Crude Oil Prices Jump 3% On Stronger Demand From Europe And China

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crude Oil Prices Surge 3% on Resurgent Demand from Europe and China

Global crude oil prices experienced a significant jump, climbing 3% on Monday, fueled by a robust increase in demand from both Europe and China. This surge marks a notable shift in the energy market, signaling a potential end to the recent period of price stagnation and hinting at a potentially bullish outlook for the coming months. The renewed appetite for oil from these two economic giants underscores the growing global recovery and points to a tightening supply situation.

Stronger-than-Expected Demand from Key Markets

The primary driver behind this price increase is the unexpectedly strong demand for crude oil from Europe and China. Europe, grappling with the ongoing energy crisis stemming from the Russia-Ukraine conflict, is actively seeking alternative energy sources, leading to increased imports of crude oil. Simultaneously, China's post-pandemic economic rebound is driving a substantial increase in industrial activity and transportation, thereby boosting its oil consumption. Analysts predict that this upward trend in demand from these two key markets is likely to continue in the near future.

Impact on Global Energy Markets

This surge in crude oil prices has significant implications for the global energy market. Firstly, it could lead to higher gasoline and diesel prices for consumers worldwide. Secondly, it will impact inflation, potentially exacerbating existing economic pressures. However, for oil-producing nations, the price increase represents a welcome boost to their revenues.

OPEC+ Production Decisions and Geopolitical Factors

While increased demand is the primary factor, the decisions made by OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) also play a crucial role. Recent production cuts by OPEC+ have contributed to tighter global supplies, further supporting the price increase. Moreover, geopolitical instability in various oil-producing regions continues to add an element of uncertainty to the market, potentially influencing price volatility in the coming weeks and months.

Looking Ahead: A Bullish Outlook?

Several factors suggest that crude oil prices could maintain an upward trajectory in the short to medium term. These include:

- Continued economic recovery in China: As China's economy continues to recover, its demand for energy is expected to remain robust.

- Persistent energy crisis in Europe: Europe's search for alternative energy sources will continue to drive demand for crude oil.

- OPEC+ production constraints: The continued production cuts by OPEC+ will keep global supplies relatively tight.

- Geopolitical risks: Continued geopolitical instability could further exacerbate price volatility.

However, it's important to acknowledge potential downside risks, including a potential global economic slowdown or unexpected increases in oil production outside OPEC+.

Conclusion: The recent 3% jump in crude oil prices reflects a complex interplay of factors, primarily driven by resurgent demand from Europe and China. While the bullish outlook is promising for oil-producing nations, consumers and businesses should brace for potentially higher energy costs. The ongoing situation necessitates close monitoring of both global economic developments and geopolitical events to accurately predict future price movements in this volatile market. Further analysis of OPEC+ policies and the evolving energy landscape will be crucial in determining the long-term trajectory of crude oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crude Oil Prices Jump 3% On Stronger Demand From Europe And China. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indiana Pacers At Cleveland Cavaliers Box Score And Analysis May 6 2025

May 07, 2025

Indiana Pacers At Cleveland Cavaliers Box Score And Analysis May 6 2025

May 07, 2025 -

Shotgun Cop Man Unique Platformer Gameplay And Satans Arrest

May 07, 2025

Shotgun Cop Man Unique Platformer Gameplay And Satans Arrest

May 07, 2025 -

2024 Ncaa Division Iii Womens Lacrosse Tournament Bracket Announced

May 07, 2025

2024 Ncaa Division Iii Womens Lacrosse Tournament Bracket Announced

May 07, 2025 -

Crackdown On Visas Which Nationalities Face Scrutiny Over Asylum Expenses

May 07, 2025

Crackdown On Visas Which Nationalities Face Scrutiny Over Asylum Expenses

May 07, 2025 -

Open Ai Governance Overhaul No More For Profit Board Control

May 07, 2025

Open Ai Governance Overhaul No More For Profit Board Control

May 07, 2025

Latest Posts

-

Acesso A Casas De Praia E Campo Descubra O Modelo De Co Propriedade

May 08, 2025

Acesso A Casas De Praia E Campo Descubra O Modelo De Co Propriedade

May 08, 2025 -

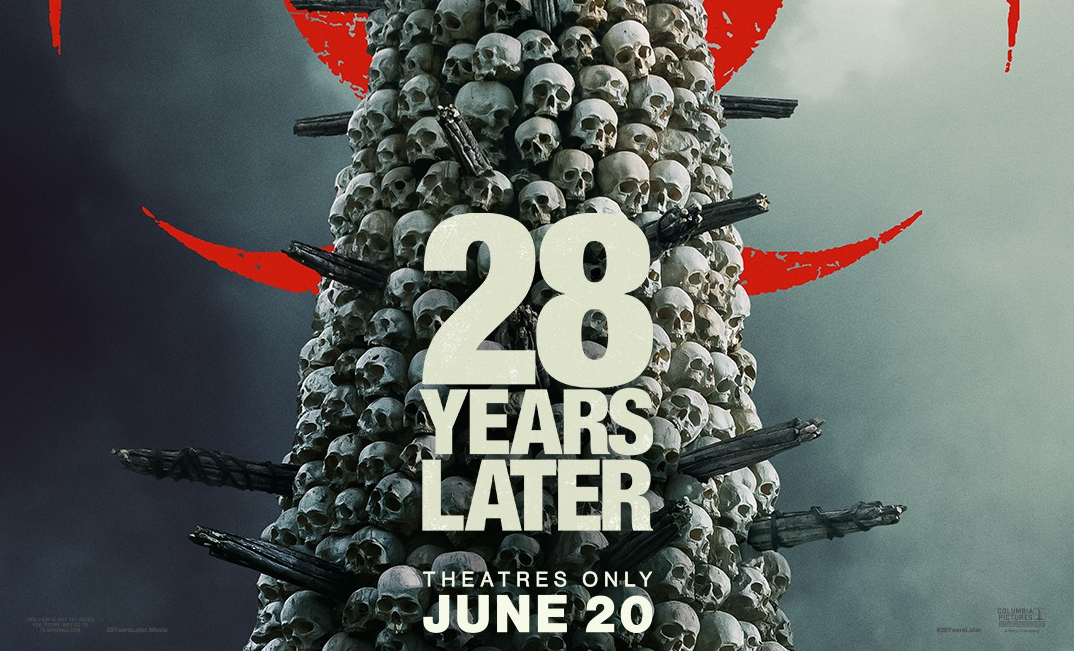

Explore The Bone Temple A First Look At The 28 Years Later Poster

May 08, 2025

Explore The Bone Temple A First Look At The 28 Years Later Poster

May 08, 2025 -

Analyzing The Impact Of Facebook Ads Trump And Bidens Reach To Older Women

May 08, 2025

Analyzing The Impact Of Facebook Ads Trump And Bidens Reach To Older Women

May 08, 2025 -

Exploring The Fractured Mind A Writers Journey Through Broken Brains

May 08, 2025

Exploring The Fractured Mind A Writers Journey Through Broken Brains

May 08, 2025 -

Xlm Price Alert Is The Stellar Support Level About To Break

May 08, 2025

Xlm Price Alert Is The Stellar Support Level About To Break

May 08, 2025