Crypto Taxation: The Need For Modern Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation: The Need for Modern Regulations

The explosive growth of the cryptocurrency market has left governments worldwide scrambling to catch up with its implications, particularly regarding taxation. The lack of clear and consistent crypto taxation regulations creates uncertainty for investors, hinders market growth, and presents significant challenges for tax authorities. It's time for a modern approach to crypto taxation that balances innovation with responsible financial oversight.

The Current Regulatory Landscape: A Patchwork of Approaches

Currently, the regulatory landscape for cryptocurrency taxation is a fragmented mess. Different countries have adopted wildly varying approaches, leading to confusion and complexities for both individuals and businesses involved in crypto transactions. Some jurisdictions treat cryptocurrency as property, subject to capital gains tax, while others classify it as a currency or a commodity, leading to different tax implications. This lack of harmonization creates significant challenges for international investors and businesses operating across borders.

Challenges Posed by the Decentralized Nature of Crypto

The decentralized nature of cryptocurrencies poses unique challenges for tax authorities. Unlike traditional financial transactions, which are typically recorded and reported through centralized institutions, cryptocurrency transactions occur on public blockchains, which are transparent but require sophisticated tracking methods. The anonymity afforded by some cryptocurrencies further complicates the task of tax enforcement. Authorities struggle with:

- Tracking transactions: Identifying and tracking crypto transactions across various exchanges and wallets.

- Valuing crypto assets: Determining the fair market value of cryptocurrencies, which can be highly volatile.

- Enforcing tax compliance: Collecting taxes from individuals and businesses who may deliberately try to avoid paying their dues.

The Need for Clear and Consistent Regulations

The absence of clear and consistent regulations creates several negative consequences:

- Increased tax evasion: The complexity of crypto taxation makes it easier for individuals and businesses to evade taxes.

- Market uncertainty: The lack of clear rules discourages investment and hinders the growth of the crypto market.

- Loss of revenue for governments: Governments lose significant tax revenue due to inadequate regulation and enforcement.

Towards a Modern Regulatory Framework

To address these issues, a modern regulatory framework for crypto taxation should:

- Establish clear definitions: Clearly define cryptocurrencies and their treatment for tax purposes.

- Simplify reporting requirements: Develop user-friendly systems for reporting crypto transactions.

- Improve international cooperation: Foster collaboration between tax authorities worldwide to enhance information sharing and enforcement.

- Embrace technological solutions: Utilize blockchain analytics and other technologies to improve tracking and monitoring of crypto transactions.

- Promote education and awareness: Educate taxpayers about their obligations related to crypto taxation.

The Future of Crypto Taxation

The future of crypto taxation hinges on the ability of governments to adapt to the rapidly evolving landscape of digital assets. This requires a shift from reactive to proactive regulation, leveraging technological advancements to ensure fair and effective tax collection while fostering innovation within the crypto ecosystem. A global consensus on clear guidelines is crucial to unlock the full potential of this transformative technology while mitigating risks and ensuring responsible financial practices. The longer we wait for comprehensive regulations, the greater the risk of hindering growth and losing valuable tax revenue. The need for modern, adaptable, and internationally harmonized crypto tax laws is not simply desirable – it’s essential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation: The Need For Modern Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live Game Indiana Pacers Vs Cleveland Cavaliers Updates Stats And More

May 05, 2025

Live Game Indiana Pacers Vs Cleveland Cavaliers Updates Stats And More

May 05, 2025 -

Lecce Enrico Galiano E La Sua Lezione Sulla Speranza Nonostante Gli Errori

May 05, 2025

Lecce Enrico Galiano E La Sua Lezione Sulla Speranza Nonostante Gli Errori

May 05, 2025 -

Check Before You Go Full List Of May Day Bank Holiday Supermarket Hours

May 05, 2025

Check Before You Go Full List Of May Day Bank Holiday Supermarket Hours

May 05, 2025 -

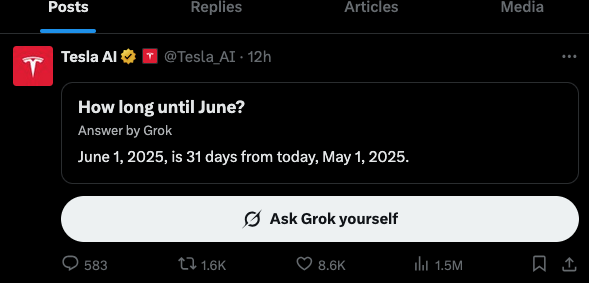

Teslas Autonomous Vehicle Plans Austin Robotaxi Launch In June 2025

May 05, 2025

Teslas Autonomous Vehicle Plans Austin Robotaxi Launch In June 2025

May 05, 2025 -

Revised Opening Hours For Aldi Stores Over The Early May Bank Holiday Weekend

May 05, 2025

Revised Opening Hours For Aldi Stores Over The Early May Bank Holiday Weekend

May 05, 2025