Crypto Supply Shock: Bitcoin And Ethereum Face Scarcity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Supply Shock: Bitcoin and Ethereum Face Looming Scarcity

The cryptocurrency market is buzzing with talk of impending scarcity, particularly for Bitcoin (BTC) and Ethereum (ETH). This isn't just hype; analysts are pointing to concrete data suggesting a tightening supply, potentially leading to significant price appreciation in the future. This supply shock, driven by factors like halving events and increasing institutional adoption, is shaping up to be a major catalyst for the crypto market.

Bitcoin's Halving Effect: A Proven Scarcity Mechanism

Bitcoin's design incorporates a built-in scarcity mechanism: the halving. Every four years, the reward miners receive for verifying transactions is cut in half. This predictable reduction in the rate of new Bitcoin entering circulation directly impacts the overall supply. The next halving is expected in 2024, and history suggests a subsequent price surge. Past halvings have been followed by significant bull runs, making this upcoming event a key focal point for investors. This inherent scarcity, coupled with the fixed supply limit of 21 million Bitcoin, makes it a highly sought-after asset.

Ethereum's Transition to Proof-of-Stake: A Different Kind of Scarcity

Ethereum's journey to scarcity is different, stemming from its recent transition to a Proof-of-Stake (PoS) consensus mechanism. The shift from energy-intensive Proof-of-Work (PoW) to PoS drastically reduced ETH's inflation rate. Previously, new ETH was constantly being minted to reward miners. Now, with staking, ETH is locked up to validate transactions, effectively removing it from active circulation. This "burn mechanism," coupled with the increasing demand for ETH's use in decentralized finance (DeFi) and non-fungible tokens (NFTs), contributes to the growing scarcity.

Institutional Adoption Fuels Demand:

Beyond the technical aspects, the increasing adoption of Bitcoin and Ethereum by institutional investors is further driving up demand. Large financial institutions, hedge funds, and corporations are allocating a portion of their portfolios to cryptocurrencies, recognizing their potential as a hedge against inflation and a diversifier in a volatile market. This institutional interest adds another layer to the already tightening supply, creating a perfect storm for price appreciation.

What Does This Mean for Investors?

The looming supply shock presents both opportunities and challenges for investors. While the potential for significant price appreciation is undeniable, it's crucial to remember the inherent volatility of the cryptocurrency market.

Here are some key considerations:

- Diversification: Don't put all your eggs in one basket. Diversify your crypto portfolio across different assets to mitigate risk.

- Risk Tolerance: Crypto investments are inherently risky. Only invest what you can afford to lose.

- Long-Term Perspective: The scarcity narrative plays out over the long term. Short-term price fluctuations are expected.

- Due Diligence: Thoroughly research any cryptocurrency before investing. Understand the underlying technology and market dynamics.

Conclusion: A Bullish Outlook, But Proceed with Caution

The combination of halving events, the shift to PoS, and increasing institutional demand paints a bullish picture for Bitcoin and Ethereum. The prospect of scarcity is a powerful driver in the crypto market, potentially leading to significant price appreciation in the coming years. However, investors must approach this with a balanced perspective, acknowledging the inherent risks and volatility of the cryptocurrency space. Careful planning, risk management, and thorough research are crucial for navigating this exciting, yet uncertain, market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Supply Shock: Bitcoin And Ethereum Face Scarcity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Whats Driving The Rise In Colon Cancer Among Young Adults

May 25, 2025

Whats Driving The Rise In Colon Cancer Among Young Adults

May 25, 2025 -

Hope And Skepticism In Tehran Amidst Progressing Nuclear Talks

May 25, 2025

Hope And Skepticism In Tehran Amidst Progressing Nuclear Talks

May 25, 2025 -

The Wheel Of Time Officially Cancelled By Amazon

May 25, 2025

The Wheel Of Time Officially Cancelled By Amazon

May 25, 2025 -

Inside Microsofts Push Building An Ai Agent Factory To Lead The Tech Race

May 25, 2025

Inside Microsofts Push Building An Ai Agent Factory To Lead The Tech Race

May 25, 2025 -

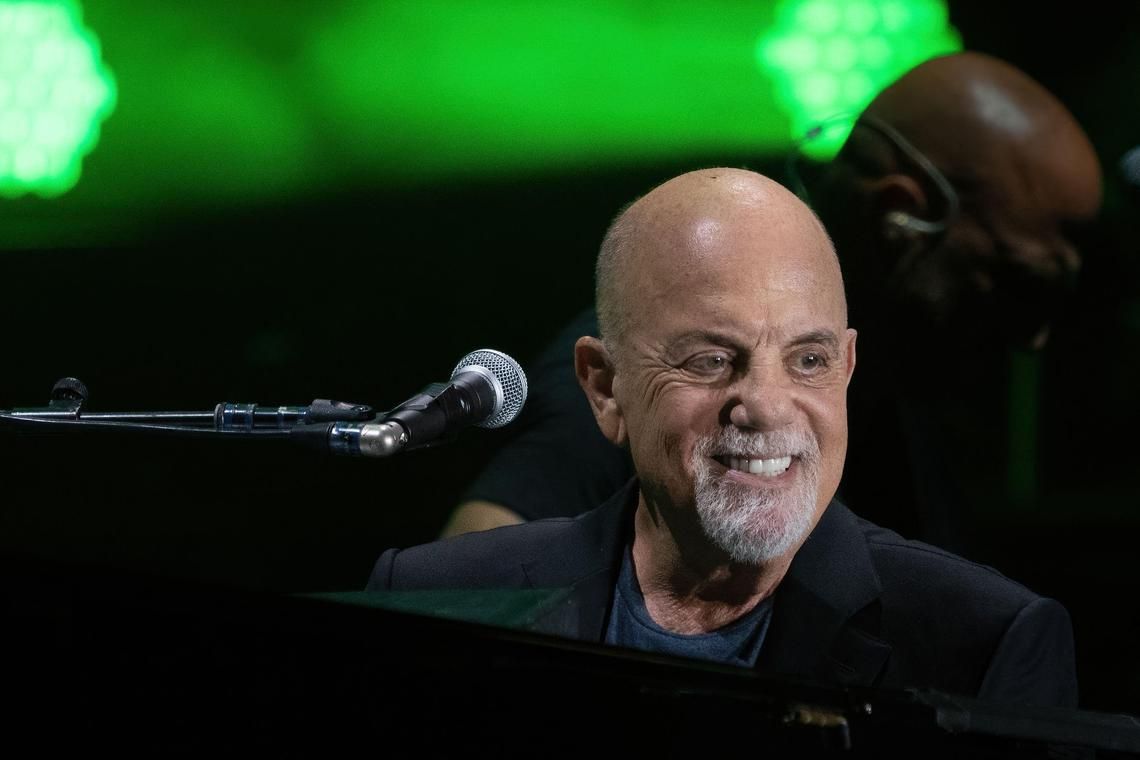

Health Update Billy Joel Cancels Shows After Brain Disorder Diagnosis

May 25, 2025

Health Update Billy Joel Cancels Shows After Brain Disorder Diagnosis

May 25, 2025

Latest Posts

-

Quick And Efficient Sabalenkas Opening Round Roland Garros Win

May 25, 2025

Quick And Efficient Sabalenkas Opening Round Roland Garros Win

May 25, 2025 -

Unraveling The Nyt Strands Answers For Sunday May 25th

May 25, 2025

Unraveling The Nyt Strands Answers For Sunday May 25th

May 25, 2025 -

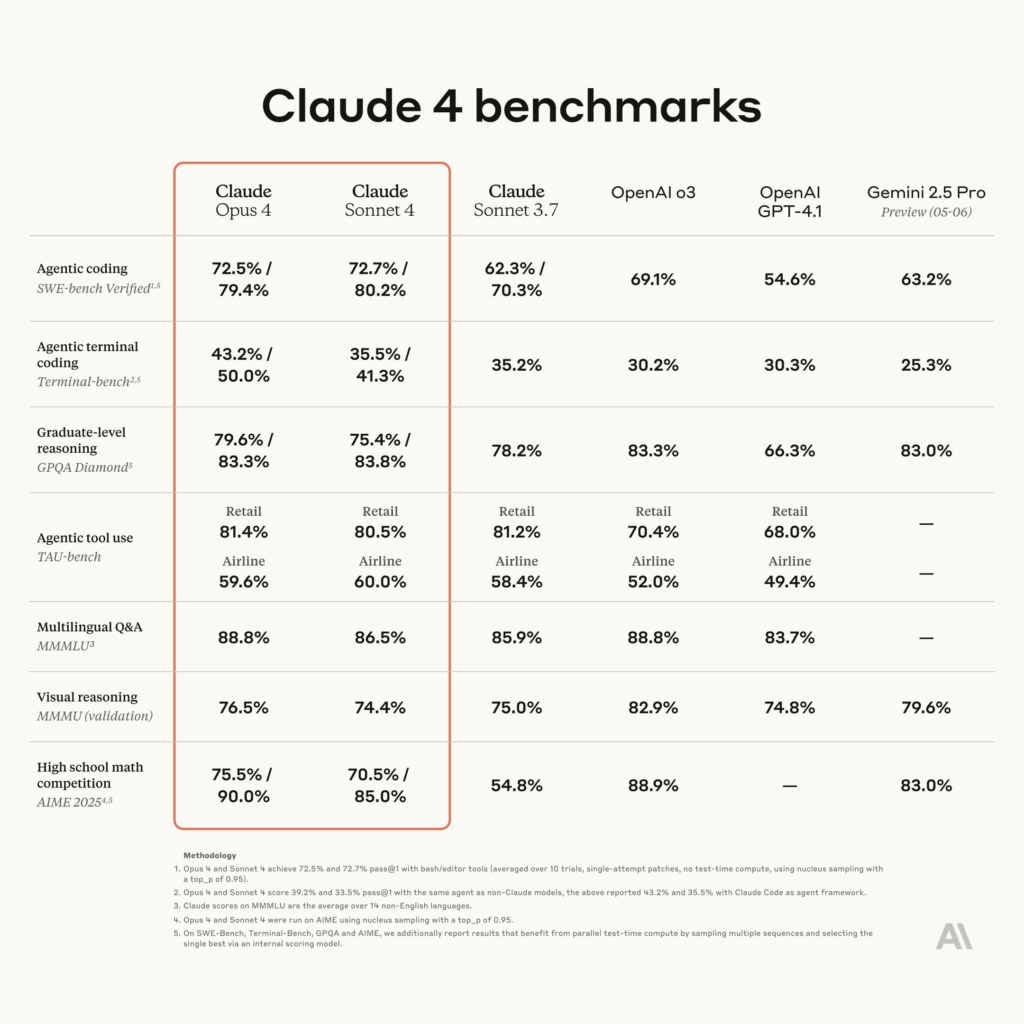

Anthropics Claude 4 Sonnet And Opus Models Unleash Next Level Agentic Coding

May 25, 2025

Anthropics Claude 4 Sonnet And Opus Models Unleash Next Level Agentic Coding

May 25, 2025 -

Commercial Fusion Energy The Potential Of Laser Fusion Technology

May 25, 2025

Commercial Fusion Energy The Potential Of Laser Fusion Technology

May 25, 2025 -

Rising Stars Eala Mboko Valentova Set For Roland Garros 2025 Grand Slam Debut

May 25, 2025

Rising Stars Eala Mboko Valentova Set For Roland Garros 2025 Grand Slam Debut

May 25, 2025