Crypto Taxation: The Gap Between Innovation And Regulation.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation: The Gap Between Innovation and Regulation

The meteoric rise of cryptocurrency has created a complex regulatory landscape, leaving governments scrambling to catch up with the rapid pace of technological innovation. The resulting gap between the dynamism of the crypto market and the often-static nature of tax laws is causing significant challenges for both taxpayers and tax authorities worldwide. This article explores the key issues surrounding crypto taxation and the ongoing struggle to find a balanced and effective solution.

The Complexity of Crypto Transactions:

Unlike traditional assets, cryptocurrencies operate on decentralized, blockchain-based systems. This decentralized nature presents unique challenges for tax authorities attempting to track transactions and enforce tax laws. The anonymity offered by some cryptocurrencies further complicates matters, making it difficult to identify taxpayers and monitor their activities. This lack of transparency fuels concerns about tax evasion and money laundering, leading to calls for stricter regulations.

Global Variations in Crypto Tax Laws:

The regulatory landscape surrounding crypto taxation varies significantly across countries. Some nations have embraced a relatively lax approach, while others have implemented strict rules and heavy penalties for non-compliance. This inconsistency creates complexities for international investors and businesses operating in the crypto space. For example, some countries treat cryptocurrency as property, while others classify it as a currency or a security, leading to vastly different tax implications. This lack of harmonization poses a significant hurdle for global crypto adoption and investment.

Key Challenges for Tax Authorities:

Tax authorities face a number of significant challenges in effectively taxing cryptocurrency transactions:

- Tracking Transactions: The decentralized and pseudonymous nature of blockchain technology makes it difficult to monitor transactions effectively.

- Valuing Crypto Assets: Determining the fair market value of cryptocurrencies can be challenging due to their volatile nature and lack of standardized valuation methods.

- Enforcement: Enforcing tax laws in the decentralized crypto space requires sophisticated technology and international cooperation.

- Defining Crypto Assets: Classifying different types of crypto assets (e.g., Bitcoin, NFTs, stablecoins) and applying appropriate tax rules is a complex task.

The Need for Clearer Regulations:

Many experts advocate for clearer, more consistent, and internationally harmonized regulations to address the challenges surrounding crypto taxation. This would not only simplify compliance for taxpayers but also enhance the integrity of the crypto market and reduce the potential for illicit activities. Clear guidelines on issues such as:

- Capital Gains Tax: Determining the taxable event (e.g., sale, trade, staking) and the appropriate tax rate.

- Tax Reporting: Establishing clear requirements for reporting crypto transactions to tax authorities.

- Cross-border Transactions: Addressing the complexities of taxing crypto transactions that cross international borders.

are crucial for a functioning regulatory framework.

The Future of Crypto Taxation:

The future of crypto taxation likely involves a blend of technological innovation and regulatory adaptation. Governments are increasingly exploring the use of blockchain analytics and artificial intelligence to improve transaction tracking and enforcement. International cooperation will also be crucial in harmonizing tax rules and preventing tax avoidance. Finding the right balance between fostering innovation and ensuring tax compliance is a key challenge that will require ongoing dialogue and collaboration between governments, industry players, and tax professionals. The ongoing evolution of crypto technology demands a similarly agile and adaptable regulatory response. Ignoring the challenge only risks exacerbating the gap between innovation and regulation, ultimately hindering the healthy growth of this transformative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation: The Gap Between Innovation And Regulation.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ter Stegens Comeback Flicks Change Of Heart Shakes Up Bayerns Champions League Plans

May 04, 2025

Ter Stegens Comeback Flicks Change Of Heart Shakes Up Bayerns Champions League Plans

May 04, 2025 -

Coaching Changes And Key Players Examining The Denver Nuggets Adelman Jokic Porter Westbrook And Murray

May 04, 2025

Coaching Changes And Key Players Examining The Denver Nuggets Adelman Jokic Porter Westbrook And Murray

May 04, 2025 -

Password Manager Showdown Google Dominates In Tech Radar Pro Reader Poll

May 04, 2025

Password Manager Showdown Google Dominates In Tech Radar Pro Reader Poll

May 04, 2025 -

Mc Carthy Sanders And Aoc Frontrunners For 2028 Presidential Race

May 04, 2025

Mc Carthy Sanders And Aoc Frontrunners For 2028 Presidential Race

May 04, 2025 -

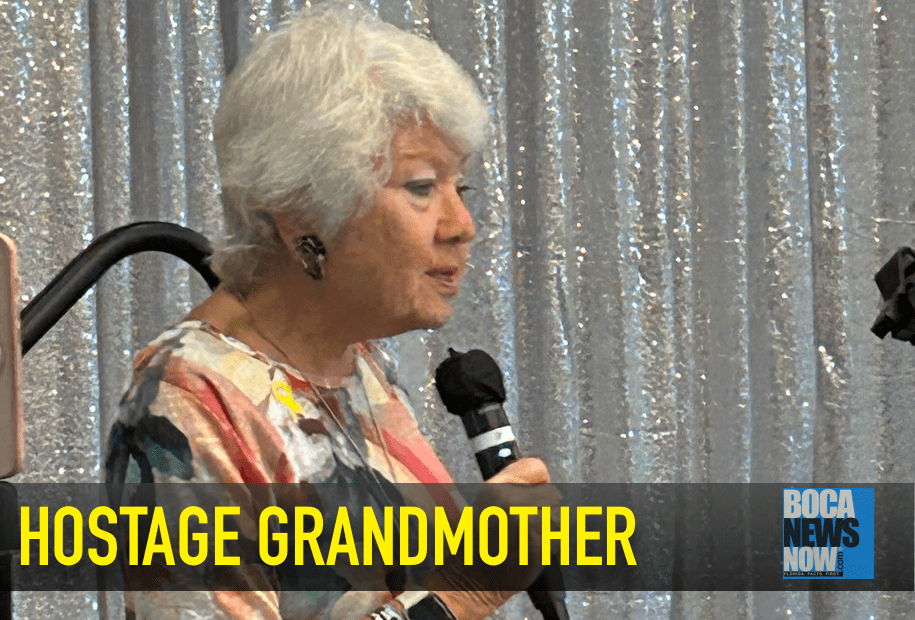

Emotional Plea Grandmother Of Slain Israeli Speaks In Delray Beach

May 04, 2025

Emotional Plea Grandmother Of Slain Israeli Speaks In Delray Beach

May 04, 2025