Cryptocurrency Investment Strategies: Lessons From Warren Buffett

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency Investment Strategies: Lessons from Warren Buffett (Even Though He Hates Crypto)

The world of cryptocurrency is volatile, unpredictable, and often baffling. While legendary investor Warren Buffett famously dislikes Bitcoin and other cryptocurrencies, his core investment philosophies offer surprisingly valuable lessons for navigating this turbulent digital landscape. Even if the Oracle of Omaha wouldn't touch crypto with a ten-foot pole, understanding his principles can help you make smarter, safer decisions in the crypto market.

H2: Understanding Buffett's Core Principles

Before diving into how Buffett's wisdom applies to crypto, let's recap his key investment strategies:

- Value Investing: Buffett focuses on identifying undervalued assets with strong fundamentals and long-term growth potential. He looks for companies with proven track records and sustainable competitive advantages.

- Long-Term Perspective: He's a patient investor, holding assets for years, even decades, riding out market fluctuations to reap long-term gains. Short-term market noise doesn't sway his decisions.

- Risk Management: Buffett emphasizes disciplined risk management, meticulously assessing potential downsides before investing. He famously avoids speculative investments with high uncertainty.

- Understanding the Business: He thoroughly researches companies before investing, understanding their business models, competitive landscape, and management teams.

H2: Applying Buffett's Wisdom to Cryptocurrency

While Buffett's aversion to crypto is well-documented, his principles can still be applied, albeit with adaptation:

H3: Value Investing in Crypto:

Finding "undervalued" cryptocurrencies requires a different approach than traditional value investing. Instead of focusing on balance sheets and earnings, consider factors like:

- Technology & Adoption: Look for projects with innovative underlying technology and growing adoption rates. A strong community and developer ecosystem are crucial indicators.

- Use Case: Cryptocurrencies with clear use cases beyond speculation (like DeFi platforms or stablecoins) might offer more long-term value.

- Market Capitalization: While not a perfect metric, market cap provides a relative measure of a cryptocurrency's size and potential. Be wary of extremely low market cap projects, as they are often highly volatile.

H3: Long-Term Perspective in Crypto:

The cryptocurrency market is notorious for its wild swings. Buffett's long-term perspective is vital here. Only invest what you can afford to lose and be prepared to hold for an extended period, weathering inevitable dips. Dollar-cost averaging (DCA) is a strategy aligned with this approach, spreading your investment over time to reduce risk.

H3: Risk Management in Crypto:

Cryptocurrency is inherently risky. Diversification across multiple cryptocurrencies and asset classes is crucial for risk mitigation. Never invest more than you can comfortably afford to lose. Consider using secure hardware wallets and strong passwords to protect your investments.

H3: Understanding the Technology (Not Just the Price):

Buffett’s emphasis on understanding the underlying business translates to understanding the blockchain technology, the project's whitepaper, and the team behind it. Don't solely focus on price charts; research the technology and its potential.

H2: Conclusion: A Cautious Approach

While Warren Buffett’s investment strategy doesn’t directly endorse cryptocurrency, adapting his core principles – value investing, long-term vision, risk management, and thorough research – provides a framework for navigating the complex world of crypto. Remember, cryptocurrency investment involves significant risk, and it's crucial to approach it with caution and a well-defined strategy. Never invest more than you can afford to lose and always conduct thorough due diligence before committing your funds. The crypto market is a high-stakes game, and even the wisest investors can’t guarantee success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency Investment Strategies: Lessons From Warren Buffett. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vinicius Jr Ronaldinho Congratulate Shai Gilgeous Alexander On Mvp Award

May 23, 2025

Vinicius Jr Ronaldinho Congratulate Shai Gilgeous Alexander On Mvp Award

May 23, 2025 -

Nationwide Milk Recall Lethal Bacteria Found Consumers Urged To Check Products

May 23, 2025

Nationwide Milk Recall Lethal Bacteria Found Consumers Urged To Check Products

May 23, 2025 -

Kentucky Lottery Winner Shares How 150 000 Scratch Off Changed Their Life

May 23, 2025

Kentucky Lottery Winner Shares How 150 000 Scratch Off Changed Their Life

May 23, 2025 -

Arsenals Shock Bid Gunners Enter Rodrygo Transfer Race With Chelsea

May 23, 2025

Arsenals Shock Bid Gunners Enter Rodrygo Transfer Race With Chelsea

May 23, 2025 -

This Obscure Dating Show Is The New Love Island Tik Tok Cant Get Enough

May 23, 2025

This Obscure Dating Show Is The New Love Island Tik Tok Cant Get Enough

May 23, 2025

Latest Posts

-

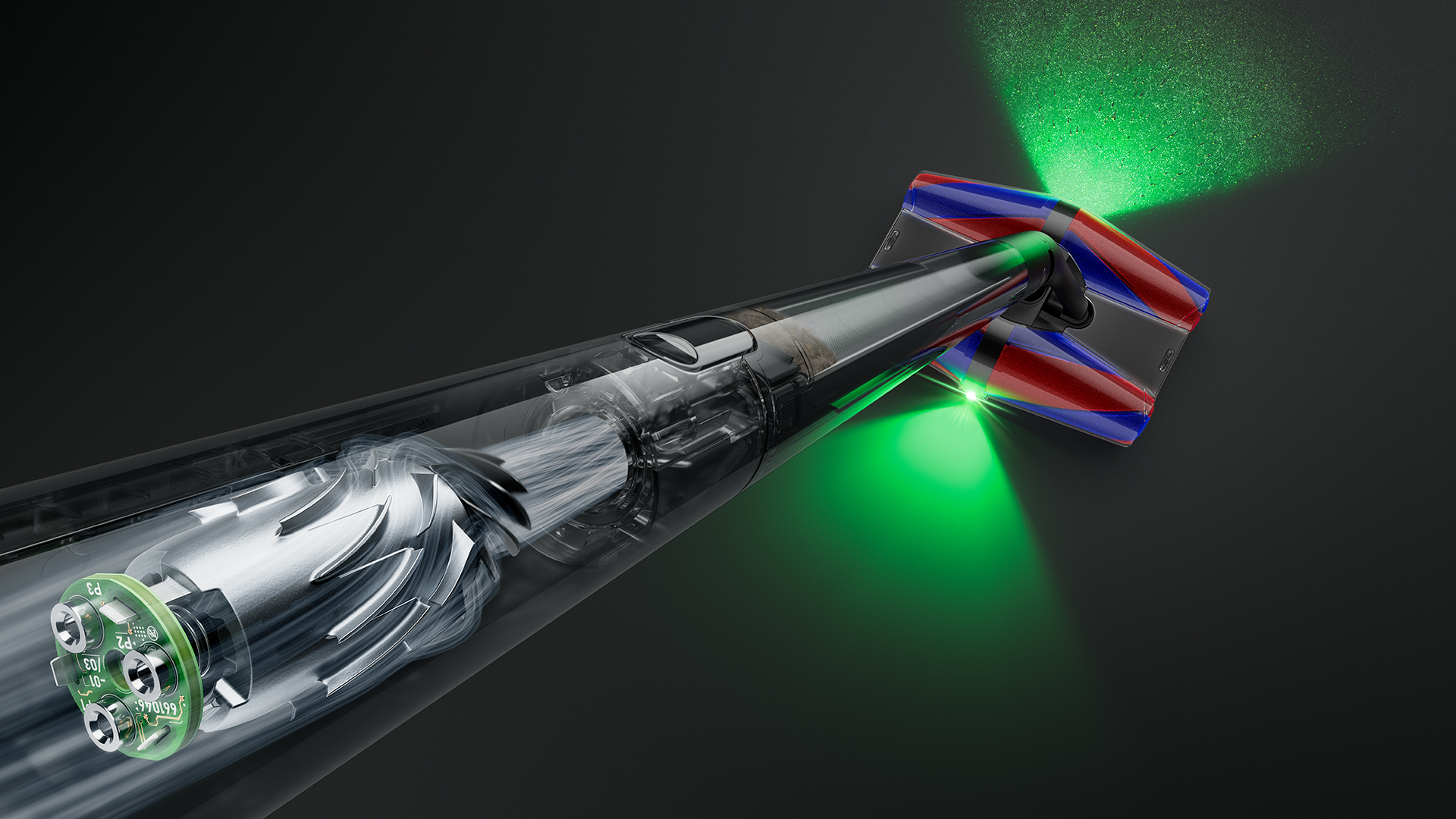

Dysons Game Changing Vacuum As Thin As A Broom Powerful Performance

May 24, 2025

Dysons Game Changing Vacuum As Thin As A Broom Powerful Performance

May 24, 2025 -

Moto Gp Silverstone Key Highlights And Race Results

May 24, 2025

Moto Gp Silverstone Key Highlights And Race Results

May 24, 2025 -

Trump Price Jumps 12 Whales Accumulate Before Key Event

May 24, 2025

Trump Price Jumps 12 Whales Accumulate Before Key Event

May 24, 2025 -

Fact Check Piyush Gupta Clarifies Authenticity Of Circulating Linked In Meeting Image

May 24, 2025

Fact Check Piyush Gupta Clarifies Authenticity Of Circulating Linked In Meeting Image

May 24, 2025 -

Polar Bears And Tortoises Hayley Atwell Shares How Nature Interrupted Mission Impossible

May 24, 2025

Polar Bears And Tortoises Hayley Atwell Shares How Nature Interrupted Mission Impossible

May 24, 2025