Crypto Exchange OKX Faces Double Fine: $500M In US, $1.2M In Malta

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Exchange OKX Hit with Double Fine: $500 Million US Penalty Looms, Malta Imposes $1.2 Million Fine

OKX, a prominent cryptocurrency exchange, is facing a significant financial blow, grappling with regulatory actions from both the United States and Malta. The dual fines highlight the increasing scrutiny faced by crypto platforms globally as regulators attempt to establish clearer guidelines within the volatile digital asset market.

The situation presents a stark contrast: a potential staggering $500 million penalty from US regulators, alongside a considerably smaller but still impactful $1.2 million fine levied by the Maltese authorities. This discrepancy reveals the complexities of navigating international crypto regulations and the varying approaches taken by different jurisdictions.

The US Investigation: A Colossal Potential Fine

While the specifics remain undisclosed, reports suggest the potential $500 million fine from US regulators stems from alleged violations of anti-money laundering (AML) and know-your-customer (KYC) regulations. These regulations are crucial in preventing illicit activities, such as terrorist financing and money laundering, from leveraging the anonymity often associated with cryptocurrency transactions. The exact nature of the alleged violations and the timeline for the final penalty remain unclear, but the sheer magnitude of the potential fine underscores the seriousness of the accusations. This hefty sum could significantly impact OKX's financial stability and operations. The investigation highlights the growing pressure on crypto exchanges to implement robust compliance programs that meet stringent international standards.

Malta's Action: A More Moderate Penalty

In contrast to the looming US penalty, the Maltese Financial Services Authority (MFSA) imposed a significantly smaller $1.2 million fine on OKX. This fine, however, still represents a considerable sum and reflects Malta’s commitment to regulating the cryptocurrency industry within its jurisdiction. The MFSA's statement cited breaches of the Virtual Financial Assets Act, highlighting the importance of compliance with local regulations, even amidst the complexities of the international crypto landscape. The smaller penalty compared to the potential US fine might be due to the nature of the violations or the different regulatory frameworks in place.

Implications for the Crypto Industry

The dual fines levied against OKX serve as a critical warning to other cryptocurrency exchanges operating globally. The incident emphasizes the paramount importance of proactive compliance with international regulations regarding AML/KYC procedures. Exchanges must invest in robust compliance infrastructure, regularly review their practices, and proactively engage with regulators to minimize risk and ensure long-term stability.

The situation also underscores the need for greater international cooperation in regulating the cryptocurrency market. The discrepancies between the fines levied by US and Maltese authorities highlight the fragmented nature of current regulations and the challenges in enforcing consistent standards across different jurisdictions.

Key Takeaways:

- Increased Regulatory Scrutiny: The actions against OKX show the growing global focus on regulating cryptocurrency exchanges.

- Compliance is Crucial: Robust AML/KYC programs are essential for navigating the increasingly complex regulatory landscape.

- International Harmonization Needed: Consistent global regulations are vital for promoting stability and trust within the cryptocurrency market.

- Significant Financial Impact: The potential fines could significantly affect OKX's financial health and future operations.

The unfolding situation with OKX will undoubtedly be closely watched by the entire crypto community. The outcome will have significant implications for the future of cryptocurrency regulation and the operational practices of exchanges worldwide. As the investigations progress, further updates and developments are expected, shaping the future of the crypto regulatory landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Exchange OKX Faces Double Fine: $500M In US, $1.2M In Malta. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Suzuka Starting Grid Your Guide To The Japanese Grand Prix Lineup

Apr 07, 2025

Suzuka Starting Grid Your Guide To The Japanese Grand Prix Lineup

Apr 07, 2025 -

Snl Tackles Trumps Tariffs And Wallens Gods Country Remarks

Apr 07, 2025

Snl Tackles Trumps Tariffs And Wallens Gods Country Remarks

Apr 07, 2025 -

Russells Mercedes Qualifying Gamble Backfires High Price Paid

Apr 07, 2025

Russells Mercedes Qualifying Gamble Backfires High Price Paid

Apr 07, 2025 -

Lehecka Vs Korda Prediction Atp Monte Carlo Masters 2025 Showdown

Apr 07, 2025

Lehecka Vs Korda Prediction Atp Monte Carlo Masters 2025 Showdown

Apr 07, 2025 -

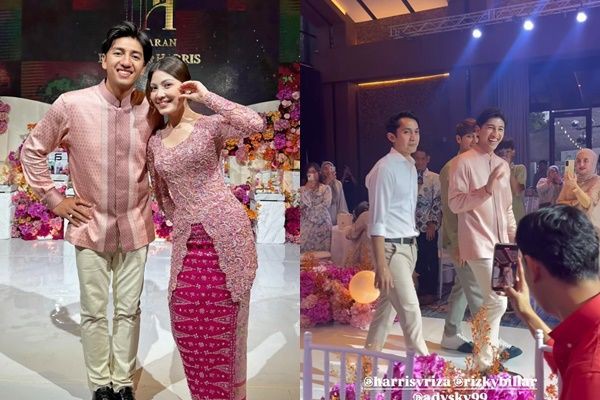

Detail Lamaran Harris Vriza Dan Haviza Devi Di Medan Gaun Dekorasi Dan Momen Spesial

Apr 07, 2025

Detail Lamaran Harris Vriza Dan Haviza Devi Di Medan Gaun Dekorasi Dan Momen Spesial

Apr 07, 2025