Crypto Exchanges In Australia Face Heightened Scrutiny Amid Regulatory Changes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Exchanges in Australia Face Heightened Scrutiny Amid Regulatory Changes

Australia's cryptocurrency landscape is undergoing a significant shift, with crypto exchanges facing increased regulatory scrutiny. Recent changes and proposed legislation are forcing platforms to adapt or risk facing hefty penalties. This heightened scrutiny aims to protect investors and maintain the integrity of the financial system, but it also presents challenges for the burgeoning crypto industry in Australia.

The Rise of Regulation and its Impact

The Australian government is taking a proactive approach to regulating the cryptocurrency market, driven by concerns over money laundering, consumer protection, and the overall stability of the financial system. This isn't a sudden crackdown; rather, it's a gradual tightening of existing frameworks and the introduction of new legislation specifically targeting crypto exchanges.

Key areas of focus include:

- Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF): Exchanges are being held to stricter standards regarding Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. This involves rigorous verification processes for users and reporting suspicious activity to authorities. Failure to comply can result in substantial fines and potential closure.

- Licensing and Registration: The Australian Transaction Reports and Analysis Centre (AUSTRAC) plays a crucial role in overseeing these regulations. Exchanges are increasingly required to obtain licenses and register with AUSTRAC to operate legally. The application process is stringent, requiring substantial documentation and demonstrating robust compliance procedures.

- Consumer Protection: Protecting consumers from scams and fraudulent activities is paramount. Regulations are being implemented to ensure greater transparency in pricing, trading practices, and the security of customer funds held on exchanges. This includes clear disclosure of fees and risks associated with cryptocurrency investments.

Challenges Faced by Australian Crypto Exchanges

The increased regulatory pressure presents several challenges for Australian crypto exchanges:

- Compliance Costs: Meeting the stringent regulatory requirements involves significant financial investment in technology, personnel, and legal expertise. Smaller exchanges may struggle to bear these costs, potentially leading to consolidation within the industry.

- Operational Complexity: Implementing robust KYC/AML procedures and maintaining accurate records can be complex and time-consuming. Exchanges need to invest in sophisticated systems and train their staff to ensure compliance.

- Innovation Stifled?: Some argue that overly stringent regulations could stifle innovation and hinder the growth of the Australian cryptocurrency sector. Finding a balance between protecting consumers and fostering innovation is a key challenge for policymakers.

Looking Ahead: Navigating the Regulatory Landscape

The future of crypto exchanges in Australia hinges on their ability to adapt to the evolving regulatory landscape. Those who prioritize compliance and invest in robust systems are more likely to thrive. Collaboration between the government, regulatory bodies, and industry players will be essential to create a framework that promotes both innovation and investor protection. The industry needs to demonstrate its commitment to responsible practices and work towards establishing a clear and transparent regulatory environment. This will not only ensure the long-term sustainability of the Australian crypto market but also build trust and confidence among investors. The coming years will be crucial in determining the shape and future of the Australian cryptocurrency industry, and the success of individual exchanges will depend heavily on their ability to navigate this complex regulatory environment effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Exchanges In Australia Face Heightened Scrutiny Amid Regulatory Changes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

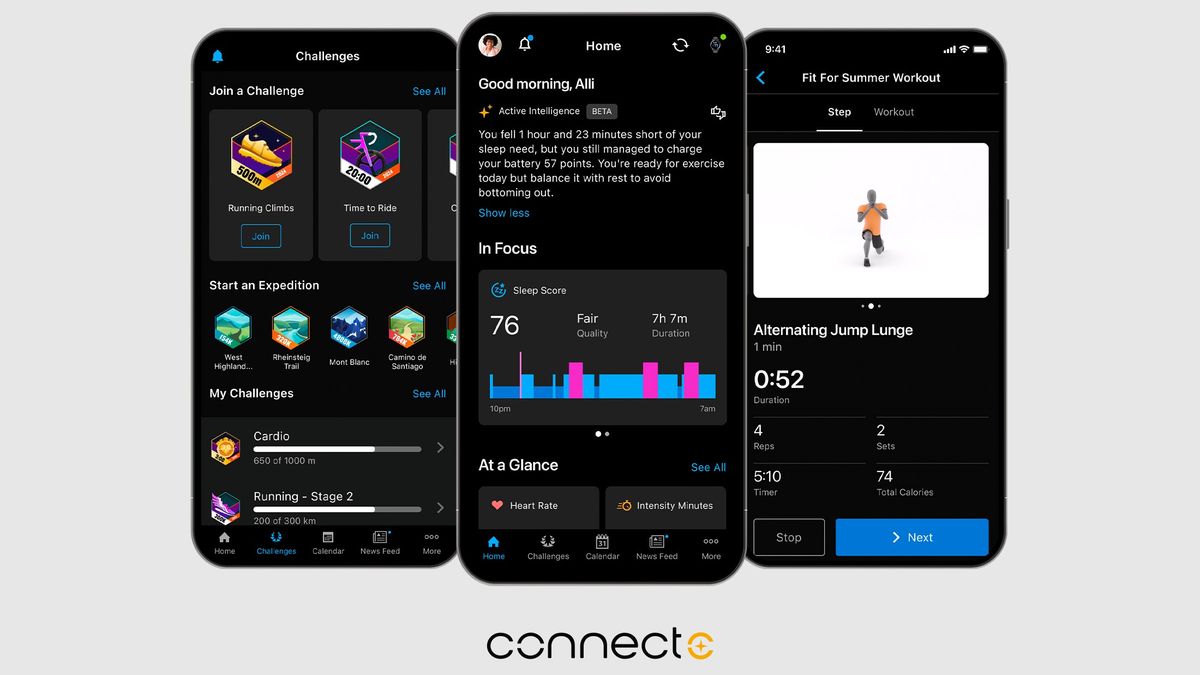

The Garmin Connect Premium Upgrade Examining The Value Proposition

Mar 30, 2025

The Garmin Connect Premium Upgrade Examining The Value Proposition

Mar 30, 2025 -

St Mirrens Robinson On Var Injuries And The Road Ahead For The Saints

Mar 30, 2025

St Mirrens Robinson On Var Injuries And The Road Ahead For The Saints

Mar 30, 2025 -

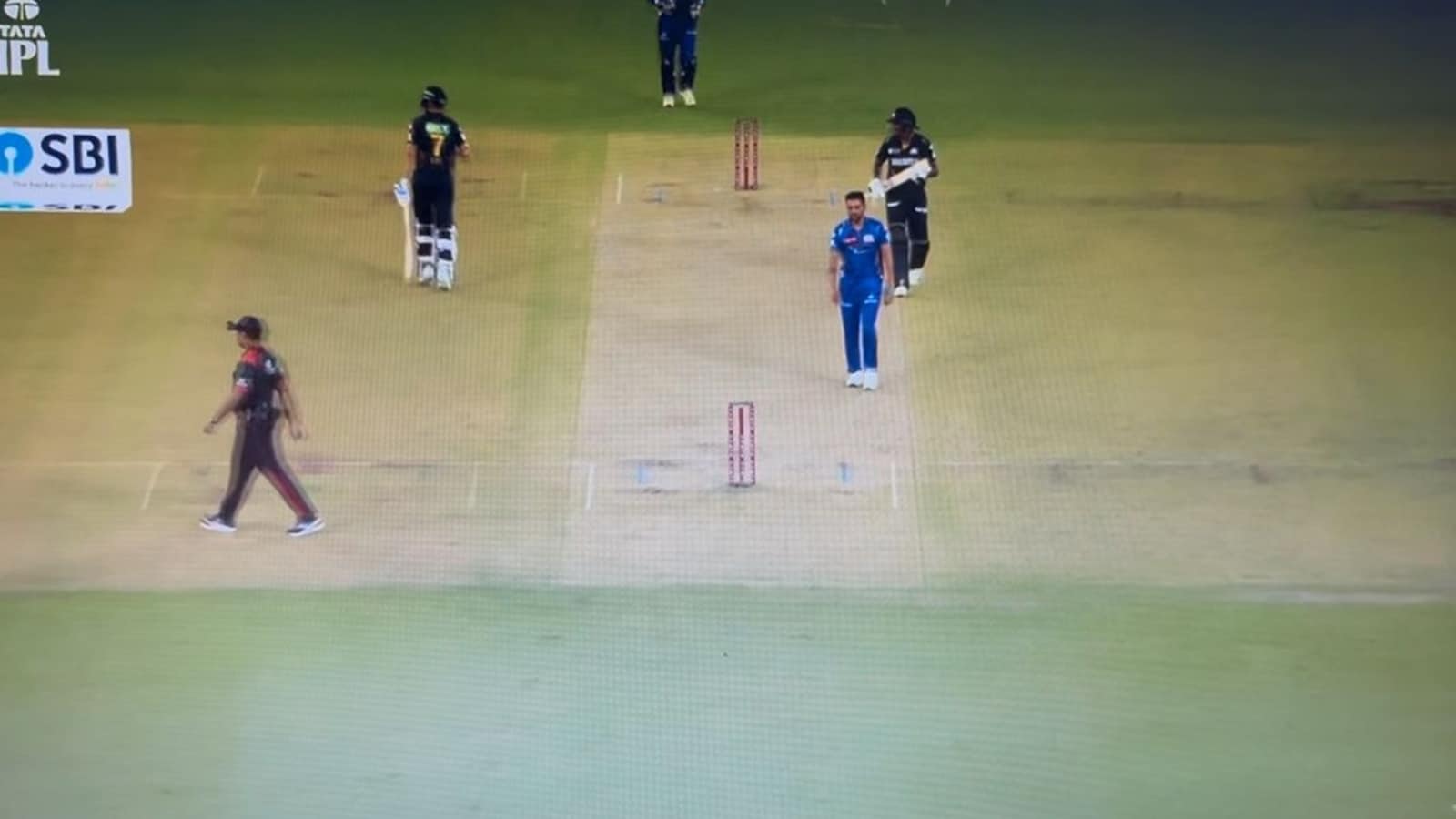

Mis Fielding And Sudharsans Run Gavaskars Furious Reaction Sparks Debate

Mar 30, 2025

Mis Fielding And Sudharsans Run Gavaskars Furious Reaction Sparks Debate

Mar 30, 2025 -

Premier League Betting Norwichs Home Game Both Teams To Score

Mar 30, 2025

Premier League Betting Norwichs Home Game Both Teams To Score

Mar 30, 2025 -

Blue Jays Pitching Staff Will Scherzers Addition Make A Difference

Mar 30, 2025

Blue Jays Pitching Staff Will Scherzers Addition Make A Difference

Mar 30, 2025