Cryptocurrency's Evolution Outpaces Antiquated Tax Legislation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency's Evolution Outpaces Antiquated Tax Legislation: A Growing Gap

The meteoric rise of cryptocurrencies has left tax laws struggling to keep pace. While Bitcoin and other digital assets continue to evolve at a breakneck speed, introducing new tokens, DeFi protocols, and NFTs, tax legislation remains largely stuck in the past, creating confusion and uncertainty for both taxpayers and tax authorities. This growing gap between technological innovation and outdated legal frameworks is a major challenge that needs urgent attention.

The Problem: A Mismatch Between Technology and Law

The core issue is the inherent mismatch between the dynamic nature of the cryptocurrency market and the relatively static nature of tax laws. Existing tax codes, designed for traditional financial assets, often fail to adequately address the unique characteristics of cryptocurrencies. This leads to several key problems:

- Difficulty in Valuation: Determining the fair market value of cryptocurrencies at the time of transaction can be complex. The volatile nature of crypto prices makes accurate valuation challenging, leading to potential discrepancies in tax calculations.

- Classifying Crypto Transactions: Are crypto transactions considered investments, bartering, or something else entirely? This lack of clear classification creates ambiguity and increases the risk of misreporting.

- Tracking and Reporting: The decentralized and pseudonymous nature of many crypto transactions makes tracking and reporting them significantly more difficult than traditional financial activities. This poses a challenge for both taxpayers and tax agencies.

- Stagnant Legislation: Many countries are still grappling with how to best regulate cryptocurrencies, resulting in inconsistent and often inadequate tax laws. The regulatory landscape is constantly shifting, leaving taxpayers uncertain about their obligations.

- The DeFi Conundrum: The emergence of decentralized finance (DeFi) adds another layer of complexity. The automated nature of DeFi transactions and the use of smart contracts make tracking and taxing these activities even more challenging. NFTs, another rapidly developing sector, also present unique tax implications.

The Consequences of Outdated Legislation:

The lack of clear and comprehensive tax laws surrounding cryptocurrencies has several significant consequences:

- Increased Tax Compliance Burden: Taxpayers face a considerable burden in trying to navigate the complexities of crypto taxation, often needing specialized advice.

- Potential for Tax Evasion: The ambiguity surrounding crypto taxation creates opportunities for tax evasion, undermining the fairness and efficiency of the tax system.

- Reduced Investment: Uncertainty around tax implications can deter investors from participating in the cryptocurrency market.

- Regulatory Arbitrage: The lack of harmonized global regulations creates opportunities for regulatory arbitrage, potentially leading to unfair competitive advantages for certain jurisdictions.

The Need for Modernization:

To address these challenges, a significant overhaul of tax legislation is urgently needed. This requires:

- Clearer Definitions: Tax codes need to provide clear definitions of cryptocurrencies and related activities, establishing a consistent framework for taxation.

- Improved Tracking Mechanisms: Governments need to explore innovative ways to track and monitor cryptocurrency transactions, while respecting privacy concerns.

- International Cooperation: Global collaboration is crucial to establish harmonized tax regulations for cryptocurrencies, preventing regulatory arbitrage and ensuring a level playing field.

- Education and Awareness: Efforts are needed to educate both taxpayers and tax professionals about the complexities of cryptocurrency taxation.

The Future of Crypto Taxation:

The evolution of cryptocurrency technology will continue to outpace existing legal frameworks unless significant action is taken. Governments must prioritize the modernization of tax laws to create a clear, fair, and efficient regulatory environment for this rapidly growing asset class. Failure to do so risks hindering innovation, undermining tax compliance, and perpetuating uncertainty in the market. The time for action is now. The future of cryptocurrency taxation hinges on the ability of governments to adapt and innovate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency's Evolution Outpaces Antiquated Tax Legislation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Navigating A Crisis Why Honesty Is Crucial For Effective Communication

May 02, 2025

Navigating A Crisis Why Honesty Is Crucial For Effective Communication

May 02, 2025 -

Jet Zero And Delta A Partnership Redefining Airline Service Excellence

May 02, 2025

Jet Zero And Delta A Partnership Redefining Airline Service Excellence

May 02, 2025 -

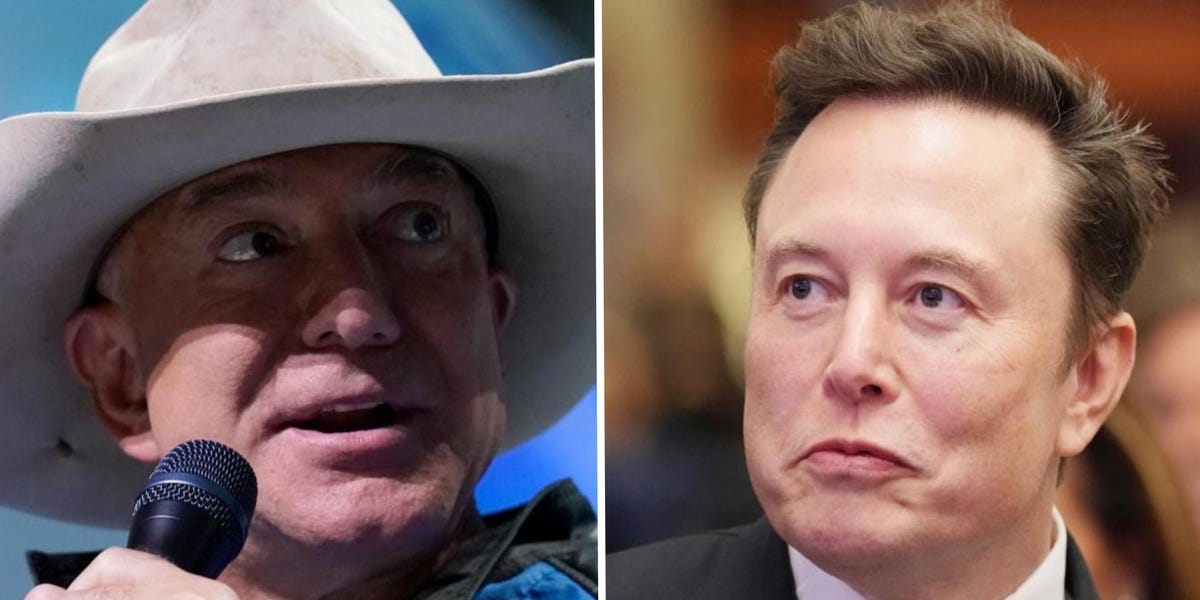

Amazons Satellite Push Reducing Reliance On Elon Musks Space X

May 02, 2025

Amazons Satellite Push Reducing Reliance On Elon Musks Space X

May 02, 2025 -

Michael Block Qualifies For Pga Championship Quail Hollow Story

May 02, 2025

Michael Block Qualifies For Pga Championship Quail Hollow Story

May 02, 2025 -

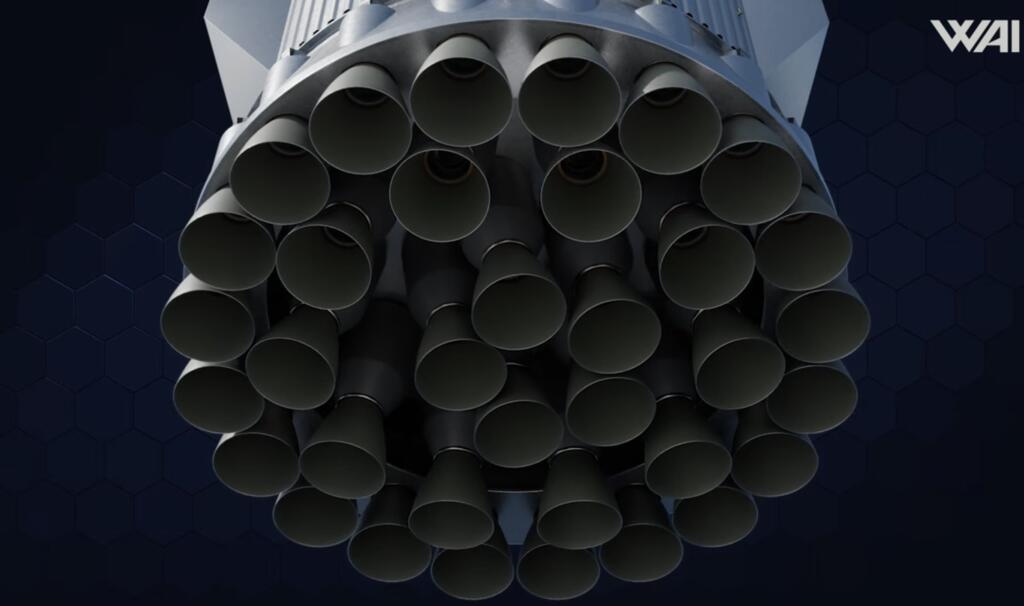

Space X Unveils Starship Booster With 35 Raptor 3 Engines Increased Thrust And Capacity

May 02, 2025

Space X Unveils Starship Booster With 35 Raptor 3 Engines Increased Thrust And Capacity

May 02, 2025