Crypto Taxation: The 2014 Code Needs A Modern Overhaul.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation: The 2014 Code Needs a Modern Overhaul

The explosive growth of cryptocurrency has left the existing tax framework, largely unchanged since 2014, struggling to keep pace. This outdated system, designed for traditional assets, creates confusion, inconsistencies, and significant challenges for both taxpayers and tax authorities alike. It's time for a comprehensive overhaul of cryptocurrency taxation.

The current system, based on Internal Revenue Service (IRS) Notice 2014-21, treats cryptocurrencies like property. This means every transaction, from buying Bitcoin to using it for a cup of coffee, is considered a taxable event. While seemingly straightforward, the practical implications are complex and often lead to unintended consequences. Let's delve into the key problems and explore potential solutions.

The Challenges of the 2014 Tax Code for Crypto:

-

Complex Calculations: Tracking every cryptocurrency transaction, including staking rewards, airdrops, and DeFi yields, is a Herculean task for many individuals. Calculating capital gains and losses across numerous wallets and exchanges becomes incredibly intricate, often requiring specialized software and potentially leading to errors.

-

Lack of Clarity on DeFi: The decentralized finance (DeFi) revolution introduces a whole new level of complexity. Staking, lending, and yield farming generate taxable income, but the precise tax implications of these activities remain unclear in many jurisdictions, leading to uncertainty and potential non-compliance.

-

Cross-border Transactions: The global nature of cryptocurrency transactions complicates matters further. Determining the correct tax jurisdiction for international transactions can be extremely difficult, particularly for individuals involved in cross-border DeFi activities.

-

NFT Taxation: Non-fungible tokens (NFTs) present unique tax challenges. Are they collectibles, artwork, or something else entirely? The lack of clear guidance on NFT taxation leaves many investors unsure how to properly report their gains and losses.

-

Enforcement Difficulties: The IRS faces significant challenges in enforcing cryptocurrency tax laws. Tracking anonymous transactions and ensuring compliance across a global, decentralized network remains a substantial hurdle.

The Need for a Modernized Approach:

The current system is inadequate for the dynamic nature of the crypto market. A modernized approach is crucial, one that considers the unique characteristics of cryptocurrencies and addresses the challenges outlined above. Here's what a potential overhaul might entail:

-

Simplified Reporting Mechanisms: The introduction of streamlined reporting systems, potentially incorporating data directly from exchanges and wallets, could significantly reduce the burden on taxpayers.

-

Clearer DeFi Guidelines: The IRS needs to provide clear and comprehensive guidance on the tax implications of various DeFi activities, including staking, lending, and yield farming.

-

International Cooperation: Collaboration between tax authorities worldwide is essential to effectively address cross-border cryptocurrency transactions.

-

Specific NFT Tax Rules: Clearer and more specific regulations are needed regarding the taxation of NFTs, addressing their unique characteristics as digital assets.

-

Increased Educational Resources: Improved educational resources and taxpayer assistance programs can help individuals better understand their cryptocurrency tax obligations.

Conclusion:

The current cryptocurrency tax framework is severely outdated and needs a fundamental overhaul. The lack of clarity, coupled with the complexities inherent in the crypto market, creates an unsustainable situation for taxpayers and tax authorities alike. A modernized approach that embraces technology, clarifies regulations, and promotes international cooperation is essential to ensure fair and efficient taxation of cryptocurrencies in the years to come. This will not only promote compliance but also foster responsible growth and innovation within the cryptocurrency ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation: The 2014 Code Needs A Modern Overhaul.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

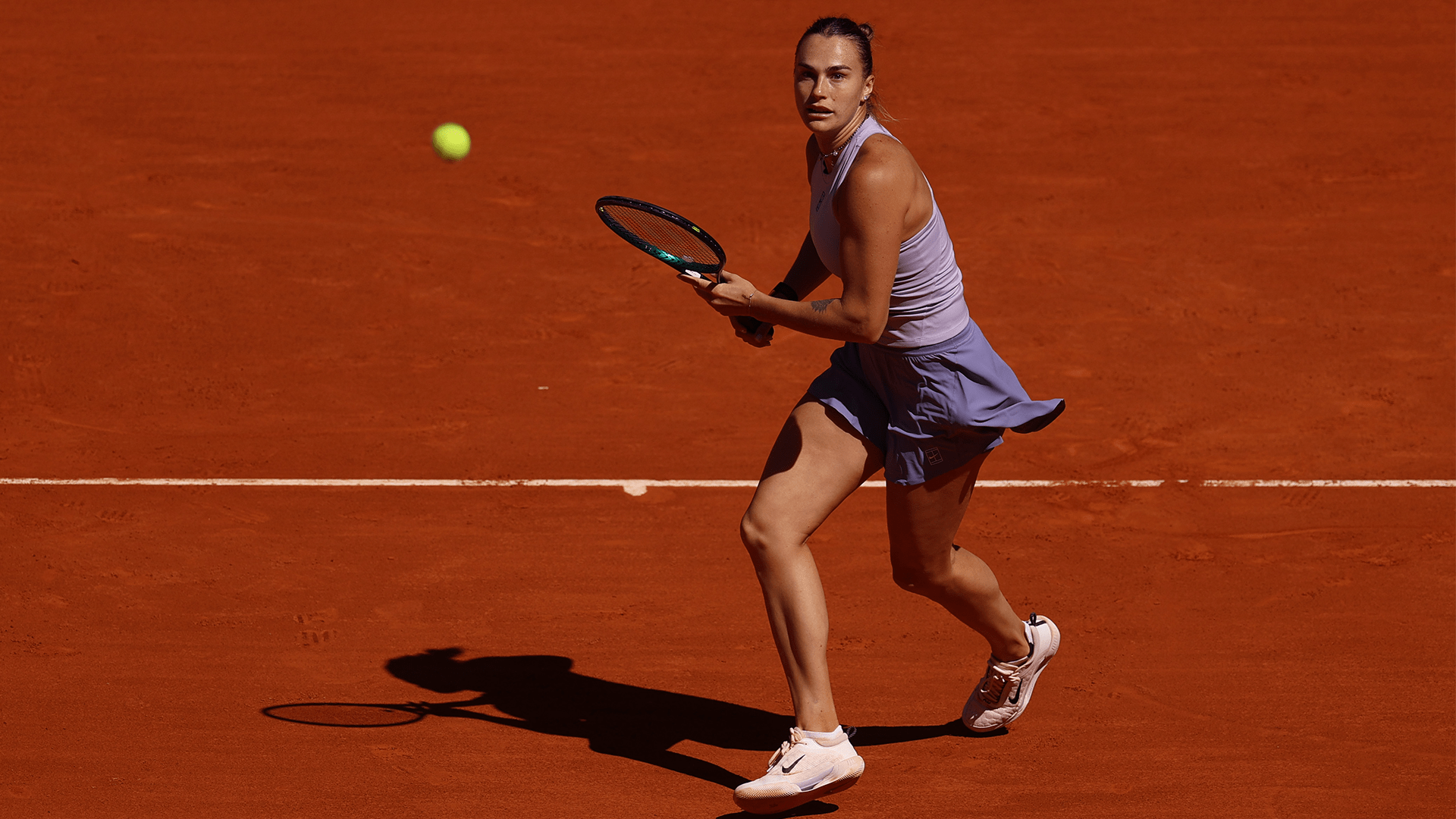

How To Watch Aryna Sabalenka Vs Peyton Stearns At The Madrid Open

May 01, 2025

How To Watch Aryna Sabalenka Vs Peyton Stearns At The Madrid Open

May 01, 2025 -

Top 3 Rotten Tomatoes Certified Fresh Films Streaming Now On Prime Video

May 01, 2025

Top 3 Rotten Tomatoes Certified Fresh Films Streaming Now On Prime Video

May 01, 2025 -

Fearnley Withdraws From Madrid Open After Power Outage Disruption

May 01, 2025

Fearnley Withdraws From Madrid Open After Power Outage Disruption

May 01, 2025 -

Suspect A Powerful Review Of The De Menezes Shooting Tragedy

May 01, 2025

Suspect A Powerful Review Of The De Menezes Shooting Tragedy

May 01, 2025 -

Wsl Arsenal Stumbles Against Aston Villa Paving The Way For Chelseas Potential Triumph

May 01, 2025

Wsl Arsenal Stumbles Against Aston Villa Paving The Way For Chelseas Potential Triumph

May 01, 2025