Crypto Taxation: The 2014 Code Needs A Major Overhaul.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Crypto Taxation: The 2014 Code Needs a Major Overhaul</h1>

The explosive growth of the cryptocurrency market has left tax laws, particularly those based on the outdated 2014 IRS guidance, woefully inadequate. This mismatch between rapidly evolving technology and stagnant legislation is causing confusion, frustration, and significant compliance challenges for millions of cryptocurrency investors and businesses. It's time for a major overhaul.

<h2>The 2014 Guidance: A Relic of the Past</h2>

The IRS first addressed cryptocurrency taxation in 2014, treating digital assets as property. While this provided a starting point, the guidance failed to anticipate the complexities of decentralized finance (DeFi), staking, NFTs, and other innovative applications that have since emerged. The lack of clarity surrounding these new developments leads to inconsistent interpretations and potential for significant tax liabilities that are difficult to calculate accurately.

<h3>Key Issues with the Current System:</h3>

- Ambiguous definitions: The 2014 guidance lacks precise definitions for crucial terms like "forking," "airdrops," and "hard forks," leaving taxpayers unsure how to report these events for tax purposes.

- Complex calculations: Tracking the cost basis of cryptocurrency transactions across multiple exchanges and wallets can be incredibly challenging, especially for those engaging in frequent trading or DeFi activities. This complexity often leads to unintentional errors and potential penalties.

- Lack of guidance on specific crypto activities: The IRS has yet to provide comprehensive guidance on the taxation of staking rewards, lending, borrowing, and the sale of NFTs, leaving taxpayers to navigate these issues with limited clarity.

- International inconsistencies: The global nature of cryptocurrency presents further challenges, with varying tax regulations across jurisdictions causing difficulties for international investors.

<h2>The Urgent Need for Reform</h2>

The current tax framework is not only confusing but also potentially unfair. Many taxpayers lack the resources to navigate the complexities of cryptocurrency taxation, leading to underreporting or incorrect reporting. This, in turn, creates an uneven playing field and undermines the fairness of the tax system.

<h3>Proposed Solutions for Reform:</h3>

- Clearer definitions and guidelines: The IRS needs to update its guidance to provide clear definitions for all relevant cryptocurrency activities, including DeFi protocols, NFTs, and staking.

- Simplified reporting mechanisms: Streamlining the reporting process, perhaps through the use of automated tax software that integrates with cryptocurrency exchanges and wallets, could significantly reduce the burden on taxpayers.

- Improved education and resources: The IRS should invest in educational resources to help taxpayers understand their obligations and comply with the law.

- Collaboration with industry stakeholders: Working with cryptocurrency exchanges, blockchain developers, and tax professionals would ensure that any new legislation is practical and effective.

<h2>The Future of Crypto Taxation</h2>

The cryptocurrency market is here to stay. To ensure a fair and efficient tax system, a comprehensive overhaul of the 2014 guidance is not just necessary – it's essential. Failing to address these issues will only lead to increased non-compliance, legal challenges, and lost revenue for governments. Proactive legislative action is crucial to foster responsible innovation and growth in the cryptocurrency sector. The time for a modern, comprehensive, and clear crypto tax code is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation: The 2014 Code Needs A Major Overhaul.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mars Maps And Their Makers A History Of Scientific Rivalry And Planetary Exploration

May 03, 2025

Mars Maps And Their Makers A History Of Scientific Rivalry And Planetary Exploration

May 03, 2025 -

O Custo Das Greves Como As Paralisacoes No Setor Publico Afetam A Economia

May 03, 2025

O Custo Das Greves Como As Paralisacoes No Setor Publico Afetam A Economia

May 03, 2025 -

Algorand Algo Price Consolidation Bulls Aim For 0 30

May 03, 2025

Algorand Algo Price Consolidation Bulls Aim For 0 30

May 03, 2025 -

Trumpet Of Patriots Candidate Ubiquitous Presence Unknown Identity

May 03, 2025

Trumpet Of Patriots Candidate Ubiquitous Presence Unknown Identity

May 03, 2025 -

Stablecoins A New Avenue For Banks To Enhance Liquidity And Deposits

May 03, 2025

Stablecoins A New Avenue For Banks To Enhance Liquidity And Deposits

May 03, 2025

Latest Posts

-

Balancing Innovation And Security The Challenges Of Ai And Key Access In Web3

May 03, 2025

Balancing Innovation And Security The Challenges Of Ai And Key Access In Web3

May 03, 2025 -

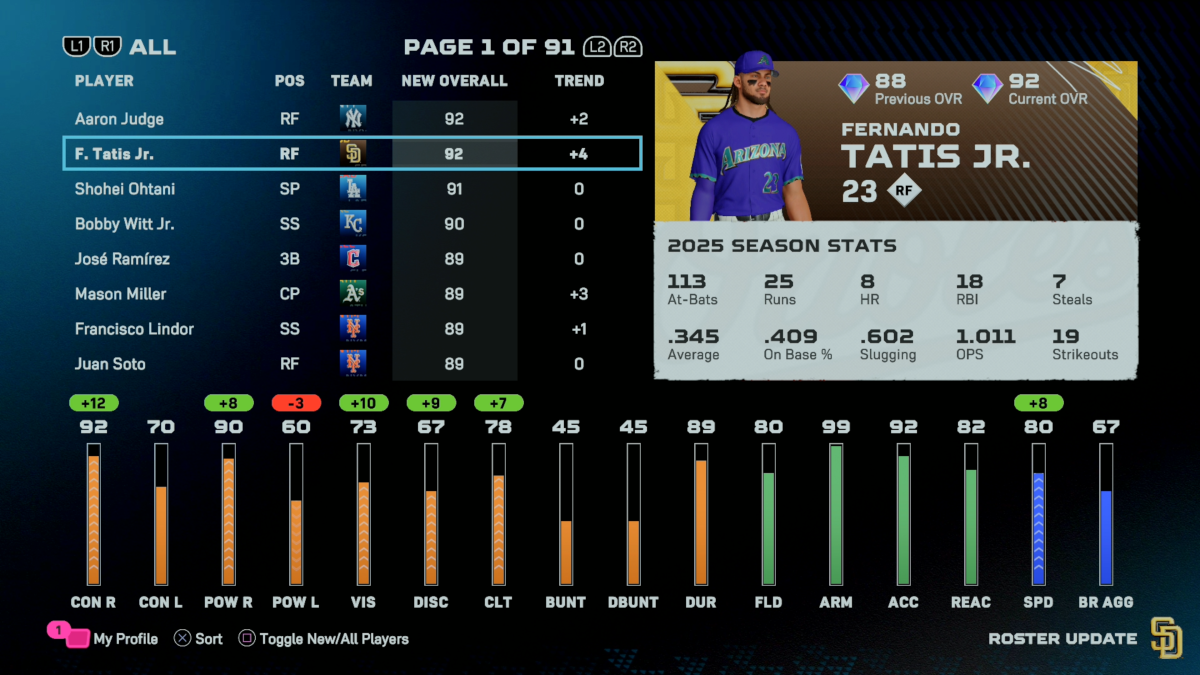

Mlb The Show 25 Fernando Tatis Jr Dominates Diamond Dynasty Ratings

May 03, 2025

Mlb The Show 25 Fernando Tatis Jr Dominates Diamond Dynasty Ratings

May 03, 2025 -

Microsofts Azure To Power Elon Musks Grok Ai Details Of The Partnership Revealed

May 03, 2025

Microsofts Azure To Power Elon Musks Grok Ai Details Of The Partnership Revealed

May 03, 2025 -

Mlb The Show 25 Diamond Dynasty Impact Of Tatis Jr S Rating Increase

May 03, 2025

Mlb The Show 25 Diamond Dynasty Impact Of Tatis Jr S Rating Increase

May 03, 2025 -

Social Media Frenzy Oklahomas Sec Title Victory Sparks Debate

May 03, 2025

Social Media Frenzy Oklahomas Sec Title Victory Sparks Debate

May 03, 2025