Crude Oil Prices Climb 3% On Stronger Demand And Reduced US Supply

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crude Oil Prices Surge 3% on Booming Demand and Tight US Supply

Global crude oil prices experienced a significant jump, climbing 3% on Wednesday, fueled by a resurgence in demand and a notable reduction in US oil supplies. This surge marks a significant shift in the energy market, impacting everything from gasoline prices at the pump to the broader global economy. The increase is being attributed to a confluence of factors, signaling a potential tightening of the global oil market.

Stronger-Than-Expected Demand Drives Prices Up

The primary driver behind the price increase is the unexpectedly robust global demand for crude oil. Data released this week points to a substantial increase in consumption, particularly from Asia, where economic recovery is boosting industrial activity and transportation fuels. This heightened demand is outpacing current supply levels, creating a tighter market and putting upward pressure on prices. Analysts are closely watching consumption figures from China, the world's largest oil importer, for further indications of sustained demand growth.

Reduced US Oil Inventories Exacerbate the Situation

Adding fuel to the fire, the latest report from the US Energy Information Administration (EIA) revealed a sharper-than-anticipated decline in US crude oil inventories. This drop indicates that supply is not keeping pace with the growing demand, further tightening the market and justifying the price surge. The EIA report highlighted several contributing factors to the reduced inventories, including lower imports and sustained strong domestic consumption.

Geopolitical Factors Remain a Wild Card

While strong demand and reduced supply are the immediate catalysts for the price increase, geopolitical factors continue to play a significant, albeit uncertain, role. Ongoing tensions in several oil-producing regions remain a potential source of further volatility. Any unexpected disruptions to supply chains from these regions could lead to even more dramatic price swings in the near future. Investors and analysts are closely monitoring these geopolitical developments for potential impacts on the global oil market.

What This Means for Consumers and the Economy

The 3% increase in crude oil prices is likely to translate into higher gasoline prices at the pump for consumers. This price hike could also have broader implications for inflation, impacting the cost of transportation, manufacturing, and other goods and services. Central banks around the world will be carefully monitoring these price increases as they consider their monetary policy strategies.

Looking Ahead: Uncertainty Remains

While the current market conditions point to continued price increases in the short term, the future remains uncertain. The balance between global supply and demand will continue to be a key factor determining the direction of oil prices. Analysts will be closely watching key economic indicators, geopolitical events, and further reports from the EIA and other international energy agencies to gauge the potential for sustained price increases or a potential market correction. The coming weeks will be crucial in determining the long-term trajectory of crude oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crude Oil Prices Climb 3% On Stronger Demand And Reduced US Supply. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Milans 2 1 Genoa Victory Quick Fire Goals Secure Rainy Day Win

May 07, 2025

Milans 2 1 Genoa Victory Quick Fire Goals Secure Rainy Day Win

May 07, 2025 -

Close Call Knicks Edge Out Celtics 108 105 In Intense Matchup May 5 2025

May 07, 2025

Close Call Knicks Edge Out Celtics 108 105 In Intense Matchup May 5 2025

May 07, 2025 -

Shotgun Cop Man A Platform Game About Arresting Satan

May 07, 2025

Shotgun Cop Man A Platform Game About Arresting Satan

May 07, 2025 -

Pacers Vs Cavaliers Game 2 Top Pascal Siakam Player Prop Predictions

May 07, 2025

Pacers Vs Cavaliers Game 2 Top Pascal Siakam Player Prop Predictions

May 07, 2025 -

Conclave Procedures How The Vatican Ensures A Secret Papal Vote

May 07, 2025

Conclave Procedures How The Vatican Ensures A Secret Papal Vote

May 07, 2025

Latest Posts

-

Warriors Edge Timberwolves In Game 1 Despite Curry Injury

May 08, 2025

Warriors Edge Timberwolves In Game 1 Despite Curry Injury

May 08, 2025 -

Fact Check Pakistan Minister Attaullah Tarar Denies Terror Camps Existence

May 08, 2025

Fact Check Pakistan Minister Attaullah Tarar Denies Terror Camps Existence

May 08, 2025 -

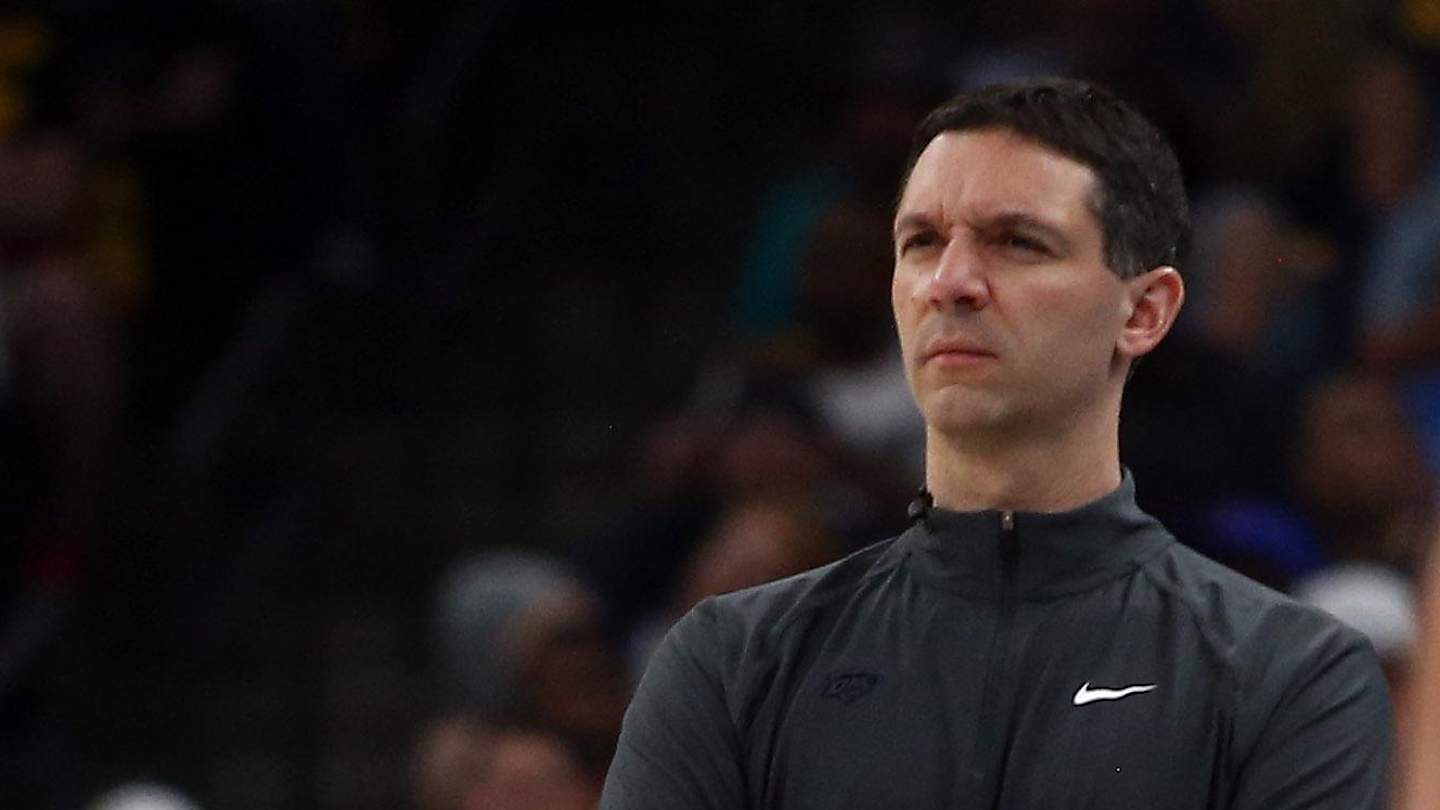

Nba Strategy Mark Daigneault Explains Foul Management

May 08, 2025

Nba Strategy Mark Daigneault Explains Foul Management

May 08, 2025 -

Al Raed And Al Hilal Face Off A Pivotal Saudi Pro League Encounter

May 08, 2025

Al Raed And Al Hilal Face Off A Pivotal Saudi Pro League Encounter

May 08, 2025 -

Shehbaz Sharif Minister Under Fire Uk Anchors Sharp Questions On Terrorism Following Op Sindoor

May 08, 2025

Shehbaz Sharif Minister Under Fire Uk Anchors Sharp Questions On Terrorism Following Op Sindoor

May 08, 2025