Crypto Taxation In 2024: Addressing The 2014 Legacy.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation in 2024: Addressing the 2014 Legacy

The cryptocurrency landscape has exploded since its nascent days, leaving many grappling with the complexities of crypto taxation. While the IRS first addressed cryptocurrencies in 2014, the rapidly evolving nature of digital assets means navigating tax obligations in 2024 requires a nuanced understanding of both the original guidance and subsequent clarifications. This article unravels the complexities of crypto taxation in 2024, addressing the legacy of the 2014 IRS pronouncements and highlighting key considerations for taxpayers.

The 2014 IRS Guidance: A Foundation, Not a Finish Line

The IRS's 2014 guidance established a crucial precedent: cryptocurrencies are treated as property for tax purposes. This means that transactions involving cryptocurrencies, such as buying, selling, trading, or using them to pay for goods and services, are taxable events. This foundational principle remains the cornerstone of crypto tax law, but its practical application has become significantly more intricate due to the rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and the sheer volume of crypto transactions.

Key Tax Implications for Crypto in 2024:

- Capital Gains Taxes: Profit from selling cryptocurrency is considered a capital gain and is taxable at either short-term or long-term rates, depending on how long you held the asset. Understanding the difference between short-term and long-term capital gains is crucial for minimizing your tax liability.

- Taxable Events Beyond Sales: Activities like staking, mining, airdrops, and earning interest on crypto holdings can also trigger taxable events. The IRS considers these income generating activities and therefore taxable. Failing to report these activities can lead to significant penalties.

- Reporting Requirements: Accurate record-keeping is paramount. The IRS requires detailed records of all cryptocurrency transactions, including the date, amount, and cost basis of each asset. Many specialized crypto tax software solutions are available to help manage this complexity.

- Wash Sales Rule: The wash sale rule, which typically applies to stocks, also applies to crypto. This rule prevents you from deducting a loss if you repurchase a substantially identical asset within 30 days before or after the sale.

- Gifting and Inheritance: Gifting or inheriting cryptocurrency also has tax implications. The giver may need to report the fair market value of the crypto at the time of gifting, while the recipient will inherit the asset with a cost basis equal to its fair market value at the time of death.

Navigating the Challenges: DeFi, NFTs, and Beyond

The 2014 guidance didn't anticipate the explosion of DeFi and NFTs. These innovative technologies present unique tax challenges. For example, yield farming in DeFi often involves complex transactions and multiple tokens, making accurate tax reporting incredibly difficult. Similarly, the sale of NFTs requires careful consideration of both capital gains and potential royalties.

Staying Compliant in 2024:

- Consult a Tax Professional: Given the intricate nature of crypto taxation, consulting with a tax professional experienced in cryptocurrency is strongly recommended. They can provide personalized guidance based on your specific transactions and circumstances.

- Utilize Crypto Tax Software: Several software solutions are designed to simplify the process of tracking and reporting crypto transactions. These tools can automate many aspects of tax preparation, reducing the likelihood of errors.

- Stay Updated on IRS Guidance: The IRS continues to issue guidance and clarifications on crypto taxation. Staying informed about the latest updates is essential for maintaining compliance.

The Future of Crypto Taxation:

The evolution of the cryptocurrency space is relentless. We can expect continued refinement and clarification from the IRS in the coming years. Proactive planning and diligent record-keeping are crucial for navigating the complex world of crypto taxation and avoiding potential penalties. The 2014 legacy serves as a reminder that understanding and adhering to tax laws is paramount, even within this rapidly evolving digital landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation In 2024: Addressing The 2014 Legacy.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wordle 1413 Hints And Answer Nyt Game For May 2nd Friday

May 03, 2025

Wordle 1413 Hints And Answer Nyt Game For May 2nd Friday

May 03, 2025 -

Betting On Baseball Padres Vs Pirates Predictions And Odds For May 3

May 03, 2025

Betting On Baseball Padres Vs Pirates Predictions And Odds For May 3

May 03, 2025 -

Global Anti Trump Sentiment Faces Key Test In Australian National Election

May 03, 2025

Global Anti Trump Sentiment Faces Key Test In Australian National Election

May 03, 2025 -

Global Anti Trump Sentiment Tested In Australias National Election

May 03, 2025

Global Anti Trump Sentiment Tested In Australias National Election

May 03, 2025 -

Oklahoma Softballs Rise Examining The Week 12 College Softball Rankings

May 03, 2025

Oklahoma Softballs Rise Examining The Week 12 College Softball Rankings

May 03, 2025

Latest Posts

-

Jaettilaeisten Taisto Pelipaeivae Ja Seiskapeli Kohtaavat Laennessae

May 04, 2025

Jaettilaeisten Taisto Pelipaeivae Ja Seiskapeli Kohtaavat Laennessae

May 04, 2025 -

Experiencing Zelle Issues Heres Whats Happening

May 04, 2025

Experiencing Zelle Issues Heres Whats Happening

May 04, 2025 -

Grand Theft Auto Vi Key Details And Speculation From The Official Trailer

May 04, 2025

Grand Theft Auto Vi Key Details And Speculation From The Official Trailer

May 04, 2025 -

Strategic Insights Analyzing The Impact Of Adelman Jokic Porter Westbrook And Murray On The Nuggets

May 04, 2025

Strategic Insights Analyzing The Impact Of Adelman Jokic Porter Westbrook And Murray On The Nuggets

May 04, 2025 -

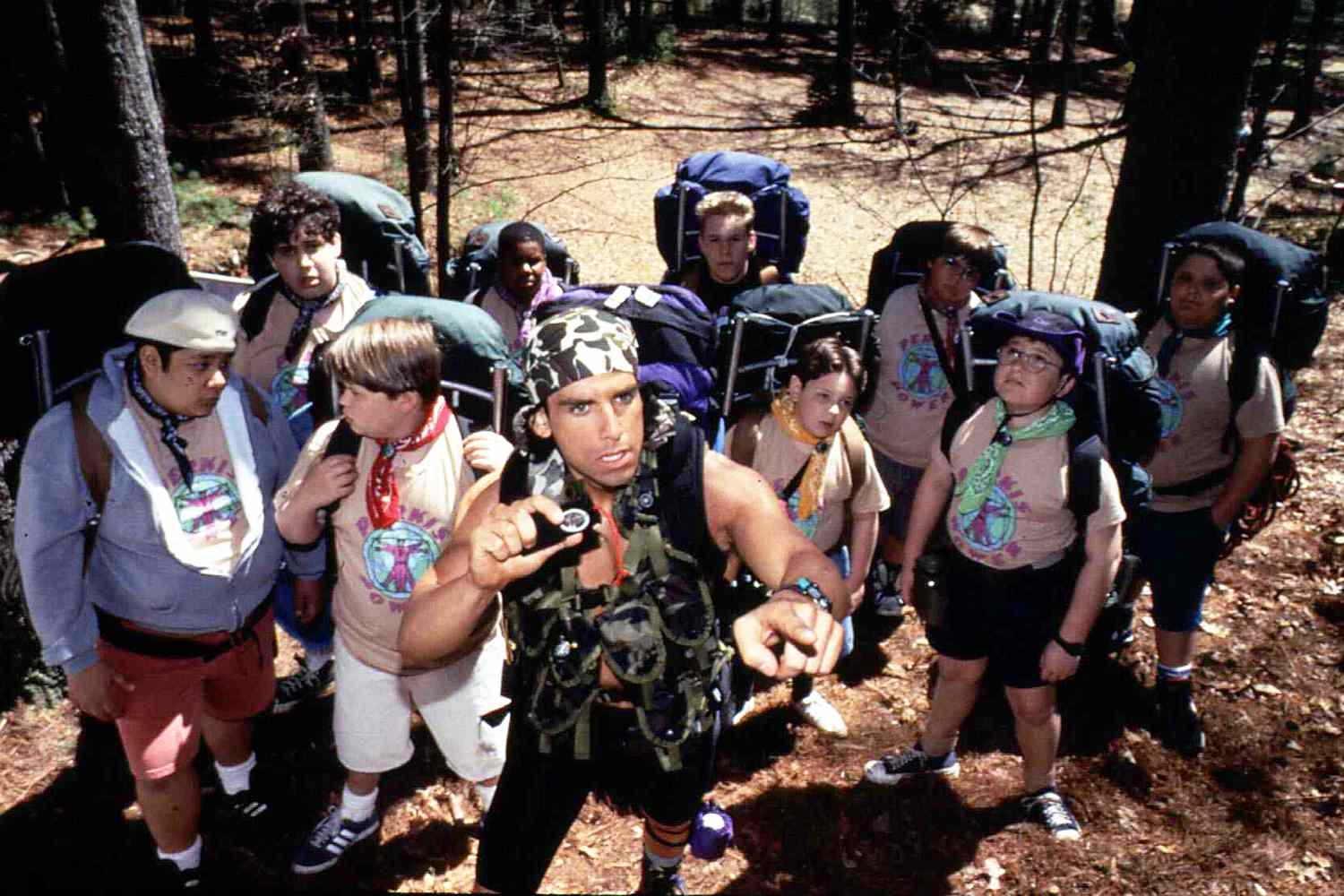

Shaun Weiss Reveals Ben Stillers Intense Heavyweights Set Experience

May 04, 2025

Shaun Weiss Reveals Ben Stillers Intense Heavyweights Set Experience

May 04, 2025