Crypto Market Booms As Confidence In US Dollar Erodes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Market Booms as Confidence in US Dollar Erodes

The cryptocurrency market is experiencing a significant surge, fueled by growing concerns about the stability of the US dollar. As inflation remains stubbornly high and economic uncertainty looms, investors are increasingly seeking alternative assets, driving a renewed interest in Bitcoin, Ethereum, and other digital currencies. This flight to safety, or perhaps more accurately, a flight away from perceived instability, has injected fresh momentum into a market that had been relatively subdued earlier this year.

The Dollar's Decline: A Catalyst for Crypto Adoption?

The US dollar's weakening position on the global stage is a key factor contributing to the crypto boom. High inflation rates, coupled with aggressive interest rate hikes by the Federal Reserve, have eroded investor confidence in the dollar's long-term value. This uncertainty is pushing investors towards assets perceived as less susceptible to macroeconomic fluctuations, with cryptocurrencies emerging as a compelling alternative.

Bitcoin Leads the Charge

Bitcoin (BTC), the world's largest cryptocurrency by market capitalization, has seen a particularly significant price increase in recent weeks. This surge reflects its status as a digital gold – a store of value that is independent of traditional financial systems. Many investors view Bitcoin as a hedge against inflation and geopolitical instability, further bolstering its appeal during times of economic uncertainty.

-

Increased Institutional Interest: The recent price surge isn't solely driven by retail investors. Several institutional players are also showing increased interest in Bitcoin and other cryptocurrencies, signifying a growing acceptance of digital assets as a legitimate investment class.

-

Technological Advancements: Ongoing advancements in blockchain technology, such as layer-2 scaling solutions, are improving the efficiency and scalability of cryptocurrency networks. This makes cryptocurrencies more attractive to a wider range of users and investors.

Ethereum's Steady Rise

Ethereum (ETH), the second-largest cryptocurrency, has also experienced a significant price increase. Its popularity is driven by its role as the foundation for decentralized applications (dApps) and its growing ecosystem of decentralized finance (DeFi) projects. The expanding DeFi space continues to attract significant investment, contributing to Ethereum's price appreciation.

Beyond Bitcoin and Ethereum: The Altcoin Rally

The price increases aren't limited to Bitcoin and Ethereum. Many altcoins – alternative cryptocurrencies – are also experiencing significant gains. This broader market rally signifies a renewed confidence in the overall cryptocurrency ecosystem.

Risks Remain

While the current market surge is encouraging for crypto investors, it's crucial to acknowledge the inherent risks involved. The cryptocurrency market remains highly volatile, and price fluctuations can be dramatic. Investors should always conduct thorough research and only invest what they can afford to lose.

The Future of Crypto and the US Dollar

The current market trends suggest a growing correlation between the US dollar's performance and the cryptocurrency market's trajectory. As long as uncertainty surrounding the dollar persists, the appeal of cryptocurrencies as an alternative investment is likely to remain strong. However, the long-term relationship between these two asset classes remains to be seen and will depend on various macroeconomic and technological factors. The crypto market’s future is intricately linked to the evolving global economic landscape, making it a fascinating and dynamic space to watch.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Market Booms As Confidence In US Dollar Erodes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Defense Department Addresses Made In China Boats After Tornado Strikes Australian Navy Vessel

Apr 30, 2025

Defense Department Addresses Made In China Boats After Tornado Strikes Australian Navy Vessel

Apr 30, 2025 -

Us Trade Deal In Limbo Trump Tariffs And The Uks Parliamentary Hurdle

Apr 30, 2025

Us Trade Deal In Limbo Trump Tariffs And The Uks Parliamentary Hurdle

Apr 30, 2025 -

Urgent New Woo Commerce Phishing Attack Targets Users With Fake Patch Updates

Apr 30, 2025

Urgent New Woo Commerce Phishing Attack Targets Users With Fake Patch Updates

Apr 30, 2025 -

Acl Elite Showdown Al Ahli And Al Hilals Crucial Battles

Apr 30, 2025

Acl Elite Showdown Al Ahli And Al Hilals Crucial Battles

Apr 30, 2025 -

Delhi Capitals Suffer Third Home Defeat Kkrs Narine Steals The Show

Apr 30, 2025

Delhi Capitals Suffer Third Home Defeat Kkrs Narine Steals The Show

Apr 30, 2025

Latest Posts

-

Fearnley Withdraws Madrid Open Disrupted By Power Outage

Apr 30, 2025

Fearnley Withdraws Madrid Open Disrupted By Power Outage

Apr 30, 2025 -

Ultime Dalla Rifinitura Inzaghi Prova La Formazione Dell Inter Per Il Barcellona

Apr 30, 2025

Ultime Dalla Rifinitura Inzaghi Prova La Formazione Dell Inter Per Il Barcellona

Apr 30, 2025 -

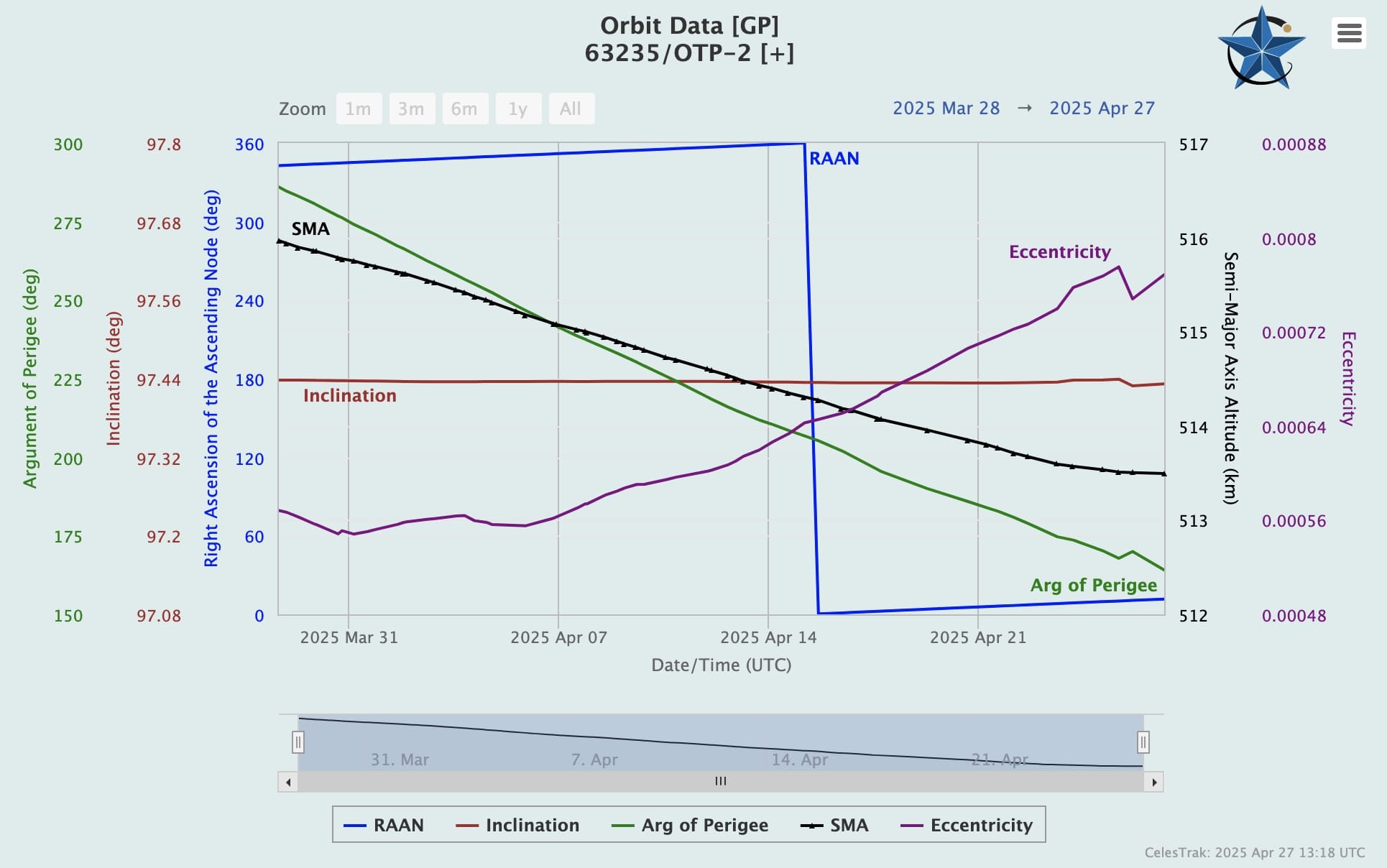

Propellantless Space Drive Update Otp 2 Satellite Shows Reduced Orbital Decline

Apr 30, 2025

Propellantless Space Drive Update Otp 2 Satellite Shows Reduced Orbital Decline

Apr 30, 2025 -

Late Aston Villa Goal Against Arsenal Boosts Chelseas Wsl Championship Chances

Apr 30, 2025

Late Aston Villa Goal Against Arsenal Boosts Chelseas Wsl Championship Chances

Apr 30, 2025 -

Lamine Yamal The Barcelona Prodigy Distances Himself From Messi Legacy

Apr 30, 2025

Lamine Yamal The Barcelona Prodigy Distances Himself From Messi Legacy

Apr 30, 2025