Crypto Market Analysis: Bitcoin (BTC) Price Prediction And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Market Analysis: Bitcoin (BTC) Price Prediction and Future Outlook

The cryptocurrency market, particularly Bitcoin (BTC), remains a volatile yet captivating investment landscape. Its fluctuating price and uncertain future continue to draw both seasoned investors and curious newcomers. This analysis delves into the current state of the Bitcoin market, offering insights into potential price predictions and exploring the long-term outlook for the world's leading cryptocurrency.

Bitcoin's Current Market Position:

As of today, Bitcoin is trading at [Insert Current Bitcoin Price and Date - this needs to be updated dynamically]. While the price has experienced significant swings in recent months, several factors contribute to its current market position. These include:

- Macroeconomic Factors: Global inflation, interest rate hikes by central banks, and geopolitical instability all significantly impact Bitcoin's price. These macroeconomic headwinds often correlate with decreased risk appetite among investors, impacting the cryptocurrency market.

- Regulatory Landscape: The evolving regulatory environment surrounding cryptocurrencies globally plays a crucial role. Increased regulatory clarity in certain jurisdictions can boost investor confidence, while stricter regulations can lead to price dips. The ongoing debate about Bitcoin's classification as a security or a commodity remains a key factor.

- Technological Advancements: Developments within the Bitcoin ecosystem, such as the Lightning Network's expansion improving transaction speeds and reducing fees, contribute to its long-term viability and potentially influence price. Innovations in scalability and security constantly shape the narrative.

- Adoption Rate: Increasing adoption by institutional investors and mainstream businesses signals growing confidence in Bitcoin as a store of value and a medium of exchange. This growing acceptance is a crucial driver of price appreciation.

Bitcoin Price Prediction: Navigating Uncertainty:

Predicting Bitcoin's price with certainty is impossible. The cryptocurrency market is inherently volatile and influenced by numerous unpredictable factors. However, several analytical approaches offer potential scenarios:

- Technical Analysis: Chart patterns, indicators like moving averages and Relative Strength Index (RSI), and historical price movements are used to identify potential support and resistance levels. While not foolproof, technical analysis provides insights into short-term price trends.

- Fundamental Analysis: This approach focuses on evaluating Bitcoin's underlying value proposition, considering factors like its limited supply, growing adoption, and its role as a decentralized digital asset. Fundamental analysis generally provides a longer-term perspective.

- Sentiment Analysis: Gauging market sentiment through social media trends, news coverage, and investor surveys can offer clues about potential price movements. However, sentiment can be easily manipulated and shouldn't be the sole basis for investment decisions.

Long-Term Outlook for Bitcoin:

Despite the inherent volatility, many experts believe Bitcoin has the potential for significant long-term growth. Its decentralized nature, scarcity, and growing acceptance as a hedge against inflation are key arguments supporting this view. However, potential risks include:

- Increased Regulation: Stringent regulations could stifle innovation and adoption.

- Technological Disruptions: Emergence of competing cryptocurrencies or technological breakthroughs could challenge Bitcoin's dominance.

- Security Concerns: Security breaches and vulnerabilities remain a concern, although Bitcoin's network has proven remarkably resilient.

Conclusion:

Investing in Bitcoin requires a thorough understanding of its inherent risks and volatility. While price predictions are inherently speculative, a comprehensive analysis of macroeconomic factors, regulatory developments, technological advancements, and market sentiment can help inform investment strategies. Conducting your own thorough research and seeking advice from qualified financial advisors is crucial before making any investment decisions. The future of Bitcoin remains uncertain, but its potential as a disruptive technology and a store of value continues to fuel debate and interest worldwide. Remember, this analysis is for informational purposes only and not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Market Analysis: Bitcoin (BTC) Price Prediction And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

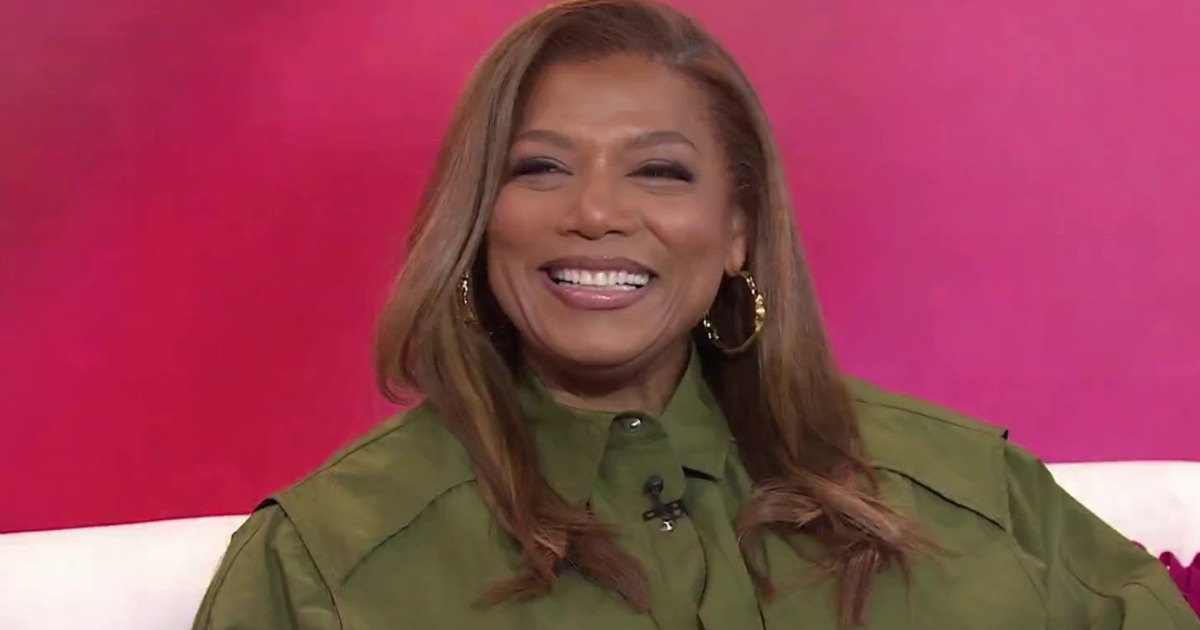

Queen Latifahs Multifaceted Career From Music To Film And Beyond

May 17, 2025

Queen Latifahs Multifaceted Career From Music To Film And Beyond

May 17, 2025 -

Alejandra Silva Shares Unseen Photos Of Her Children With Richard Gere

May 17, 2025

Alejandra Silva Shares Unseen Photos Of Her Children With Richard Gere

May 17, 2025 -

Gloom Descends Record Low In Us Consumer Confidence

May 17, 2025

Gloom Descends Record Low In Us Consumer Confidence

May 17, 2025 -

Trading Hamster Kombat Hmstr Navigating Oversold Conditions And Potential Rebounds

May 17, 2025

Trading Hamster Kombat Hmstr Navigating Oversold Conditions And Potential Rebounds

May 17, 2025 -

Squid Game Stars Confirmed For Netflixs Los Angeles Fan Event

May 17, 2025

Squid Game Stars Confirmed For Netflixs Los Angeles Fan Event

May 17, 2025