Cramer's Bullish: Intercontinental Exchange (ICE) A Top Pick

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cramer's Bullish: Intercontinental Exchange (ICE) a Top Pick for Investors

Jim Cramer, the renowned CNBC host and financial commentator, has declared Intercontinental Exchange (ICE) a top pick for investors, sending ripples through the market. His bullish stance on the company, a leading operator of global exchanges and clearing houses, highlights ICE's strong position in a rapidly evolving financial landscape. But what exactly makes ICE such an attractive investment, according to Cramer and other market analysts? Let's delve into the details.

ICE: More Than Just an Exchange

Intercontinental Exchange, often simply referred to as ICE, is far from a one-trick pony. While its operations include major exchanges like the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), its reach extends far beyond traditional stock trading. ICE offers a wide range of services, including:

- Futures and Options Trading: ICE operates numerous exchanges for trading futures and options contracts across various asset classes, including energy, agricultural products, and metals. This diversified portfolio provides resilience against market fluctuations in any single sector.

- Data and Analytics: The company provides crucial market data and analytics to institutional investors, helping them make informed trading decisions. This segment represents a significant and growing revenue stream.

- Clearing and Settlement Services: ICE's clearing houses ensure the smooth and efficient settlement of trades, minimizing risk for participating institutions. This critical function is a cornerstone of market stability.

Cramer's Rationale: A Strong Foundation for Future Growth

Cramer's bullish sentiment stems from several factors contributing to ICE's strong fundamentals:

- Dominant Market Position: ICE holds a commanding position in many of its key markets, giving it significant pricing power and a competitive advantage.

- Consistent Revenue Growth: The company has consistently demonstrated strong revenue growth, showcasing its ability to adapt and thrive in a dynamic environment. This is a key indicator of long-term financial health.

- Diversified Revenue Streams: As previously mentioned, ICE's diversified business model lessens its dependence on any single market segment, offering greater stability during economic uncertainty.

- Strategic Acquisitions: ICE has a proven track record of successful acquisitions, strategically expanding its product offerings and market reach.

Potential Risks and Considerations

While Cramer's recommendation is positive, it's crucial to acknowledge potential risks:

- Regulatory Scrutiny: The financial services industry is heavily regulated, and changes in regulations could impact ICE's operations and profitability.

- Competition: While ICE holds a strong position, competition in the financial technology sector is fierce, and new entrants could challenge its market share.

- Economic Downturn: A significant economic downturn could negatively affect trading volumes and subsequently impact ICE's revenue.

Should You Invest in ICE?

Jim Cramer's endorsement of Intercontinental Exchange is a significant signal, but it's not the sole factor to consider. Potential investors should conduct thorough due diligence, researching ICE's financial performance, competitive landscape, and future growth prospects. Analyzing the company's financial statements, considering your own risk tolerance, and seeking advice from a qualified financial advisor are crucial steps before making any investment decisions. This article provides information and should not be considered financial advice. Always consult with a financial professional before making any investment choices.

Keywords: Jim Cramer, Intercontinental Exchange, ICE, stock pick, investment, NYSE, LSE, financial markets, exchange, futures, options, data analytics, clearing house, market analysis, stock market, investment strategy, financial news, trading, CNBC.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cramer's Bullish: Intercontinental Exchange (ICE) A Top Pick. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Heart Radio Awards Lady Gagas Powerful Message Of Lgbtq Support

Mar 18, 2025

I Heart Radio Awards Lady Gagas Powerful Message Of Lgbtq Support

Mar 18, 2025 -

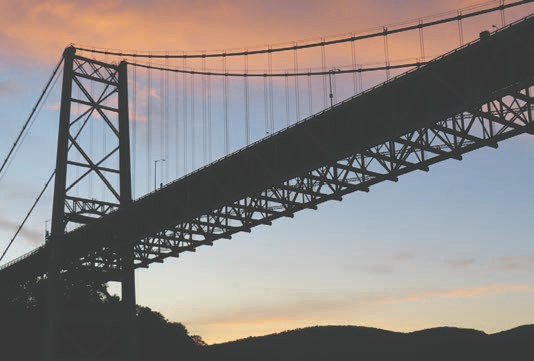

Public Safety Initiative Anti Climb Fencing Eyed For Bear Mountain Bridge

Mar 18, 2025

Public Safety Initiative Anti Climb Fencing Eyed For Bear Mountain Bridge

Mar 18, 2025 -

Controversy Erupts Shahid Afridi Under Fire From Top Cricket Officials In Pakistan

Mar 18, 2025

Controversy Erupts Shahid Afridi Under Fire From Top Cricket Officials In Pakistan

Mar 18, 2025 -

Jamie Foxx Health Update Daughter Corinnes Crucial Role Revealed

Mar 18, 2025

Jamie Foxx Health Update Daughter Corinnes Crucial Role Revealed

Mar 18, 2025 -

Stonehenges Construction 3 Ton Stones Traced To Earlier Structures

Mar 18, 2025

Stonehenges Construction 3 Ton Stones Traced To Earlier Structures

Mar 18, 2025

Latest Posts

-

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025 -

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025 -

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025 -

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025 -

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025