Crypto Taxation In 2024: Modernizing Regulations For A Mature Market.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation in 2024: Modernizing Regulations for a Mature Market

The cryptocurrency market, once a niche corner of the financial world, has exploded into a mainstream phenomenon. With this maturation comes the increasing need for clear and comprehensive crypto taxation regulations. 2024 presents a critical juncture, demanding modernized approaches that address the unique challenges posed by this evolving digital asset landscape. Governments worldwide are grappling with how to effectively tax cryptocurrency transactions, capital gains, and staking rewards, balancing the need for revenue generation with the promotion of innovation and responsible growth.

The Current Landscape: A Patchwork of Regulations

Currently, the global regulatory landscape for crypto taxation is fragmented and inconsistent. Different countries employ varying approaches, leading to confusion and difficulties for both individual investors and businesses operating in the crypto space. Some jurisdictions treat cryptocurrencies as property, subject to capital gains taxes upon sale, while others classify them as commodities, currencies, or securities, each with its own tax implications. This lack of standardization creates complexities for international transactions and cross-border investments.

Key Challenges in Crypto Tax Regulation:

- Defining Crypto Assets: The very nature of crypto assets presents a challenge. The wide variety of tokens, from Bitcoin and Ethereum to stablecoins and NFTs, necessitates a nuanced approach to classification and taxation. The evolving nature of Decentralized Finance (DeFi) further complicates matters.

- Tracking Transactions: The decentralized and pseudonymous nature of many blockchain networks makes tracking transactions difficult. Governments are exploring various technological solutions, including blockchain analytics, to enhance transparency and improve tax compliance.

- Valuation Challenges: Determining the fair market value of cryptocurrencies at the time of acquisition and disposal can be problematic, especially for volatile assets. This necessitates clear guidelines and potentially standardized valuation methods.

- Staking and Lending: The rise of staking and lending platforms introduces new tax complexities. The treatment of staking rewards and interest earned on crypto loans varies significantly across jurisdictions.

- Cross-Border Transactions: International crypto transactions further complicate the tax landscape. Determining the appropriate tax jurisdiction and applying the relevant tax laws becomes challenging in cross-border scenarios.

Modernizing Crypto Tax Regulations: The Path Forward

To address these challenges, a modernized approach to crypto taxation is crucial. This includes:

- Standardization and Harmonization: International cooperation is essential to create a more unified and consistent framework for crypto taxation. This would simplify compliance for global businesses and investors.

- Technological Advancements: Leveraging blockchain analytics and AI-powered tax compliance solutions can enhance the efficiency and effectiveness of tax collection.

- Clearer Definitions and Guidelines: Providing clearer definitions of different crypto assets and establishing standardized valuation methods would reduce ambiguity and facilitate compliance.

- Education and Outreach: Governments need to invest in educational programs to help individuals and businesses understand their crypto tax obligations.

- Gradual Implementation: A phased approach to implementing new regulations allows for adaptation and refinement, minimizing disruption to the market.

Looking Ahead to 2024 and Beyond

2024 will likely see continued efforts to modernize crypto tax regulations globally. We can anticipate more jurisdictions developing specific frameworks to address the unique aspects of crypto taxation, focusing on clarity, fairness, and technological integration. The industry itself will also play a crucial role, advocating for sensible regulations that foster innovation while ensuring responsible growth. The path to a truly effective and globally harmonized crypto tax system is complex, but essential for the long-term stability and success of the cryptocurrency market. Staying informed about evolving regulations is vital for all stakeholders involved.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation In 2024: Modernizing Regulations For A Mature Market.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

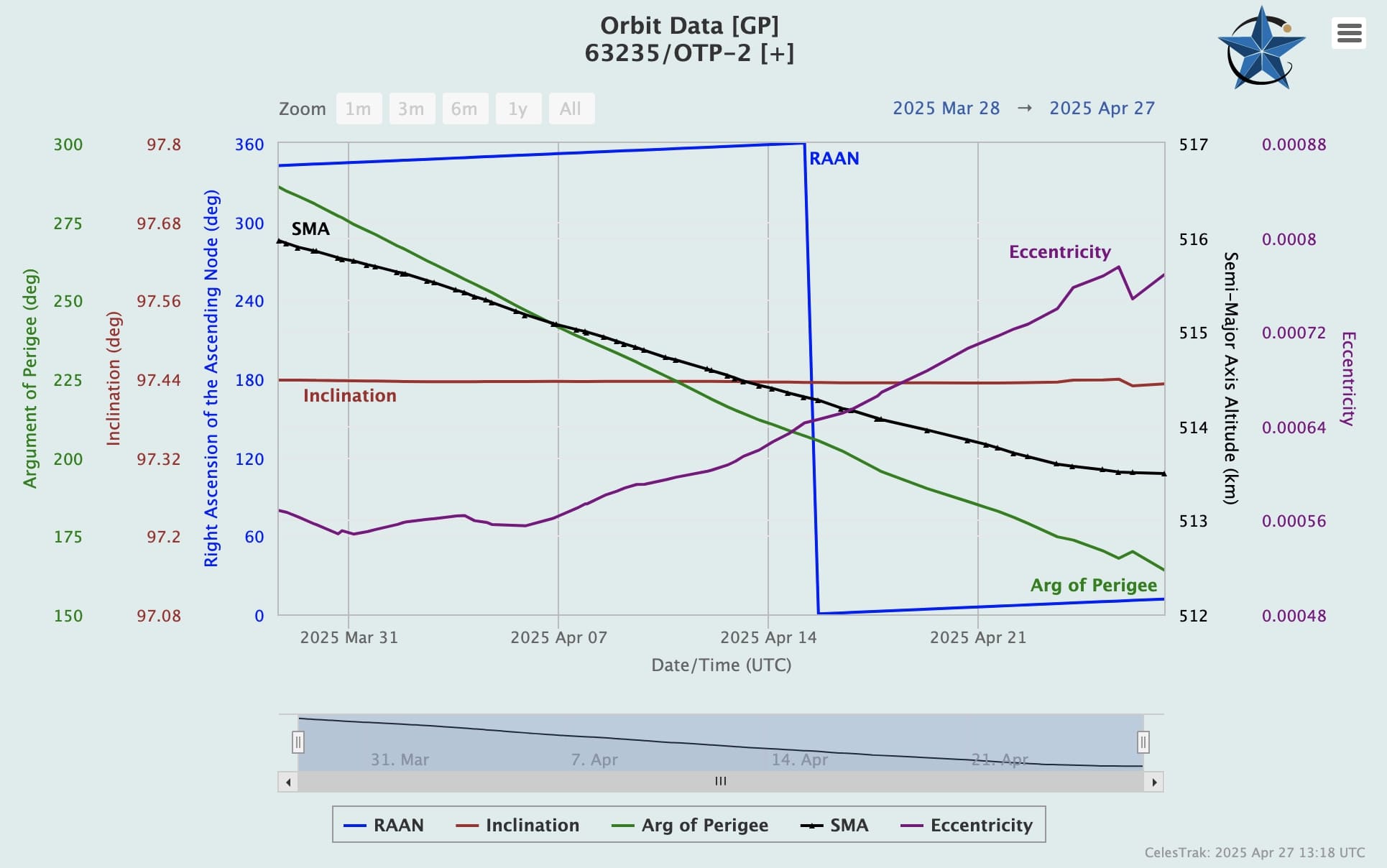

Significant Progress Otp 2 Propellantless Drive And Satellite Orbital Stability

May 01, 2025

Significant Progress Otp 2 Propellantless Drive And Satellite Orbital Stability

May 01, 2025 -

Night 13 Premier League Darts Michael Van Gerwens Chances And Predictions

May 01, 2025

Night 13 Premier League Darts Michael Van Gerwens Chances And Predictions

May 01, 2025 -

Wejscie Do Zespolu Marzen Strategie I Przyklad

May 01, 2025

Wejscie Do Zespolu Marzen Strategie I Przyklad

May 01, 2025 -

Tennis Atp Madrid Gabriel Diallo Poursuit Son Aventure Prochain Tour En Vue

May 01, 2025

Tennis Atp Madrid Gabriel Diallo Poursuit Son Aventure Prochain Tour En Vue

May 01, 2025 -

Enhanced Spectator Amenities Highlight Tpc Craig Ranchs Byron Nelson Upgrades

May 01, 2025

Enhanced Spectator Amenities Highlight Tpc Craig Ranchs Byron Nelson Upgrades

May 01, 2025