Crypto Legal Battles: Analyzing The SEC's 2025 Setbacks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Legal Battles: Analyzing the SEC's 2025 Setbacks

The Securities and Exchange Commission (SEC) has faced significant setbacks in its ongoing legal battles against the cryptocurrency industry in 2025, raising crucial questions about its regulatory approach and the future of digital assets. While the SEC Chair, Gary Gensler, has consistently maintained a hardline stance, recent court decisions and industry pushback suggest a shift in the regulatory landscape. This article analyzes the key challenges the SEC encountered and explores the potential implications for the crypto market.

Ripple's Victory: A Turning Point?

The landmark Ripple Labs vs. SEC case, concluded earlier this year, delivered a major blow to the SEC's regulatory authority. The court ruling partially favored Ripple, clarifying that not all cryptocurrencies qualify as unregistered securities. This victory has emboldened other crypto companies to challenge the SEC's broad interpretation of the Howey Test, the legal framework used to determine whether an asset is a security. The Ripple decision sets a significant precedent, potentially altering the SEC's enforcement strategy and paving the way for future legal challenges. This outcome is a key factor in understanding the SEC's 2025 setbacks.

Increased Judicial Scrutiny: A Challenging Landscape

Beyond the Ripple case, the SEC has faced increased judicial scrutiny across multiple fronts. Judges are increasingly questioning the SEC's aggressive enforcement actions and its perceived lack of clear regulatory guidelines for the crypto industry. This judicial pushback reflects a growing concern that the SEC's approach stifles innovation and harms the development of a potentially transformative technology. The lack of clear definitions and consistent application of existing securities laws within the crypto space continues to hamper the SEC's efforts.

Navigating the DeFi Ecosystem: An Uphill Battle

Regulating the decentralized finance (DeFi) ecosystem presents a unique challenge for the SEC. The decentralized and pseudonymous nature of DeFi platforms makes enforcement significantly more complex. The SEC's attempts to categorize DeFi tokens as securities have been met with resistance from the community, highlighting the difficulties in applying traditional regulatory frameworks to a novel and rapidly evolving technological landscape. This regulatory struggle represents a significant hurdle for the SEC in 2025.

The Impact on Crypto Innovation and Investment:

The SEC's setbacks have had a palpable impact on crypto innovation and investment. Uncertainty surrounding the regulatory landscape has led some projects to relocate or seek alternative jurisdictions with more favorable regulatory environments. This exodus of talent and capital could hinder the long-term growth and development of the US cryptocurrency sector, potentially putting the US at a competitive disadvantage compared to other countries embracing crypto innovation.

Looking Ahead: A Need for Clarity and Collaboration

The SEC's 2025 setbacks underscore the urgent need for greater clarity and collaboration in crypto regulation. A more nuanced and balanced approach that fosters innovation while protecting investors is crucial for the sustainable growth of the crypto market. The future likely involves increased dialogue between the SEC, the crypto industry, and lawmakers to develop a regulatory framework that balances investor protection with the potential benefits of blockchain technology. This collaborative approach will be crucial to avoid further setbacks and ensure responsible growth within the cryptocurrency market.

Key Takeaways:

- The Ripple case significantly impacted the SEC's regulatory authority.

- Increased judicial scrutiny is challenging the SEC's enforcement actions.

- Regulating DeFi presents unique and complex challenges.

- Regulatory uncertainty hinders crypto innovation and investment.

- Collaboration between the SEC and the crypto industry is crucial for future progress.

The SEC's 2025 struggles highlight a critical juncture in the ongoing debate surrounding crypto regulation. The coming years will be defining in shaping the future of the cryptocurrency industry in the United States and beyond. The need for a balanced and forward-thinking approach is clearer than ever.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Legal Battles: Analyzing The SEC's 2025 Setbacks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Akses Langsung Link Live Streaming Matchday 27 Bundesliga Di Vision

Mar 30, 2025

Akses Langsung Link Live Streaming Matchday 27 Bundesliga Di Vision

Mar 30, 2025 -

Amazon Spring Sale Our Top 100 Picks And Best Savings

Mar 30, 2025

Amazon Spring Sale Our Top 100 Picks And Best Savings

Mar 30, 2025 -

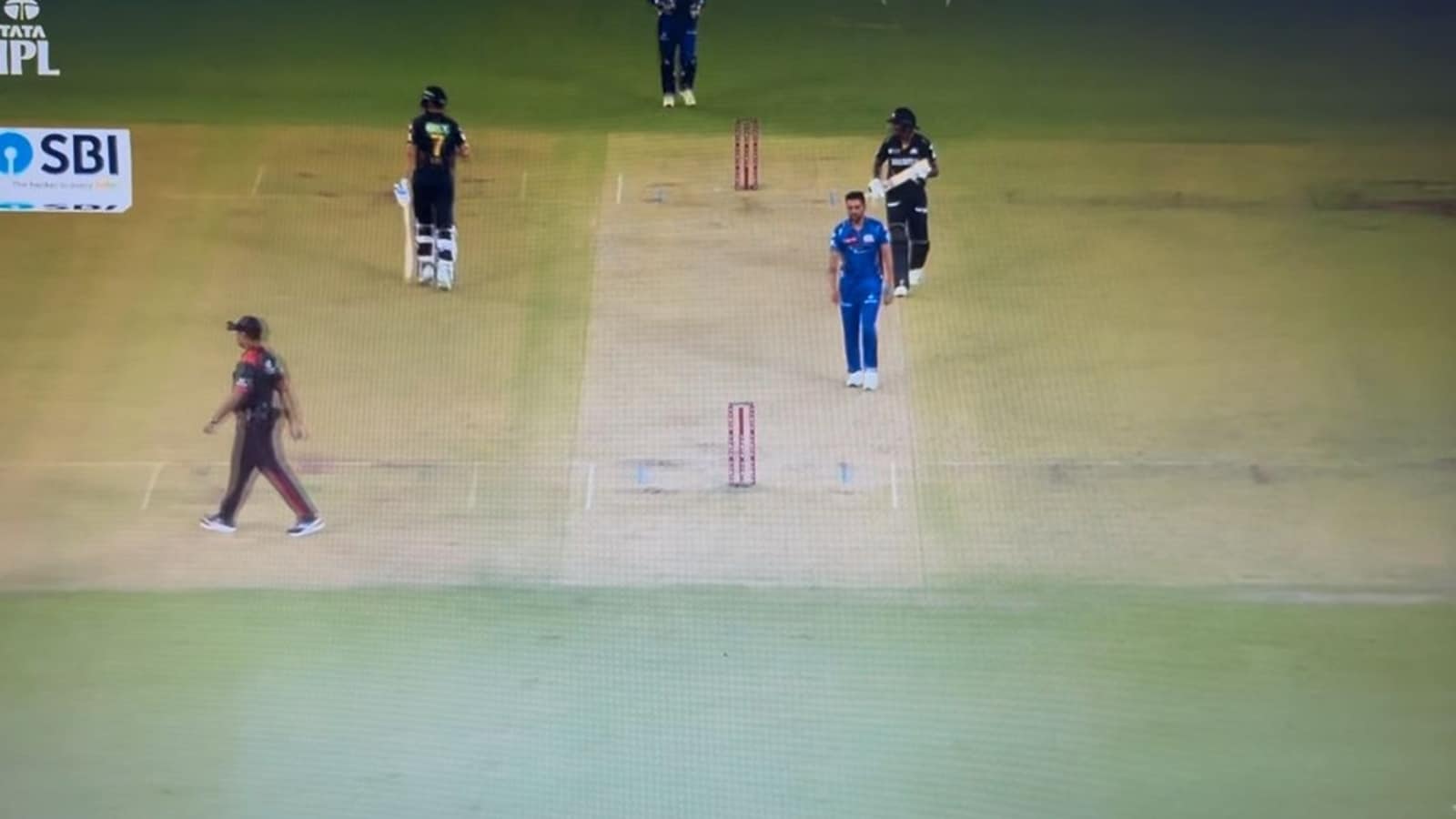

Mis Fielding Flop And Sudharsans Run Draw Gavaskars Ire

Mar 30, 2025

Mis Fielding Flop And Sudharsans Run Draw Gavaskars Ire

Mar 30, 2025 -

Watch Riyan Parags Breathtaking Catch And Wanindu Hasarangas Pushpa Celebration In Ipl 2025

Mar 30, 2025

Watch Riyan Parags Breathtaking Catch And Wanindu Hasarangas Pushpa Celebration In Ipl 2025

Mar 30, 2025 -

Inter Milan Vs Udinese Prediction Team News And Lineups

Mar 30, 2025

Inter Milan Vs Udinese Prediction Team News And Lineups

Mar 30, 2025