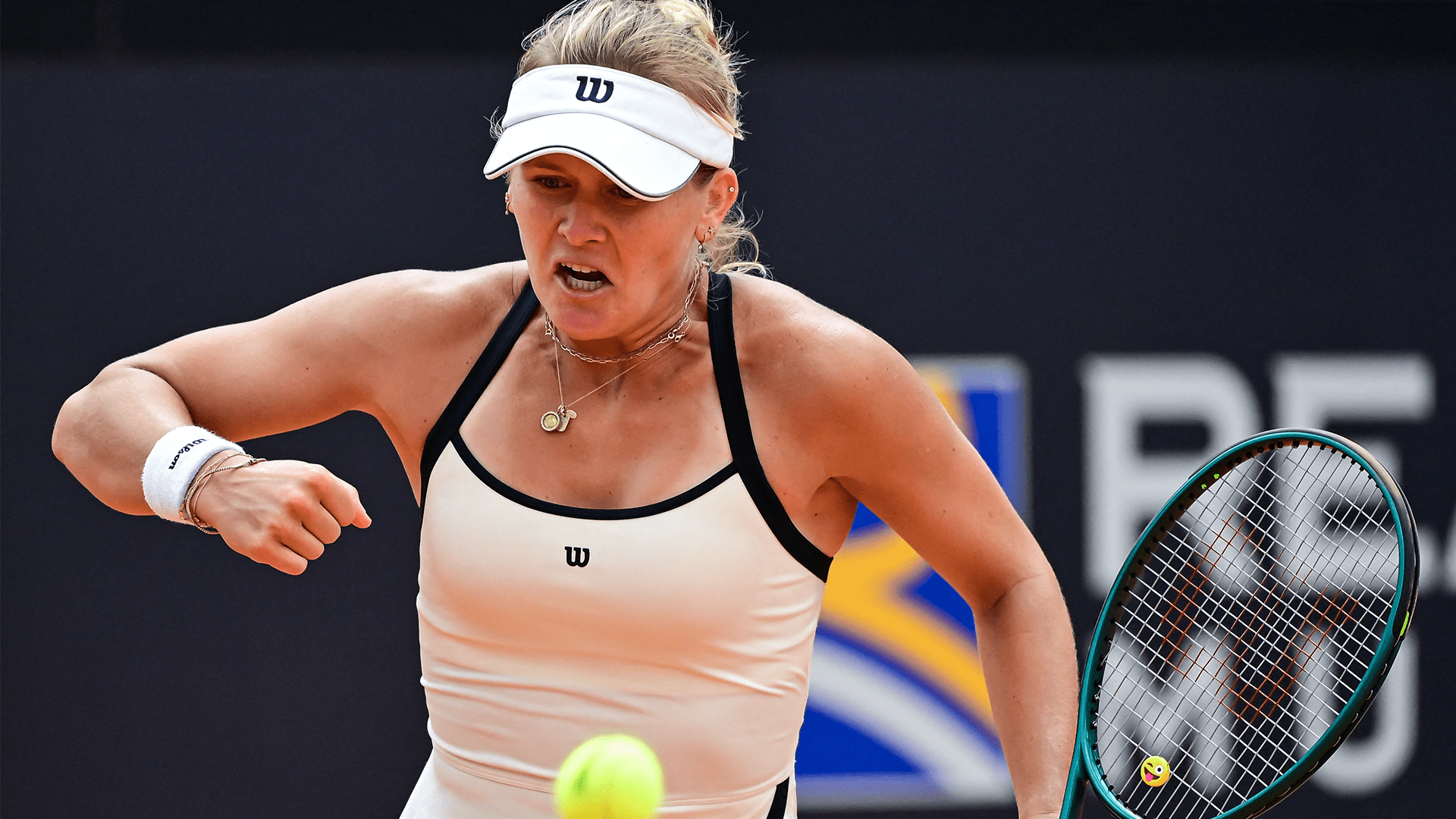

Tennis Player Peyton Stearns Unapologetic About Rome Coaching Tweet

May 16, 2025

Tennis Player Peyton Stearns Unapologetic About Rome Coaching Tweet

May 16, 2025 -

Humanoid Robot Revolution Musks Vision Of Billions Of Robots And A Terawatt Xai Data Center

May 16, 2025

Humanoid Robot Revolution Musks Vision Of Billions Of Robots And A Terawatt Xai Data Center

May 16, 2025 -

Max Homas Champ Connections An Inside Look With T Mobile

May 16, 2025

Max Homas Champ Connections An Inside Look With T Mobile

May 16, 2025 -

Post Gt 3 Test Verstappen Seeks Nordschleife Track Permission

May 16, 2025

Post Gt 3 Test Verstappen Seeks Nordschleife Track Permission

May 16, 2025 -

Sigue El Partido Alcaraz Vs Musetti Masters 1000 De Roma En Directo

May 16, 2025

Sigue El Partido Alcaraz Vs Musetti Masters 1000 De Roma En Directo

May 16, 2025