Crypto Tax Complexity: A 2024 Problem Rooted In 2014

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Tax Complexity: A 2024 Problem Rooted in 2014

The year is 2024. For many, the promise of cryptocurrency riches remains tantalizingly close, but a looming shadow hangs over the burgeoning crypto landscape: tax season. The complexities of crypto taxation, largely unforeseen in the early days of Bitcoin (2014 and beyond), are now creating a significant headache for both seasoned investors and casual traders alike. This isn't a new problem, but its magnitude is growing exponentially with the increasing mainstream adoption of digital assets.

A Decade of Unclear Regulations:

The lack of clear and consistent regulatory frameworks surrounding cryptocurrency transactions from the outset has fueled the current tax reporting nightmare. In 2014, when Bitcoin's price was a fraction of its current value, few anticipated the regulatory hurdles that would arise. Governments worldwide struggled to classify cryptocurrencies – are they commodities, securities, or something entirely new? This ambiguity created a breeding ground for confusion and inconsistencies in tax laws.

The 2024 Crunch: Why Now?

Several factors converge in 2024 to exacerbate the crypto tax problem:

- Increased Adoption: The widespread adoption of cryptocurrencies, including institutional investment and the rise of DeFi (Decentralized Finance), has significantly broadened the tax implications. More people are engaging in transactions, leading to a larger volume of reportable events.

- Sophisticated Trading Strategies: The evolution of the crypto market has seen the emergence of sophisticated trading strategies like staking, lending, and yield farming, each with its own complex tax implications. These strategies often involve multiple exchanges and jurisdictions, further compounding the difficulties.

- Improved Tracking Capabilities: While initially difficult to track, authorities now have better tools and technologies to monitor cryptocurrency transactions. This heightened scrutiny means a greater likelihood of audits and penalties for those failing to comply with tax regulations.

- Lack of Standardized Reporting: The absence of universally accepted standards for reporting crypto transactions adds to the burden. Different exchanges offer varying levels of reporting capabilities, making it challenging to consolidate all relevant data for tax preparation.

Navigating the Labyrinth: Key Considerations for 2024

Understanding your tax obligations is paramount. Here are some critical considerations:

- Record Keeping is Crucial: Meticulously track every transaction, including the date, amount, type of cryptocurrency, and the exchange or platform used. This meticulous record-keeping is your best defense against potential penalties.

- Seek Professional Advice: Given the complexity of crypto taxation, consulting a tax professional specializing in digital assets is highly recommended. They can provide personalized guidance based on your individual circumstances.

- Stay Updated on Regulations: Tax laws are constantly evolving. Stay informed about changes in regulations to ensure compliance. Regularly check your relevant tax authority's website for updates.

- Utilize Tax Software: Several tax software programs are now designed to handle crypto transactions. These tools can help simplify the process of organizing and reporting your crypto activity.

The Future of Crypto Taxation:

While the current situation presents significant challenges, the future may hold more clarity. As cryptocurrencies become increasingly mainstream, we can expect more robust regulatory frameworks to emerge, leading to more standardized reporting and simpler tax processes. However, until then, proactive planning and professional guidance are crucial for navigating the complexities of crypto taxation in 2024 and beyond. Ignoring this crucial aspect could have significant financial repercussions. Don't let the 2014 ambiguity cost you dearly in 2024.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Tax Complexity: A 2024 Problem Rooted In 2014. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Battle Tested Nuggets Pose Biggest Threat To Thunders Gilgeous Alexander

May 06, 2025

Battle Tested Nuggets Pose Biggest Threat To Thunders Gilgeous Alexander

May 06, 2025 -

David Ching Of Animoca On Catizen Portfolio Expansion And Web3 Gaming Growth

May 06, 2025

David Ching Of Animoca On Catizen Portfolio Expansion And Web3 Gaming Growth

May 06, 2025 -

Trump Era Steel And Aluminum Tariffs On The Uk Us Trade Agenda

May 06, 2025

Trump Era Steel And Aluminum Tariffs On The Uk Us Trade Agenda

May 06, 2025 -

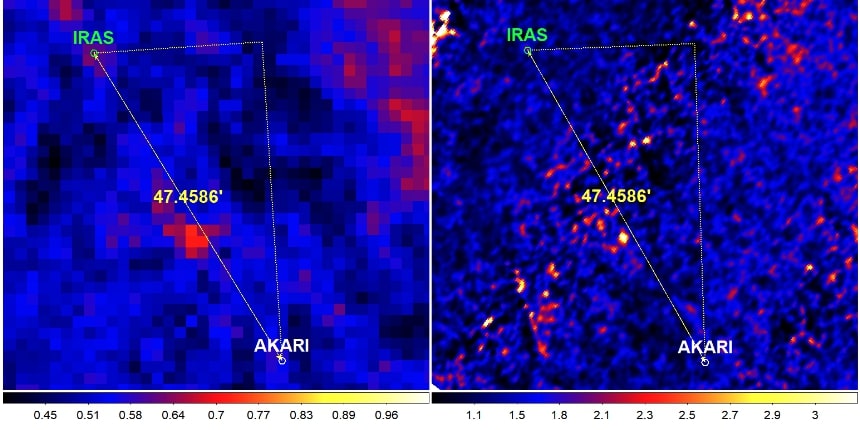

Iras And Akari Data Suggest Potential Location Of Hypothetical Planet Nine

May 06, 2025

Iras And Akari Data Suggest Potential Location Of Hypothetical Planet Nine

May 06, 2025 -

Warriors Game 7 Blow Paytons Illness Forces Absence Against Houston Rockets

May 06, 2025

Warriors Game 7 Blow Paytons Illness Forces Absence Against Houston Rockets

May 06, 2025

Latest Posts

-

Last Minute Mothers Day Gifts Under 50 Jewelry Legos And More

May 06, 2025

Last Minute Mothers Day Gifts Under 50 Jewelry Legos And More

May 06, 2025 -

Mlb Betting Fernando Tatis Jr Home Run Prop May 5th Analysis

May 06, 2025

Mlb Betting Fernando Tatis Jr Home Run Prop May 5th Analysis

May 06, 2025 -

Singapore Ministers Clarify No Personal Ties To Fujian Gang Member Su Haijin

May 06, 2025

Singapore Ministers Clarify No Personal Ties To Fujian Gang Member Su Haijin

May 06, 2025 -

Injury Update Celtics Point Guard Holiday Ready For Game 1 Vs Knicks

May 06, 2025

Injury Update Celtics Point Guard Holiday Ready For Game 1 Vs Knicks

May 06, 2025 -

High Resolution On A Budget Japan Next Unveils Affordable Almost Square 5 K Monitor

May 06, 2025

High Resolution On A Budget Japan Next Unveils Affordable Almost Square 5 K Monitor

May 06, 2025