Cramer's Bullish Call: Is Intercontinental Exchange (ICE) A Buy?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cramer's Bullish Call: Is Intercontinental Exchange (ICE) a Buy?

Jim Cramer, the renowned CNBC host and financial commentator, recently issued a bullish call on Intercontinental Exchange (ICE), sending ripples through the market. But is this a buy signal for everyday investors? Let's delve into the details and assess the potential risks and rewards.

Cramer's enthusiasm stems from ICE's strong performance and its position within the evolving financial technology landscape. He highlighted the company's diverse revenue streams, robust growth prospects, and solid management team as key reasons for his optimism. This positive outlook contrasts with some recent market anxieties surrounding the broader financial sector.

ICE: A Deep Dive into the Financials

Intercontinental Exchange, Inc. operates global exchanges, clearing houses, and data services across various asset classes, including commodities, currencies, and interest rates. Their flagship products include the New York Mercantile Exchange (NYMEX) and the ICE Futures U.S. This diversification is a key element of its resilience, lessening its vulnerability to fluctuations in any single market.

- Strong Revenue Growth: ICE has consistently demonstrated strong revenue growth, fueled by increased trading volumes and expansion into new markets. This steady performance is a significant factor contributing to Cramer's positive outlook.

- Robust Dividend: The company also boasts a healthy dividend, making it attractive to income-seeking investors. This consistent dividend payout further enhances its appeal as a long-term investment.

- Technological Innovation: ICE is actively investing in technological advancements, enhancing its trading platforms and data analytics capabilities. This commitment to innovation positions the company for continued success in a rapidly changing market.

Analyzing Cramer's Call: Reasons for Optimism and Cautions

While Cramer's bullish stance is certainly noteworthy, it's crucial to conduct thorough due diligence before making any investment decisions. Here's a balanced perspective:

Reasons for Optimism:

- Diversified Revenue Streams: As mentioned earlier, ICE's diversified business model minimizes risk.

- Strong Market Position: ICE holds a dominant position in several key markets, giving it a competitive advantage.

- Long-Term Growth Potential: The company operates in a sector expected to experience sustained growth.

Reasons for Caution:

- Regulatory Scrutiny: The financial services industry faces intense regulatory scrutiny, which could impact ICE's operations and profitability.

- Market Volatility: The overall market's volatility can affect ICE's performance, even with its diversification.

- Competition: ICE faces competition from other exchanges and data providers.

Is ICE a Buy for You?

Ultimately, whether or not Intercontinental Exchange (ICE) is a suitable investment for you depends on your individual risk tolerance, investment goals, and overall portfolio strategy. Cramer's opinion serves as one data point, but not the sole determinant.

Before investing in ICE or any other stock, remember to:

- Conduct thorough research and analysis of the company's financial statements.

- Consider your risk tolerance and investment timeline.

- Diversify your portfolio to mitigate risk.

- Consult with a qualified financial advisor for personalized advice.

The bullish call from Jim Cramer on Intercontinental Exchange (ICE) is certainly exciting, but it's essential to approach such recommendations with a critical and informed perspective. Remember that investing always carries inherent risks, and independent research is paramount before committing your capital.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cramer's Bullish Call: Is Intercontinental Exchange (ICE) A Buy?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Latest On Ar Rahmans Health Mk Stalin Speaks To Doctors

Mar 18, 2025

Latest On Ar Rahmans Health Mk Stalin Speaks To Doctors

Mar 18, 2025 -

New Audio Recording Implicates Jonathan Majors In Assault Case

Mar 18, 2025

New Audio Recording Implicates Jonathan Majors In Assault Case

Mar 18, 2025 -

New Yorks Antitrust Lawsuit Judge Rules Against Live Nation And Ticketmaster

Mar 18, 2025

New Yorks Antitrust Lawsuit Judge Rules Against Live Nation And Ticketmaster

Mar 18, 2025 -

Dicas Para Ser Dono De Casa Na Praia Ou Campo Sem Compra Total

Mar 18, 2025

Dicas Para Ser Dono De Casa Na Praia Ou Campo Sem Compra Total

Mar 18, 2025 -

Allegations Against Mason Mount Chelsea Stands By Its Player

Mar 18, 2025

Allegations Against Mason Mount Chelsea Stands By Its Player

Mar 18, 2025

Latest Posts

-

Match Arsenal Psg En Direct Ligue Des Champions 2024 2025

Apr 30, 2025

Match Arsenal Psg En Direct Ligue Des Champions 2024 2025

Apr 30, 2025 -

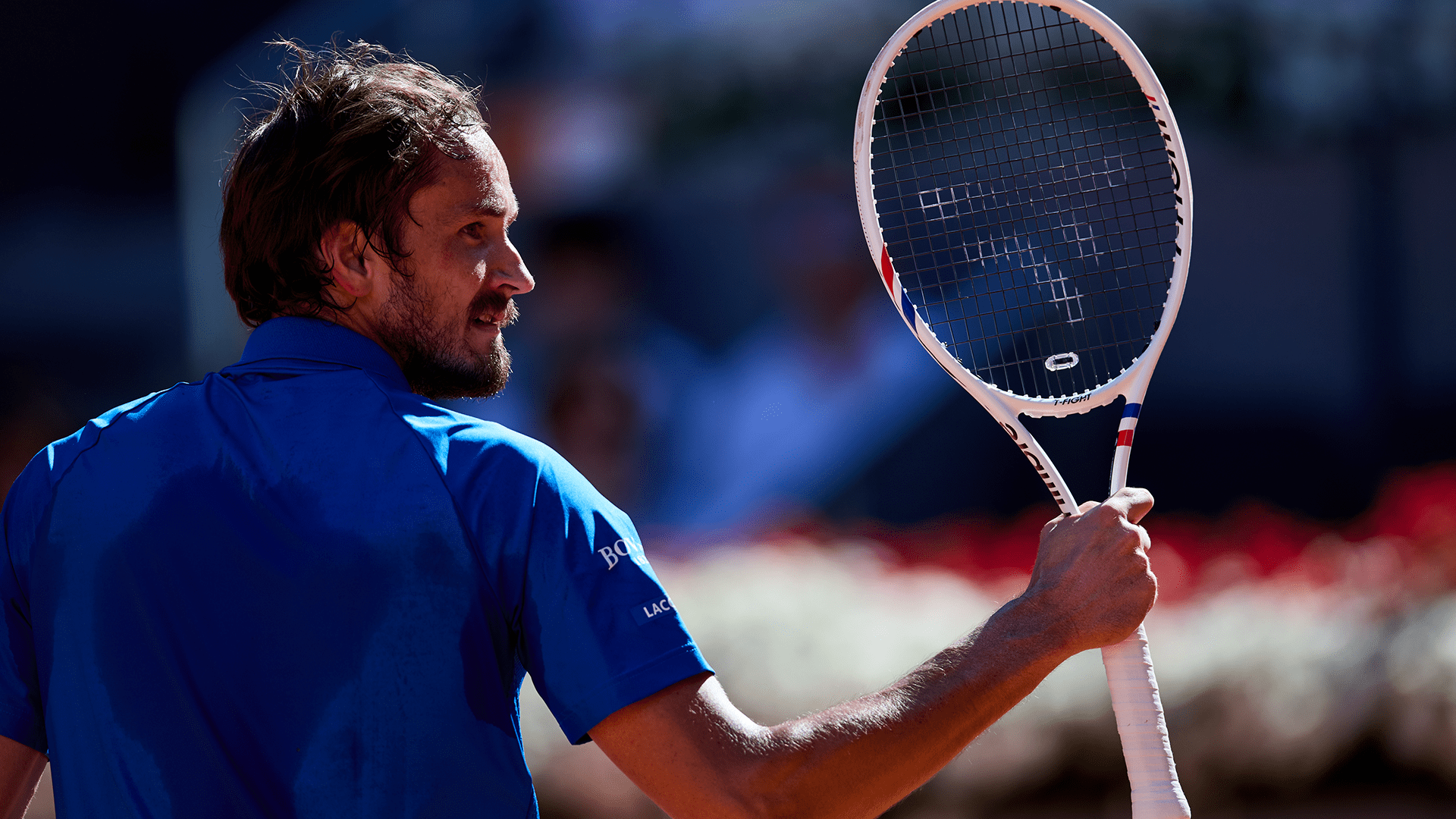

Medvedevs Firm Stance No Second Tennis Documentary In The Works

Apr 30, 2025

Medvedevs Firm Stance No Second Tennis Documentary In The Works

Apr 30, 2025 -

Khvicha Kvaratskhelia Interview Psg Luis Enrique And Attacking Football

Apr 30, 2025

Khvicha Kvaratskhelia Interview Psg Luis Enrique And Attacking Football

Apr 30, 2025 -

Ge 2025 Banners Banter And Ballots Deep Dive Into Four Constituencies

Apr 30, 2025

Ge 2025 Banners Banter And Ballots Deep Dive Into Four Constituencies

Apr 30, 2025 -

Dwayne The Rock Johnsons Transformation A New Look

Apr 30, 2025

Dwayne The Rock Johnsons Transformation A New Look

Apr 30, 2025