Crude Oil Prices Crash: OPEC+ Boosts Production, Impacts U.S. Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crude Oil Prices Crash: OPEC+ Production Boost Shakes U.S. Market

Global crude oil prices plummeted today following a surprise announcement by OPEC+ to significantly increase oil production. The move, which caught many analysts off guard, sent shockwaves through the energy market, with immediate impacts felt on U.S. gasoline prices and the broader economy. This unexpected surge in supply comes at a time when many predicted continued price increases due to geopolitical instability and robust global demand.

This dramatic shift represents a significant gamble by the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+). The decision to boost production by an additional 500,000 barrels per day, effective immediately, directly counters recent calls for restraint and aims to curb the recent upward trend in oil prices. The impact is already being felt, with benchmark Brent crude and West Texas Intermediate (WTI) both experiencing double-digit percentage drops within hours of the announcement.

OPEC+'s Bold Move: A Calculated Risk?

The OPEC+ decision raises numerous questions. Was this a calculated risk to preempt a potential price ceiling imposed by Western governments? Or is this a response to burgeoning concerns about slowing global economic growth impacting oil demand? Analysts are divided, with some suggesting the move is a strategic attempt to maintain market share and prevent further price escalation, while others see it as a potentially destabilizing action that could lead to prolonged price volatility.

- Impact on U.S. Gasoline Prices: The immediate consequence of the increased supply is a likely decrease in gasoline prices at the pump for U.S. consumers. This welcome relief comes amidst ongoing concerns about inflation and the high cost of living. However, the long-term effect remains uncertain.

- Geopolitical Implications: The decision by OPEC+, heavily influenced by Saudi Arabia and Russia, also carries significant geopolitical implications. It could be interpreted as a direct challenge to Western powers seeking to limit Russia's oil revenues amid the ongoing conflict in Ukraine.

- Impact on U.S. Energy Companies: The sudden drop in oil prices poses challenges for U.S. energy companies, potentially impacting their profitability and investment decisions. This could lead to job losses in some sectors and a slowdown in exploration and production activities.

Market Volatility and the Road Ahead

The crude oil market is currently experiencing significant volatility in the wake of the OPEC+ announcement. Many experts predict continued price fluctuations in the short term as traders and investors adjust to this unexpected development. The long-term consequences, however, are less clear.

Several factors will influence future price movements, including:

- Global Economic Growth: A slowdown in global economic activity could reduce oil demand, putting downward pressure on prices.

- Geopolitical Events: Further escalation of geopolitical tensions, particularly in Eastern Europe and the Middle East, could trigger price increases.

- OPEC+ Policy: Future decisions by OPEC+ regarding production levels will play a critical role in shaping the global oil market.

The crash in crude oil prices marks a significant turning point in the global energy landscape. While consumers may enjoy temporary relief at the gas pump, the long-term impact on the U.S. and global economies remains to be seen. The coming weeks and months will be crucial in determining how markets adapt to this unprecedented shift in oil supply. Stay tuned for further updates as this rapidly evolving situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crude Oil Prices Crash: OPEC+ Boosts Production, Impacts U.S. Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pat Spencer The Lacrosse Record Holder Who Conquered The Nbas Golden State Warriors

May 07, 2025

Pat Spencer The Lacrosse Record Holder Who Conquered The Nbas Golden State Warriors

May 07, 2025 -

Phoenix At Aces Full Game Preview And Predictions For May 6th

May 07, 2025

Phoenix At Aces Full Game Preview And Predictions For May 6th

May 07, 2025 -

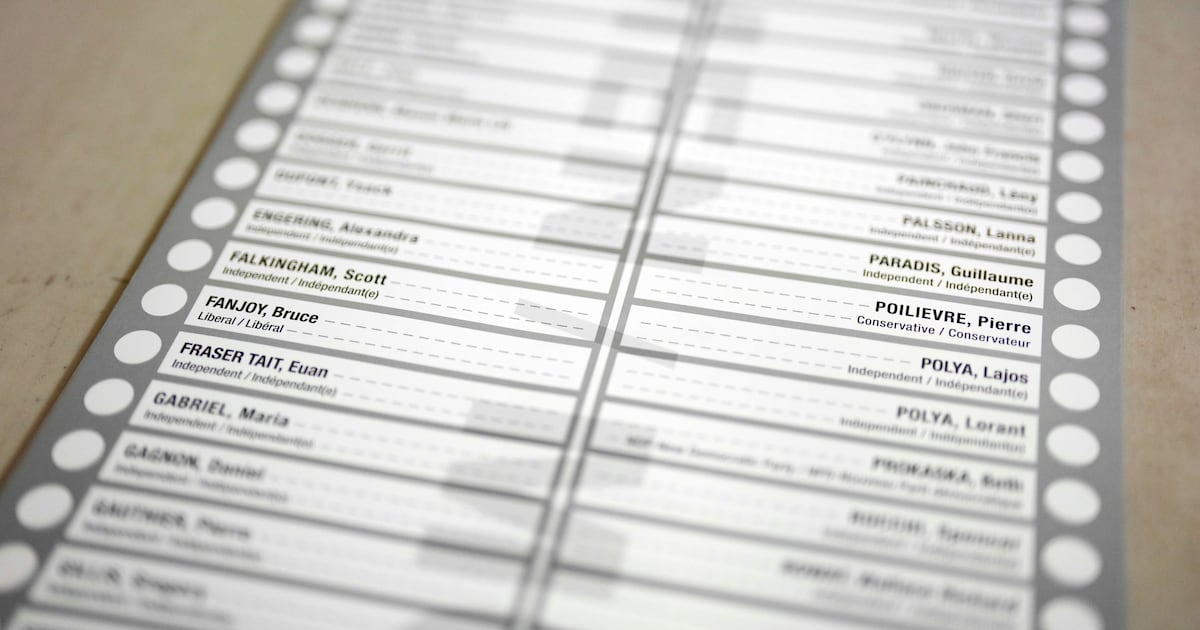

Poilievres Alberta Byelection Protest Groups 200 Name Ballot Challenge

May 07, 2025

Poilievres Alberta Byelection Protest Groups 200 Name Ballot Challenge

May 07, 2025 -

Met Gala 2024 Kiara Advani Announces Pregnancy On Red Carpet

May 07, 2025

Met Gala 2024 Kiara Advani Announces Pregnancy On Red Carpet

May 07, 2025 -

Update Changes To Visa Application Process For Select Countries

May 07, 2025

Update Changes To Visa Application Process For Select Countries

May 07, 2025

Latest Posts

-

Arsenals Road To The Final Artetas High Stakes Demand For Commitment

May 07, 2025

Arsenals Road To The Final Artetas High Stakes Demand For Commitment

May 07, 2025 -

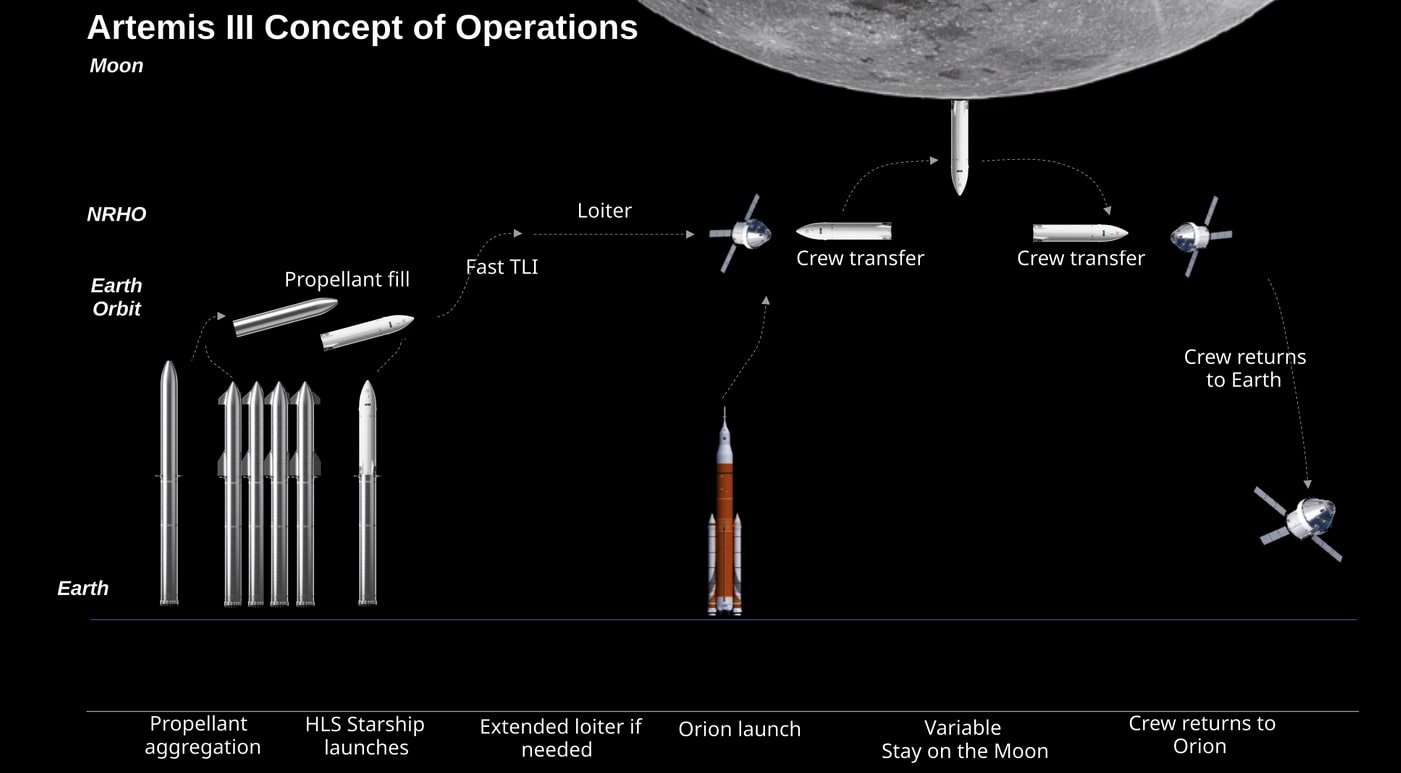

Nasa And Other Agencies Unpacking The Problem Of Budget Overruns

May 07, 2025

Nasa And Other Agencies Unpacking The Problem Of Budget Overruns

May 07, 2025 -

Injury Blow For Cleveland Garland Mobley And Hunter Miss Game 2

May 07, 2025

Injury Blow For Cleveland Garland Mobley And Hunter Miss Game 2

May 07, 2025 -

Cnn Interview Sparks Outrage Karoline Leavitt And The Maga Response

May 07, 2025

Cnn Interview Sparks Outrage Karoline Leavitt And The Maga Response

May 07, 2025 -

The Karate Kids Enduring Legacy A Look Back At The Franchise

May 07, 2025

The Karate Kids Enduring Legacy A Look Back At The Franchise

May 07, 2025