Crypto Taxation: Outdated Laws Hamper Industry Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation: Outdated Laws Hamper Industry Growth

The rapid rise of cryptocurrency has significantly outpaced the development of tax laws designed to govern it. This mismatch between technological innovation and regulatory frameworks is creating a significant hurdle for the industry's growth, impacting both individual investors and established cryptocurrency businesses. Outdated laws are creating uncertainty, hindering investment, and stifling innovation.

The Problem with Current Crypto Tax Laws:

Many countries are grappling with how to effectively tax cryptocurrency transactions. Existing tax codes, primarily designed for traditional assets, often fail to adequately address the unique characteristics of digital currencies. This leads to several key problems:

- Lack of Clarity: The ambiguous nature of current legislation leaves individuals and businesses uncertain about their tax obligations. Is staking income considered taxable? What about airdrops or the sale of NFTs? The lack of clear guidelines breeds confusion and potentially costly mistakes.

- Complex Reporting Requirements: Tracking cryptocurrency transactions can be incredibly complex. The decentralized nature of many blockchains makes it challenging to accurately report all income and capital gains, especially for those involved in frequent trading.

- High Compliance Costs: Navigating the complexities of crypto taxation requires specialized knowledge and often necessitates hiring expensive tax professionals. This adds significant overhead, particularly for smaller businesses and individual investors.

- International Inconsistencies: The lack of international harmonization in crypto tax laws creates further challenges. Different jurisdictions have varying regulations, making it difficult for businesses operating across borders to comply with all applicable laws.

How Outdated Laws Stifle Growth:

The uncertainty surrounding crypto taxation creates a chilling effect on the industry's growth in several ways:

- Reduced Investment: The lack of clear regulations discourages institutional investment, as many large firms are hesitant to enter a market with ambiguous legal landscapes.

- Hindered Innovation: The complexity and cost of compliance can stifle innovation. Startups may be discouraged from developing new cryptocurrency projects or services if the regulatory burden is too high.

- Increased Regulatory Scrutiny: The lack of clear guidelines often leads to increased regulatory scrutiny, which can further hinder the growth of the industry. Overly strict regulations can inadvertently drive innovation and investment offshore.

- Negative Impact on Adoption: The complexity surrounding crypto taxation can discourage individuals from adopting cryptocurrencies, impacting the overall growth and mainstream acceptance of the technology.

The Path Forward: Modernizing Crypto Tax Laws

To foster innovation and growth within the cryptocurrency industry, governments need to prioritize the modernization of their tax laws. This includes:

- Clear and Comprehensive Guidelines: Governments must provide clear and concise guidance on how cryptocurrency transactions should be taxed. This includes addressing specific scenarios such as staking, airdrops, and NFTs.

- Simplified Reporting Procedures: Streamlined reporting mechanisms are needed to reduce the compliance burden for both individuals and businesses. This might involve collaboration with cryptocurrency exchanges to automate reporting processes.

- International Collaboration: International cooperation is crucial to ensure regulatory consistency and avoid jurisdictional arbitrage. Harmonized tax laws would create a more predictable and stable environment for the global crypto market.

- Education and Awareness: Governments should invest in educating taxpayers about their crypto tax obligations. Increased public awareness can help reduce compliance errors and improve overall understanding.

The future of cryptocurrency is inextricably linked to the development of clear and effective tax policies. Outdated laws not only hamper the industry's growth but also create unnecessary obstacles for individuals and businesses seeking to participate in this rapidly evolving technological landscape. Modernizing crypto taxation is not just a matter of compliance; it's a vital step towards unlocking the full potential of the cryptocurrency industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation: Outdated Laws Hamper Industry Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2023 Could See Metas Xr Glasses Beat Apples Ar Glasses To Market

Apr 30, 2025

2023 Could See Metas Xr Glasses Beat Apples Ar Glasses To Market

Apr 30, 2025 -

Banks Strategic Use Of Stablecoins To Boost Liquidity And Deposits

Apr 30, 2025

Banks Strategic Use Of Stablecoins To Boost Liquidity And Deposits

Apr 30, 2025 -

Man Uniteds Nuno Mendes Transfer Decision 29m Deal Analyzed

Apr 30, 2025

Man Uniteds Nuno Mendes Transfer Decision 29m Deal Analyzed

Apr 30, 2025 -

Strong Winds Drive Rapid Wildfire Spread Southeast Of Tucson Evacuations Underway

Apr 30, 2025

Strong Winds Drive Rapid Wildfire Spread Southeast Of Tucson Evacuations Underway

Apr 30, 2025 -

Madrid Open 2024 Shnaider Vs Swiatek Betting Preview And Odds

Apr 30, 2025

Madrid Open 2024 Shnaider Vs Swiatek Betting Preview And Odds

Apr 30, 2025

Latest Posts

-

Tennis Tracker Key Madrid Open Matches Sabalenka Medvedev Ruud Results

May 01, 2025

Tennis Tracker Key Madrid Open Matches Sabalenka Medvedev Ruud Results

May 01, 2025 -

Doge And The Future Of Public Sector Privacy Challenges And Solutions

May 01, 2025

Doge And The Future Of Public Sector Privacy Challenges And Solutions

May 01, 2025 -

Copom Ipca E Industria Desvendando Os Indicadores Economicos Brasileiros E O Impacto Da China

May 01, 2025

Copom Ipca E Industria Desvendando Os Indicadores Economicos Brasileiros E O Impacto Da China

May 01, 2025 -

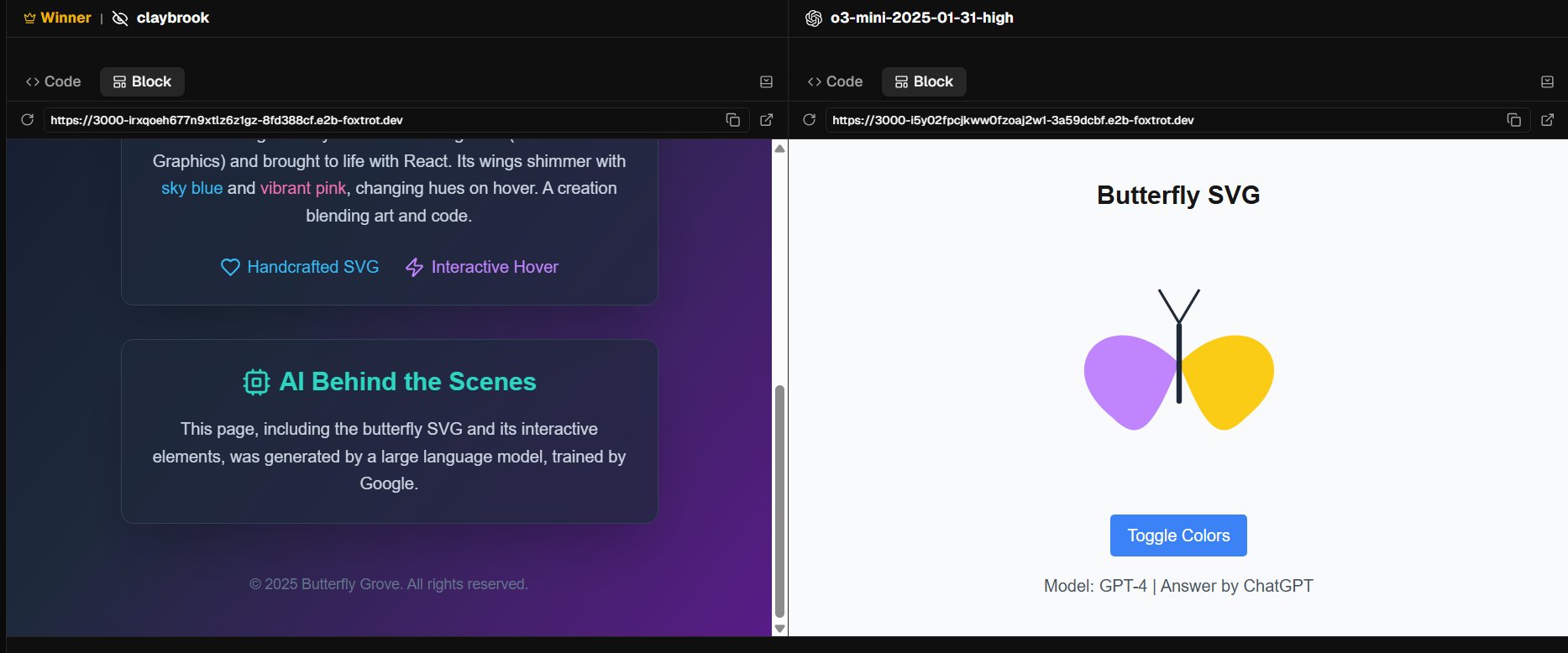

Claybrook Ai Googles New Tool For Faster Smarter Web Development

May 01, 2025

Claybrook Ai Googles New Tool For Faster Smarter Web Development

May 01, 2025 -

Dyson Fan Showdown Comparing Features And Prices To Find Your Perfect Fit

May 01, 2025

Dyson Fan Showdown Comparing Features And Prices To Find Your Perfect Fit

May 01, 2025