Crypto Market Analysis: Can Buffett's Principles Guide Successful Trading?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Market Analysis: Can Buffett's Principles Guide Successful Trading?

The volatile cryptocurrency market often feels like the Wild West, a far cry from the established world of traditional finance. Yet, some investors believe the sage wisdom of Warren Buffett, the Oracle of Omaha, can offer surprisingly relevant insights for navigating this turbulent landscape. But can Buffett's time-tested principles, honed over decades in the stock market, truly guide successful crypto trading? Let's delve into this fascinating question.

Buffett's Core Principles: A Foundation for Investing

Before applying Buffett's philosophy to crypto, let's recap his key tenets:

- Value Investing: Buffett focuses on identifying undervalued assets with strong intrinsic value, patiently waiting for the market to recognize their true worth.

- Long-Term Perspective: He advocates for a long-term investment horizon, resisting short-term market fluctuations.

- Understanding the Business: Before investing, Buffett meticulously researches the underlying business, seeking a deep understanding of its fundamentals.

- Risk Aversion: He prioritizes risk management, avoiding speculative investments and focusing on companies with proven track records.

- Discipline and Patience: Sticking to his investment strategy, even during market downturns, is a hallmark of Buffett's success.

Applying Buffett's Wisdom to Crypto: Challenges and Opportunities

Applying these principles directly to the crypto market presents both significant challenges and intriguing possibilities:

Challenges:

- Volatility: Crypto's extreme price volatility clashes with Buffett's emphasis on long-term investing. Predicting the future value of many cryptocurrencies is exceptionally difficult.

- Lack of Intrinsic Value (for many): Unlike established companies with tangible assets and revenue streams, many cryptocurrencies lack readily quantifiable intrinsic value, making traditional valuation methods challenging.

- Regulatory Uncertainty: The ever-evolving regulatory landscape adds another layer of complexity and risk.

Opportunities:

- Identifying Undervalued Projects: Despite the volatility, opportunities to identify undervalued projects with strong underlying technology or utility might exist. Thorough research and due diligence are crucial.

- Long-Term Growth Potential: Some believe that certain cryptocurrencies, particularly those with strong community support and proven use cases, have long-term growth potential.

- Diversification: Cryptocurrencies can offer a degree of diversification within a broader investment portfolio, potentially mitigating risk.

Strategies for a "Buffett-Inspired" Crypto Approach:

While directly mirroring Buffett's stock market strategy in crypto might be unrealistic, we can adapt his principles:

- Focus on Utility and Adoption: Invest in cryptocurrencies with clear use cases and growing adoption rates.

- Thorough Due Diligence: Conduct extensive research, understanding the technology, team, and market dynamics of each project.

- Diversification and Risk Management: Spread investments across multiple cryptocurrencies and avoid overexposure to any single asset.

- Long-Term Perspective (with caution): While a long-term outlook is beneficial, be prepared for significant price swings and potential losses. Dollar-cost averaging can help mitigate risk.

Conclusion: A Cautious Approach is Key

While Warren Buffett's principles offer valuable guidance for any investor, applying them to the crypto market requires a nuanced and cautious approach. The inherent volatility and lack of clear valuation metrics in the crypto world necessitates a thorough understanding of the risks involved. By adapting Buffett's focus on value, research, and risk management, investors can potentially navigate the crypto market more effectively, but success hinges on a well-informed and disciplined strategy. Remember that this is not financial advice, and always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Market Analysis: Can Buffett's Principles Guide Successful Trading?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sunday Crossword And Puzzle Answers May 25 2025

May 25, 2025

Sunday Crossword And Puzzle Answers May 25 2025

May 25, 2025 -

Dinner With Trump Memecoin 148 Million In Funding And The Role Of International Investors

May 25, 2025

Dinner With Trump Memecoin 148 Million In Funding And The Role Of International Investors

May 25, 2025 -

Libertines Star Reveals Pete Dohertys Health Status Following Toe Amputation Warning

May 25, 2025

Libertines Star Reveals Pete Dohertys Health Status Following Toe Amputation Warning

May 25, 2025 -

The Growing Threat Of Colon Cancer Among Young Adults Early Detection Is Key

May 25, 2025

The Growing Threat Of Colon Cancer Among Young Adults Early Detection Is Key

May 25, 2025 -

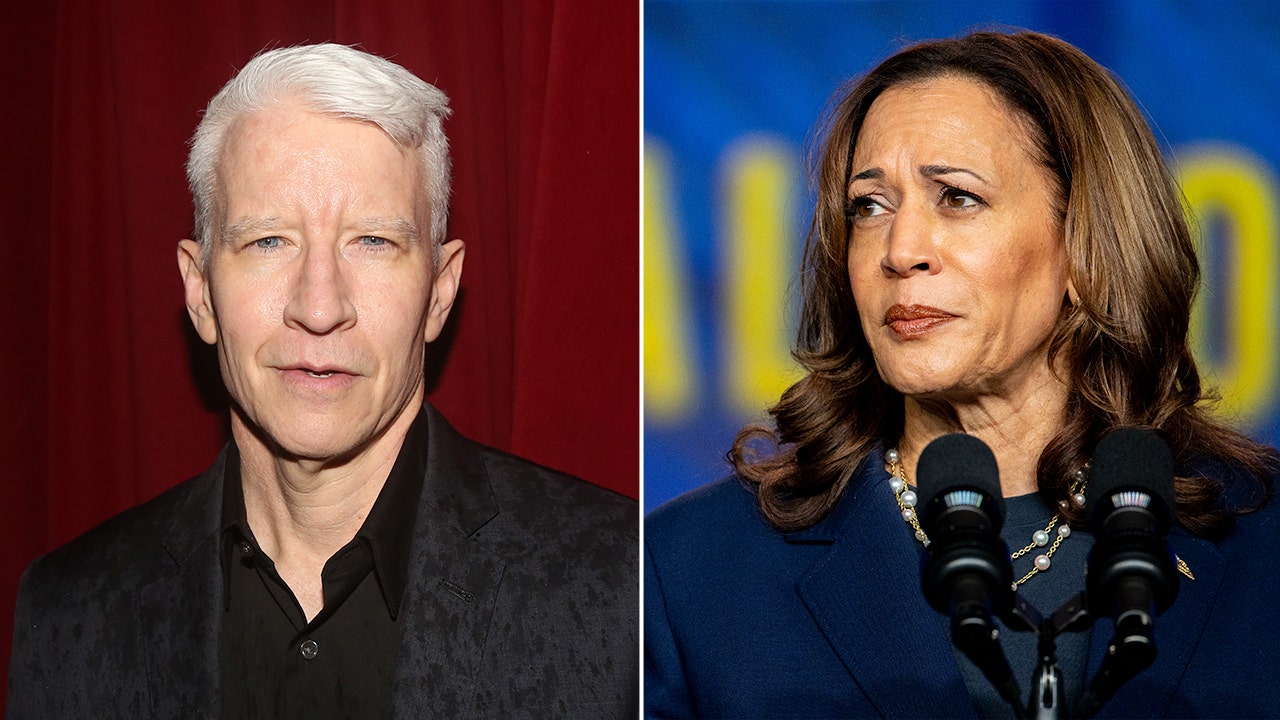

Kamala Harriss Heated Exchange With Anderson Cooper A New Book Reveals All

May 25, 2025

Kamala Harriss Heated Exchange With Anderson Cooper A New Book Reveals All

May 25, 2025

Latest Posts

-

Opelka 95 Vs Hijikata 79 Roland Garros 2025 Prediction And Betting Odds

May 25, 2025

Opelka 95 Vs Hijikata 79 Roland Garros 2025 Prediction And Betting Odds

May 25, 2025 -

Stalin Statue In Putins Russia Interpreting The Implications For The Future

May 25, 2025

Stalin Statue In Putins Russia Interpreting The Implications For The Future

May 25, 2025 -

Nba Playoffs Timberwolves Dominate Thunder In Game 3

May 25, 2025

Nba Playoffs Timberwolves Dominate Thunder In Game 3

May 25, 2025 -

Silverstone Moto2 Agius Takes First Victory

May 25, 2025

Silverstone Moto2 Agius Takes First Victory

May 25, 2025 -

Opelka Vs Hijikata 2025 French Open First Round Showdown Preview

May 25, 2025

Opelka Vs Hijikata 2025 French Open First Round Showdown Preview

May 25, 2025