Crypto Investment Surge: Over $7.5B Inflow Recovers 2025 Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Investment Surge: Over $7.5B Inflow Recovers 2025 Losses

The cryptocurrency market has witnessed a remarkable resurgence, with over $7.5 billion in investment inflows effectively erasing losses incurred earlier in 2025. This significant shift signifies a renewed confidence in the digital asset space, prompting analysts to reassess their market predictions. The inflow, observed over the past [Insert timeframe, e.g., two weeks], represents a powerful counter-trend to the previously bearish sentiment. This positive momentum is fueling speculation about a potential sustained bull run.

What Drove This Sudden Surge?

Several factors contributed to this dramatic turnaround. While pinpointing a single cause is difficult, several key elements played crucial roles:

-

Regulatory Clarity (or Lack Thereof): While regulatory uncertainty remains a persistent concern, recent developments in [mention specific country/region and its regulatory stance, e.g., the EU's Markets in Crypto-Assets (MiCA) regulation] have potentially reduced some ambiguity, fostering a more positive outlook among investors. Conversely, the lack of concrete regulatory frameworks in other major markets continues to be a wildcard.

-

Bitcoin's Price Action: Bitcoin, the dominant cryptocurrency, experienced a significant price increase, acting as a catalyst for the broader market recovery. This surge in Bitcoin's value influenced investor sentiment, encouraging them to re-enter the market or increase their existing holdings. The price increase, fuelled by [mention specific contributing factors, e.g., positive macroeconomic news, institutional adoption], spurred confidence.

-

Altcoin Performance: The recovery wasn't limited to Bitcoin. Several prominent altcoins also experienced substantial gains, further contributing to the overall inflow. [Mention specific examples of altcoins that performed well and briefly explain why]. This diversification of growth points to a broader market recovery, rather than a single-asset driven rally.

-

DeFi Revival: The decentralized finance (DeFi) sector has shown signs of revitalization, with increased activity and trading volume across various platforms. This resurgence in DeFi interest has attracted new investors and further boosted the overall crypto market capitalization.

Is This a Sustainable Trend?

While the recent influx of investment is undeniably positive, it’s crucial to approach future predictions with caution. The cryptocurrency market remains notoriously volatile, and several factors could potentially reverse this positive trend. These include:

- Continued Regulatory Uncertainty: The lack of clear regulatory frameworks in many jurisdictions remains a significant risk factor. Unpredictable regulatory changes could easily dampen investor enthusiasm.

- Macroeconomic Factors: Global economic conditions continue to influence cryptocurrency prices. Any significant downturn in the global economy could negatively impact the crypto market.

- Technological Risks: The inherent risks associated with blockchain technology, such as security vulnerabilities and scalability challenges, remain ongoing concerns.

Looking Ahead:

The $7.5 billion inflow signifies a significant shift in the crypto market landscape. However, it's vital to remember that this is not a guarantee of sustained growth. Careful analysis of macroeconomic indicators, regulatory developments, and technological advancements will be crucial in determining the long-term trajectory of the cryptocurrency market. The next few months will be crucial in assessing whether this represents a genuine market recovery or a temporary reprieve. Investors should proceed with caution and conduct thorough research before making any investment decisions.

Keywords: Crypto Investment, Cryptocurrency Market, Bitcoin Price, Altcoins, DeFi, Regulatory Clarity, Market Recovery, $7.5 Billion Inflow, 2025 Crypto Losses, Crypto Market Volatility, Investment Surge

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Investment Surge: Over $7.5B Inflow Recovers 2025 Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Victoria De Medias Rojas 3 1 Sobre Mets Actuacion Destacada De Jarren Duran

May 21, 2025

Victoria De Medias Rojas 3 1 Sobre Mets Actuacion Destacada De Jarren Duran

May 21, 2025 -

Wnba Game Recap Indiana Fever Vs Atlanta Dream Featuring Caitlin Clark

May 21, 2025

Wnba Game Recap Indiana Fever Vs Atlanta Dream Featuring Caitlin Clark

May 21, 2025 -

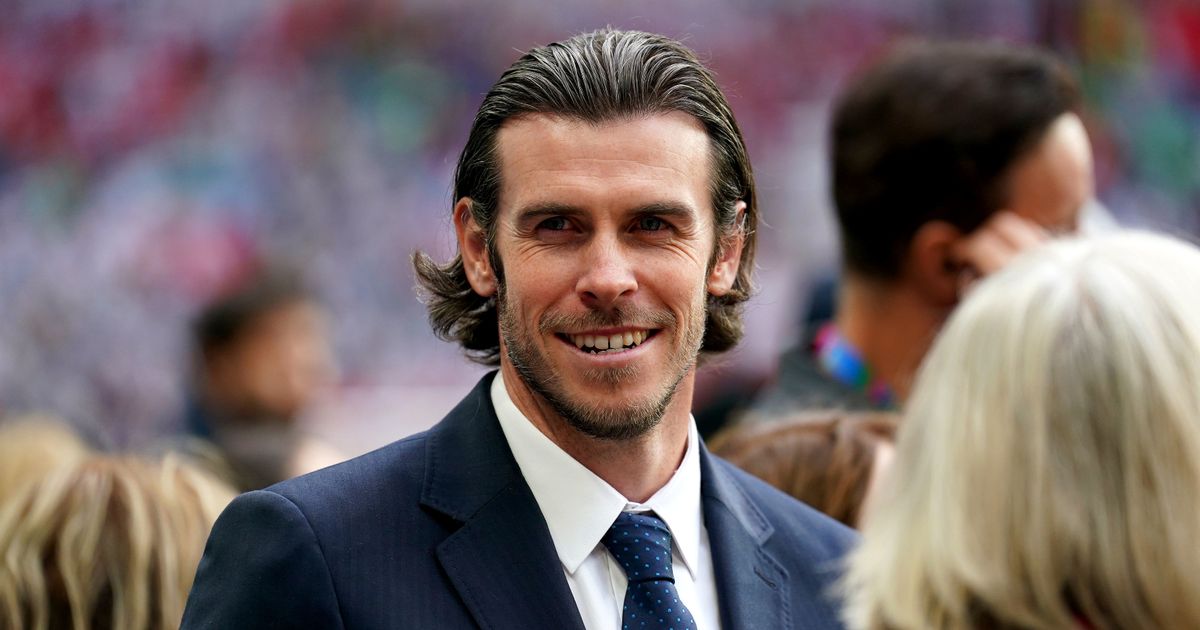

Gareth Bales New Tottenham Role Europa League Final Implications

May 21, 2025

Gareth Bales New Tottenham Role Europa League Final Implications

May 21, 2025 -

Trump Stock Price Stalled Resistance And Potential Breakdown After May 22 Dinner

May 21, 2025

Trump Stock Price Stalled Resistance And Potential Breakdown After May 22 Dinner

May 21, 2025 -

Lea Salonga Announces North American Concert Tour Nyc San Diego Miami And More

May 21, 2025

Lea Salonga Announces North American Concert Tour Nyc San Diego Miami And More

May 21, 2025