Crypto Crash: Wallet Allegedly Linked To WLFI Sheds ETH As Portfolio Plunges $209 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Crash: Wallet Linked to Wonderland Finance's Daniele Sestagalli Loses $209 Million

The crypto market's recent downturn has claimed another significant victim, with a cryptocurrency wallet allegedly linked to Daniele Sestagalli, the founder of the now-defunct Wonderland Finance (WLFI), experiencing a staggering $209 million loss. This dramatic portfolio plunge highlights the extreme volatility and inherent risks associated with the decentralized finance (DeFi) space and the devastating impact of market crashes on even the most prominent figures within the crypto ecosystem.

The significant drop in the value of the wallet's holdings, predominantly Ethereum (ETH), underscores the severity of the ongoing crypto winter and raises concerns about the future of DeFi projects. The wallet, which has been publicly speculated to belong to Sestagalli, saw its ETH holdings plummet alongside the broader market decline. This event serves as a stark reminder of the importance of risk management and diversification in the volatile world of cryptocurrency investing.

The Fall of Wonderland Finance and its Fallout

Wonderland Finance, a DeFi project promising high yields, collapsed spectacularly earlier this year amidst allegations of misappropriation of funds and questionable governance practices. The project's implosion sent shockwaves through the DeFi community, wiping out millions of dollars in investor funds. The alleged connection between the plummeting wallet and Sestagalli further fuels the ongoing debate surrounding transparency and accountability within the DeFi space.

While there's no definitive proof directly linking the wallet to Sestagalli, the timing of the losses coinciding with the WLFI collapse, along with publicly available information on the wallet's transaction history, has led to widespread speculation within the crypto community.

Key Impacts and Implications:

- DeFi Risk Amplified: The incident serves as a potent reminder of the inherent risks involved in DeFi projects. High yields often come with equally high risk, and the lack of regulation in many areas of the DeFi landscape increases the potential for losses.

- Market Volatility: The dramatic loss underscores the extreme volatility of the cryptocurrency market. Even experienced investors, potentially including those intimately involved in DeFi projects, are vulnerable to significant losses during major market downturns.

- Transparency and Accountability: The situation highlights the ongoing need for greater transparency and accountability within the DeFi ecosystem. Clearer regulatory frameworks and improved auditing processes are crucial to protect investors and maintain confidence in the market.

- The Importance of Diversification: This event stresses the vital role of diversification in a risk management strategy within the crypto space. Over-reliance on a single asset or project can lead to catastrophic losses.

What This Means for Investors:

The crypto market remains highly volatile and unpredictable. Investors should proceed with caution, conducting thorough due diligence before investing in any cryptocurrency project, especially those in the DeFi sector. It's crucial to understand the risks involved and to only invest what you can afford to lose. Diversification across multiple assets and projects is a key strategy to mitigate risk.

Looking Ahead:

The aftermath of the Wonderland Finance collapse and the subsequent losses highlight the need for significant reforms within the DeFi space. Greater transparency, robust auditing mechanisms, and potentially stronger regulatory oversight could help mitigate future crises and protect investors. The crypto market's future trajectory remains uncertain, but one thing is clear: caution, due diligence, and responsible investment strategies are paramount for navigating this dynamic and often turbulent landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Crash: Wallet Allegedly Linked To WLFI Sheds ETH As Portfolio Plunges $209 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dramatic River Valley Fire Rescue Construction Workers Heroic Actions Save Children

Apr 10, 2025

Dramatic River Valley Fire Rescue Construction Workers Heroic Actions Save Children

Apr 10, 2025 -

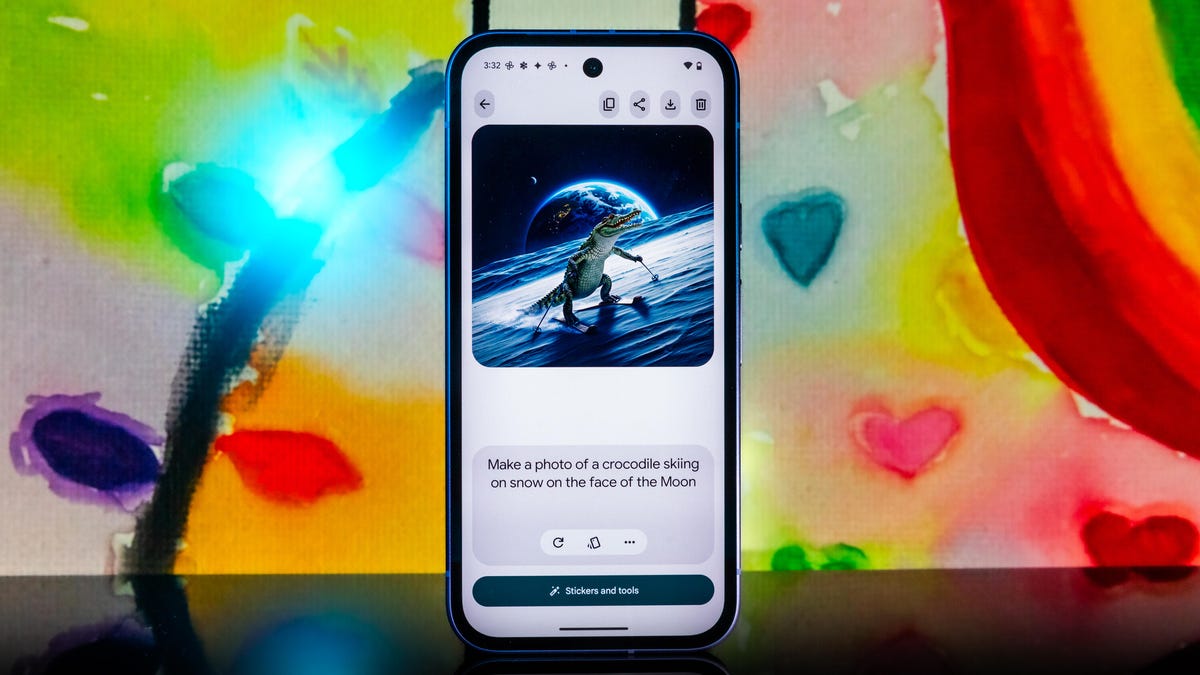

Pixel 9a Is Googles Budget Friendly Phone Worth The Hype

Apr 10, 2025

Pixel 9a Is Googles Budget Friendly Phone Worth The Hype

Apr 10, 2025 -

Oppo Find X8 Ultra Enhanced Specs In A Thinner Profile

Apr 10, 2025

Oppo Find X8 Ultra Enhanced Specs In A Thinner Profile

Apr 10, 2025 -

Analise Completa Da Edicao Das 12h30m Por Jose Pedro Pinto

Apr 10, 2025

Analise Completa Da Edicao Das 12h30m Por Jose Pedro Pinto

Apr 10, 2025 -

Uk Court Throws Out Secret Government Case Against Apple Over I Phone Security

Apr 10, 2025

Uk Court Throws Out Secret Government Case Against Apple Over I Phone Security

Apr 10, 2025