Crypto Taxation In 2024: Overcoming The 2014 Legacy.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation in 2024: Overcoming the 2014 Legacy

The world of cryptocurrency has exploded since its nascent days, leaving tax laws scrambling to keep up. The hazy landscape of crypto taxation, initially defined by somewhat ambiguous guidelines in 2014, is finally starting to gain clarity, but navigating 2024's tax implications still requires careful attention. This article will delve into the key changes, challenges, and strategies for successfully navigating crypto taxes in the coming year and beyond, effectively overcoming the legacy of less defined 2014 regulations.

The 2014 IRS Guidance: A Foundation of Uncertainty

The IRS's 2014 guidance classified cryptocurrency as property, not currency. This seemingly simple classification created a complex web of tax implications for investors, traders, and businesses. The lack of specific regulations led to significant uncertainty and inconsistent reporting, a legacy that continues to impact taxpayers today. Many were unsure how to properly account for gains and losses from trading, staking rewards, or even airdrops.

2024: A More Defined Landscape (But Still Complex)

While 2014 provided a foundation, 2024 sees a significant shift towards clearer guidelines, though the complexity remains. Tax authorities globally are increasingly scrutinizing crypto transactions, demanding accurate reporting. This means taxpayers can no longer afford to rely on vague interpretations. Key areas requiring careful attention include:

H2: Key Aspects of Crypto Taxation in 2024

-

Capital Gains and Losses: Any profit from selling cryptocurrency is considered a capital gain, taxable at either short-term (held less than one year) or long-term (held one year or longer) rates. Similarly, losses can be used to offset gains, but specific rules apply. Accurate record-keeping is paramount. This includes meticulously tracking the acquisition cost (including fees), date of acquisition, and date and price of disposal for every crypto transaction.

-

Staking and Lending: The rewards received from staking or lending crypto are generally considered taxable income in the year they are earned. This is a crucial point often overlooked, especially by those passively holding their crypto assets.

-

Airdrops and Forks: The IRS views airdrops and forks as taxable events. The fair market value of the received tokens at the time of receipt is considered taxable income.

-

DeFi Activities: The decentralized finance (DeFi) space presents unique tax challenges. Yield farming, liquidity providing, and other DeFi activities often result in taxable income or capital gains, depending on the nature of the activity.

-

NFT Transactions: Non-fungible tokens (NFTs) are also subject to capital gains taxes upon sale. This applies whether the NFTs are bought for investment purposes or as part of a business.

-

Reporting Requirements: Form 8949 is used to report capital gains and losses from cryptocurrency transactions. This form must be meticulously completed and filed alongside your annual tax return. Failing to accurately report your crypto transactions can result in significant penalties and legal consequences.

H2: Overcoming the 2014 Legacy: Proactive Strategies

To avoid the pitfalls of the 2014 era's ambiguity, taxpayers should adopt a proactive approach:

-

Maintain meticulous records: Utilize crypto tax software or spreadsheets to diligently track all transactions, including dates, amounts, and fees.

-

Seek professional advice: Consulting a tax professional experienced in cryptocurrency taxation is highly recommended. They can provide tailored guidance based on your specific circumstances.

-

Stay updated on regulations: Tax laws are constantly evolving. Keep abreast of changes in regulations to ensure compliance.

H2: The Future of Crypto Taxation

The future of crypto taxation is likely to see increased clarity and standardization, though the complexity inherent in the evolving crypto landscape will persist. Governments worldwide are working on comprehensive regulations, aiming to balance innovation with tax compliance. Staying informed and proactive is key to navigating this ever-changing environment successfully.

The legacy of 2014's uncertain crypto tax landscape should serve as a stark reminder of the importance of accurate record-keeping and proactive tax planning. By embracing these strategies, taxpayers can confidently navigate the complexities of crypto taxation in 2024 and beyond.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation In 2024: Overcoming The 2014 Legacy.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

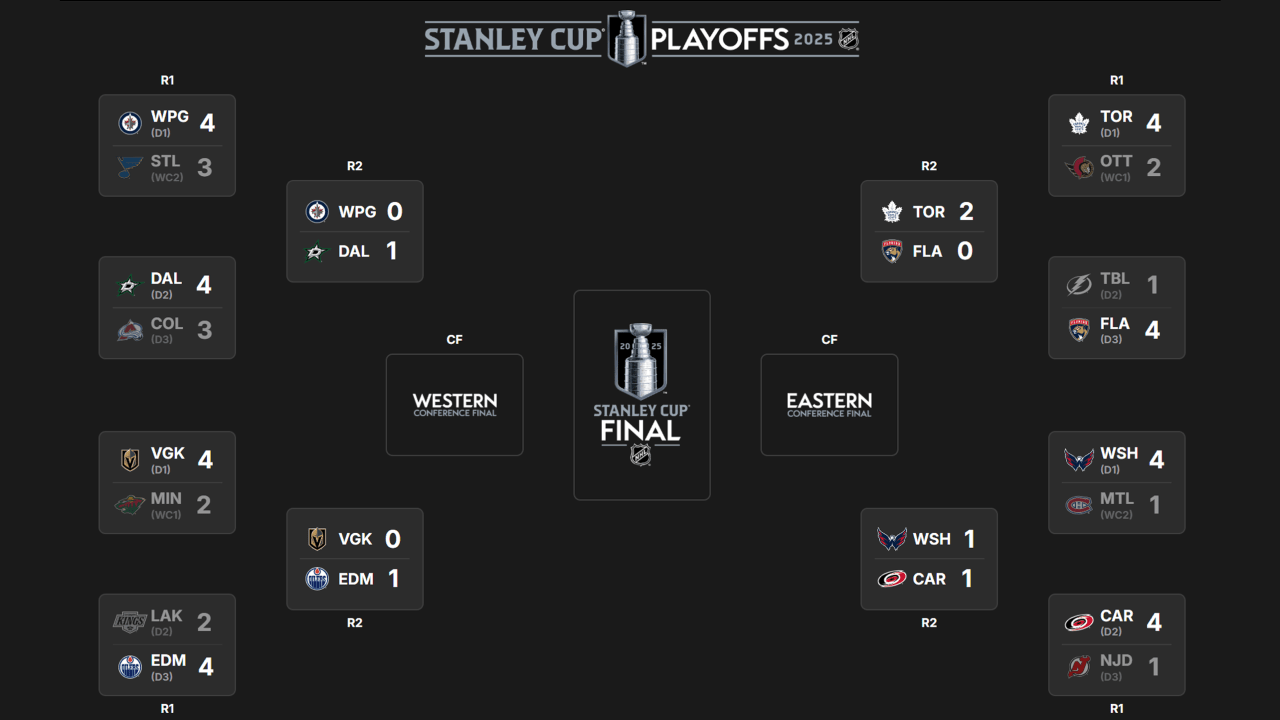

2025 Stanley Cup Playoffs Second Round Complete Game Schedule And Broadcast Info

May 09, 2025

2025 Stanley Cup Playoffs Second Round Complete Game Schedule And Broadcast Info

May 09, 2025 -

Nintendo Switch 2 Restocks Checking Inventory At Game Stop Best Buy And Other Stores

May 09, 2025

Nintendo Switch 2 Restocks Checking Inventory At Game Stop Best Buy And Other Stores

May 09, 2025 -

Ryzen 9 Mini Pc O Cu Link Port Windows 11 Pro And Low Price

May 09, 2025

Ryzen 9 Mini Pc O Cu Link Port Windows 11 Pro And Low Price

May 09, 2025 -

New York Knicks Vs Boston Celtics A Battle Of Strengths And Weaknesses

May 09, 2025

New York Knicks Vs Boston Celtics A Battle Of Strengths And Weaknesses

May 09, 2025 -

Julie Fragars Triumph Winning The 2025 Archibald Prize With A Portrait Of Justene Williams

May 09, 2025

Julie Fragars Triumph Winning The 2025 Archibald Prize With A Portrait Of Justene Williams

May 09, 2025