Court Access For Russian Crypto Owners Hinges On Tax Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Court Access for Russian Crypto Owners Hinges on Tax Compliance

The Russian legal landscape is becoming increasingly complex for cryptocurrency owners, with recent rulings highlighting a crucial link between tax compliance and access to the court system. This development has significant implications for individuals and businesses holding digital assets within the country, forcing many to re-evaluate their tax strategies. Failure to comply could leave them vulnerable and unable to seek legal redress.

The Growing Importance of Crypto Tax Compliance in Russia

For years, the regulatory environment surrounding cryptocurrencies in Russia has been in a state of flux. While not explicitly banned, the lack of clear legal frameworks has created uncertainty. However, the recent emphasis on tax compliance signals a shift towards a more defined regulatory approach. The courts are now actively using tax compliance as a gatekeeper, impacting access to justice for those involved in crypto-related disputes.

This means that Russian citizens and businesses involved in cryptocurrency transactions – buying, selling, trading, or even holding – must meticulously maintain accurate records of their activities and ensure they are fulfilling their tax obligations. This includes reporting profits and losses from crypto trading and paying the appropriate taxes.

How Tax Non-Compliance Impacts Court Access

Several recent court cases have demonstrated the direct link between tax compliance and the ability to pursue legal action. Judges are increasingly refusing to hear cases from individuals or entities suspected of tax evasion related to cryptocurrency holdings or transactions. This is based on the principle that those who fail to comply with the law cannot expect the protection of the law.

This new approach creates a significant hurdle for Russian crypto owners facing legal challenges. Whether it's a contract dispute, a fraud case, or a recovery of stolen assets, non-compliance with crypto tax laws can effectively shut them out of the court system. This leaves them with limited legal recourse and potentially exposes them to further penalties.

What Crypto Owners in Russia Should Do

Given the evolving legal landscape, Russian cryptocurrency owners must prioritize tax compliance:

- Maintain meticulous records: Keep detailed records of all crypto transactions, including dates, amounts, and counterparties.

- Seek professional advice: Consult with tax advisors and legal professionals specializing in cryptocurrency to ensure compliance with current regulations.

- Stay informed: Keep abreast of changes in Russian crypto tax laws and regulations.

- Proactively address tax discrepancies: If you believe you have any outstanding tax liabilities related to cryptocurrency, address them promptly to avoid future legal issues.

The Future of Crypto Regulation in Russia

The stricter enforcement of tax compliance in relation to cryptocurrency suggests a move towards a more formalized regulatory environment. While the specifics remain unclear, this trend indicates that future regulations are likely to be more stringent. This makes proactive compliance essential for all involved in the Russian crypto market. The long-term implications for the industry remain uncertain, but the current focus on tax compliance leaves little room for error. Ignoring this critical aspect could have severe legal consequences for Russian crypto owners.

Keywords: Russian crypto, crypto tax Russia, cryptocurrency regulation Russia, Russian court access, crypto tax compliance, digital assets Russia, Russian crypto law, tax evasion crypto Russia, cryptocurrency taxation Russia, legal implications crypto Russia

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Court Access For Russian Crypto Owners Hinges On Tax Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Crypto Tax Conundrum Navigating A 2014 Framework

May 01, 2025

The Crypto Tax Conundrum Navigating A 2014 Framework

May 01, 2025 -

Pedris Inspiration Iniesta Ballon D Or Goals And Barcelona Roots A Candid Conversation

May 01, 2025

Pedris Inspiration Iniesta Ballon D Or Goals And Barcelona Roots A Candid Conversation

May 01, 2025 -

Jets Quarterback Jordan Travis Retirement Confirmed

May 01, 2025

Jets Quarterback Jordan Travis Retirement Confirmed

May 01, 2025 -

Live Europa And Conference League Follow Man Utd Tottenham Chelsea Matches

May 01, 2025

Live Europa And Conference League Follow Man Utd Tottenham Chelsea Matches

May 01, 2025 -

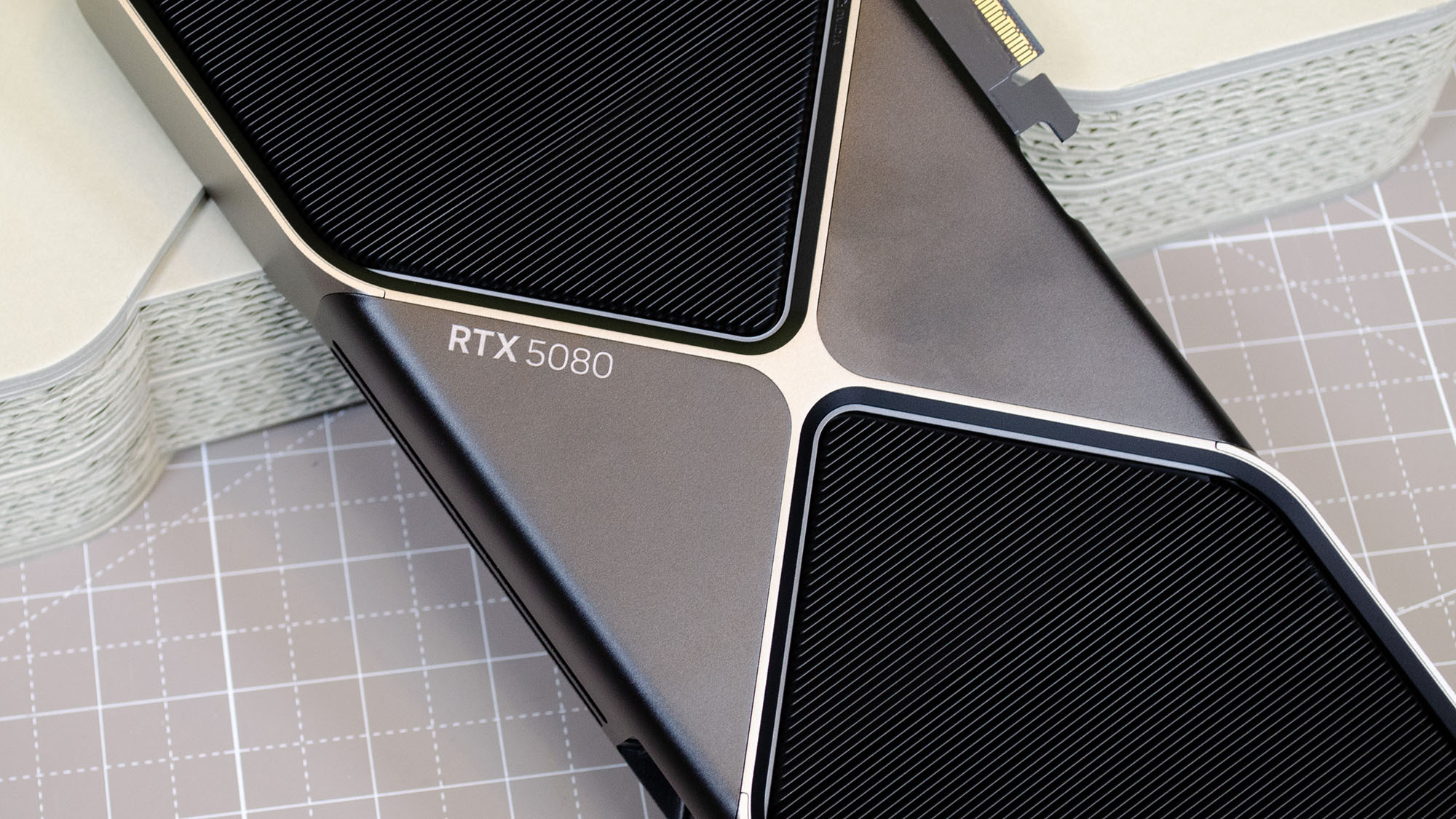

The Frustrating Reality Gamers Failed Attempts To Buy Rtx 5090 5080 Gpus

May 01, 2025

The Frustrating Reality Gamers Failed Attempts To Buy Rtx 5090 5080 Gpus

May 01, 2025