Crude Oil Market Reeling After Negative US Government Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crude Oil Market Tanks After Dismal US Government Inventory Report

The global crude oil market experienced a significant downturn following the release of a surprisingly negative US government inventory report. Prices plummeted, sending shockwaves through the energy sector and raising concerns about future market stability. This unexpected development underscores the volatility of the oil market and its sensitivity to even minor shifts in supply and demand dynamics.

The Energy Information Administration (EIA) report, released on [Date of Report Release], revealed a substantial build in US crude oil inventories, far exceeding analysts' expectations. This unexpected surplus, coupled with concerns about weakening global demand, triggered a sell-off across major oil benchmarks. West Texas Intermediate (WTI) crude, the US benchmark, saw a sharp decline of [Percentage]% while Brent crude, the international benchmark, fell by [Percentage]%.

Understanding the Impact of the EIA Report

The EIA report's key findings, including the unexpectedly large inventory increase, played a pivotal role in the market's negative reaction. Several factors contributed to this dramatic shift:

-

Higher-than-anticipated inventory levels: The report highlighted a significant increase in US crude oil stockpiles, signaling a potential oversupply in the market. This surplus suggests weaker-than-expected demand, raising concerns about future price stability.

-

Demand concerns: Global economic slowdown fears continue to weigh heavily on oil demand projections. Concerns about a potential recession in major economies are dampening expectations for future oil consumption.

-

OPEC+ production decisions: The decisions and actions of the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) also impact market sentiment. Any perceived shift in production quotas or strategies can significantly influence oil prices. The market is carefully watching OPEC+’s next meeting for hints about future production levels.

-

Geopolitical instability: Ongoing geopolitical tensions in various parts of the world continue to contribute to market uncertainty. Any escalation of conflicts or disruptions to oil supply routes can drastically impact prices.

What This Means for Consumers and the Energy Sector

The plummeting oil prices have immediate consequences for consumers and the energy sector:

-

Lower gasoline prices: While initially positive for consumers, sustained low oil prices could signal underlying economic weakness.

-

Reduced energy sector investment: Lower oil prices can discourage investment in new oil exploration and production projects, potentially impacting long-term energy security.

-

Increased volatility: The recent market downturn highlights the inherent volatility of the oil market, making it challenging for both producers and consumers to plan for the future.

Looking Ahead: Predicting Future Oil Market Trends

Predicting future oil prices remains a complex task, dependent on a confluence of economic, geopolitical, and environmental factors. However, analysts are closely monitoring several key indicators, including:

-

Global economic growth: The pace of global economic recovery will significantly influence oil demand.

-

OPEC+ policy: The future actions of OPEC+ will play a crucial role in shaping oil supply and prices.

-

Renewable energy adoption: The growing adoption of renewable energy sources could gradually reduce the world’s reliance on fossil fuels.

The crude oil market remains highly volatile and susceptible to unexpected shocks. The recent price drop, triggered by the disappointing US government inventory report, serves as a stark reminder of the market's sensitivity to shifts in supply, demand, and global economic conditions. Keeping a close eye on these factors is crucial for understanding the future trajectory of oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crude Oil Market Reeling After Negative US Government Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nhl Playoffs Oilers At Stars Game 2 Preview

May 23, 2025

Nhl Playoffs Oilers At Stars Game 2 Preview

May 23, 2025 -

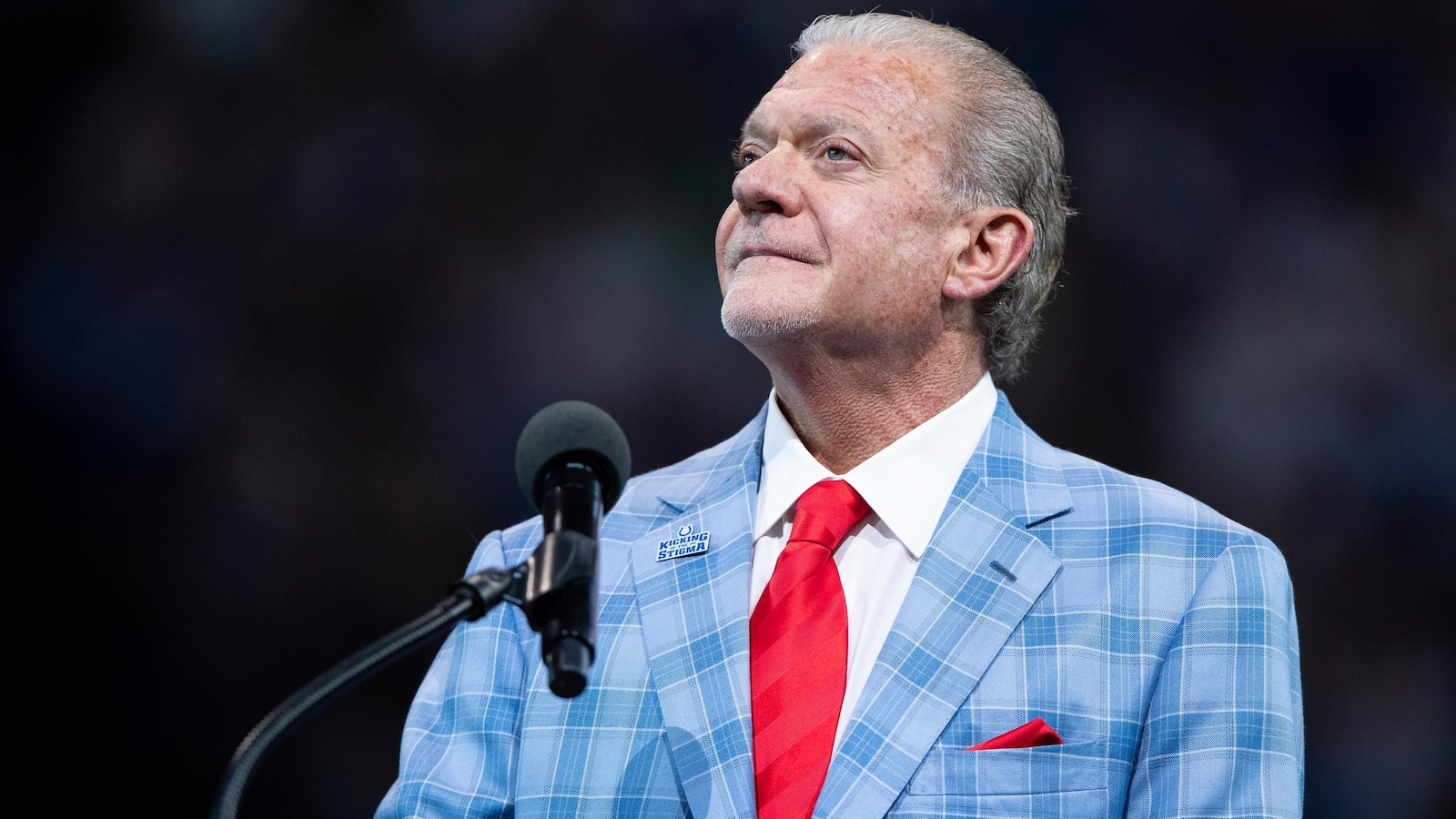

Music Loving Colts Owner Jim Irsay Dies At 65 A Life Celebrated

May 23, 2025

Music Loving Colts Owner Jim Irsay Dies At 65 A Life Celebrated

May 23, 2025 -

Did The Pacers Cheat Barkley And Miller Debate The Teams Winning Strategy

May 23, 2025

Did The Pacers Cheat Barkley And Miller Debate The Teams Winning Strategy

May 23, 2025 -

Impacto Das Chuvas No Rs 75 Vitimas Fatais Abastecimento De Agua E Energia Comprometidos

May 23, 2025

Impacto Das Chuvas No Rs 75 Vitimas Fatais Abastecimento De Agua E Energia Comprometidos

May 23, 2025 -

Witness The Implosion Unreleased Footage Of The Titans Collapse

May 23, 2025

Witness The Implosion Unreleased Footage Of The Titans Collapse

May 23, 2025

Latest Posts

-

Mejores Peliculas Bangkok Y Egipto Como Escenario De Ciencia Ficcion Y Aventuras

May 23, 2025

Mejores Peliculas Bangkok Y Egipto Como Escenario De Ciencia Ficcion Y Aventuras

May 23, 2025 -

Djokovic Defeats Arnaldi In Geneva Avenging Earlier Loss

May 23, 2025

Djokovic Defeats Arnaldi In Geneva Avenging Earlier Loss

May 23, 2025 -

Sydney Sweeney On Euphoria Season 3 More Unhinged Cassie And A Shocking Update

May 23, 2025

Sydney Sweeney On Euphoria Season 3 More Unhinged Cassie And A Shocking Update

May 23, 2025 -

Distressing Audio From Ship Footage Documents Ocean Gate Titan Sub Implosion

May 23, 2025

Distressing Audio From Ship Footage Documents Ocean Gate Titan Sub Implosion

May 23, 2025 -

Tik Toks Latest Obsession A Dating Show Rivaling Love Island

May 23, 2025

Tik Toks Latest Obsession A Dating Show Rivaling Love Island

May 23, 2025