Cryptocurrency's Maturation: Tax Laws Lagging Behind

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency's Maturation: Tax Laws Lagging Dangerously Behind

The cryptocurrency market has exploded in recent years, transitioning from a niche interest to a multi-billion dollar global phenomenon. Yet, despite its widespread adoption and increasing mainstream acceptance, tax laws surrounding digital assets remain stubbornly outdated and inconsistent, creating a minefield for both investors and governments alike. This regulatory lag poses significant challenges for the future of crypto and necessitates urgent action from lawmakers worldwide.

The Growing Pains of a Nascent Asset Class

The rapid evolution of cryptocurrencies – from Bitcoin's inception to the proliferation of thousands of altcoins, NFTs, and DeFi projects – has outpaced the ability of governments to create comprehensive and effective tax frameworks. This disparity creates several key problems:

- Lack of Clarity: The inconsistent application of existing tax laws to crypto transactions leaves individuals and businesses uncertain about their tax obligations. Is cryptocurrency considered property, currency, or something else entirely? The answer varies drastically depending on jurisdiction.

- Reporting Complexity: Tracking cryptocurrency transactions can be incredibly complex, especially for those involved in frequent trading or holding multiple assets. Current tax systems are often ill-equipped to handle the decentralized and transparent nature of blockchain technology.

- Enforcement Challenges: The pseudonymous nature of some crypto transactions makes it difficult for tax authorities to monitor and enforce regulations effectively. This lack of oversight can lead to widespread tax evasion and a loss of significant government revenue.

- International Inconsistencies: The global nature of cryptocurrency transactions necessitates international cooperation on tax policy. However, the lack of harmonized regulations creates opportunities for tax arbitrage and hinders cross-border investment.

The Urgent Need for Modernized Tax Legislation

The current situation is unsustainable. The lack of clear and consistent tax rules undermines investor confidence, stifles innovation, and creates unfair competitive advantages for those willing to ignore regulations. Governments need to:

- Develop comprehensive tax legislation: This legislation should clearly define how various crypto assets are taxed, addressing specific issues like staking rewards, airdrops, and decentralized finance (DeFi) activities.

- Invest in technological infrastructure: Tax agencies need to upgrade their systems to effectively process and analyze cryptocurrency transaction data. This may involve partnerships with blockchain analytics firms and the adoption of new technologies.

- Promote international cooperation: Harmonizing international tax policies is crucial to prevent regulatory arbitrage and foster a more stable global crypto market.

- Provide educational resources: Clear and accessible resources are needed to help individuals and businesses understand their tax obligations concerning cryptocurrencies.

Looking Ahead: Navigating the Regulatory Landscape

The maturation of the cryptocurrency market is inevitable. However, its continued growth and integration into the mainstream financial system depend on the timely development and implementation of appropriate tax laws. Failure to address this regulatory gap risks hindering innovation, creating economic instability, and undermining the long-term potential of this transformative technology. The time for decisive action is now. Ignoring the issue will only exacerbate the problems and create even greater challenges in the future. The future of finance, and indeed taxation itself, depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency's Maturation: Tax Laws Lagging Behind. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros 2024 Venus Williams Unexpected Return

May 06, 2025

Roland Garros 2024 Venus Williams Unexpected Return

May 06, 2025 -

Game 7 Blow For Warriors Gary Payton Ii Sidelined By Illness

May 06, 2025

Game 7 Blow For Warriors Gary Payton Ii Sidelined By Illness

May 06, 2025 -

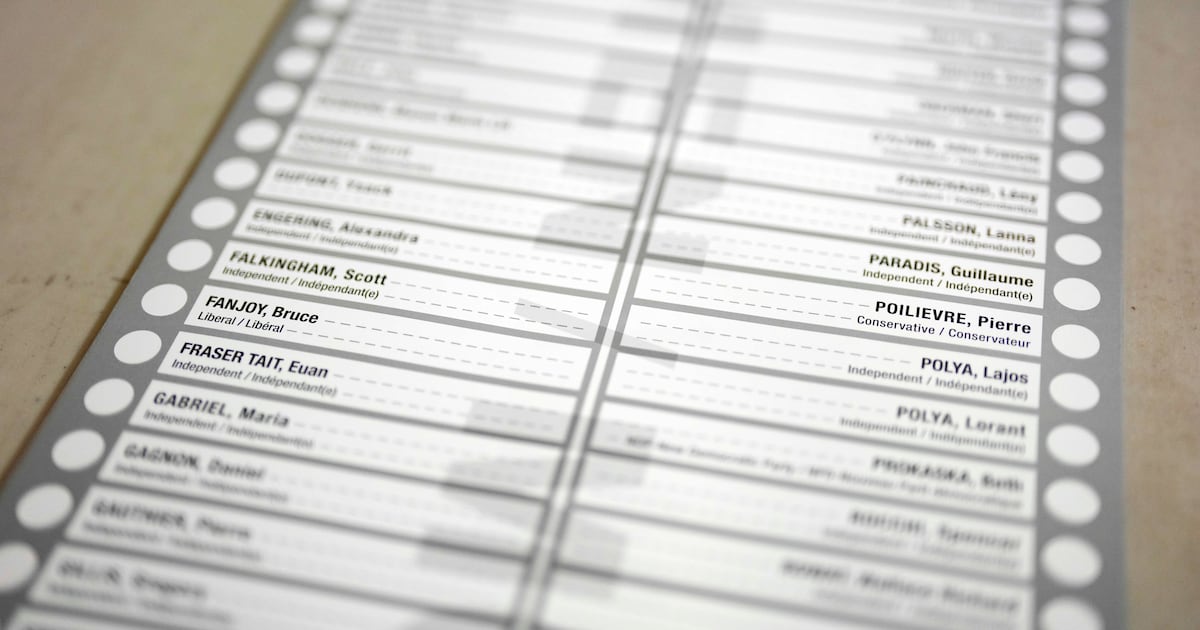

Alberta Byelection Protest Group Targets Poilievre With 200 Names

May 06, 2025

Alberta Byelection Protest Group Targets Poilievre With 200 Names

May 06, 2025 -

Quordle Game 1196 May 4th Hints And Answers To Beat The Puzzle

May 06, 2025

Quordle Game 1196 May 4th Hints And Answers To Beat The Puzzle

May 06, 2025 -

Cavaliers Star Guard Darius Garland Dealing With Concerning Toe Injury

May 06, 2025

Cavaliers Star Guard Darius Garland Dealing With Concerning Toe Injury

May 06, 2025

Latest Posts

-

Met Gala 2025 A Night Of Black Excellence And A Surprise Rihanna Pregnancy

May 06, 2025

Met Gala 2025 A Night Of Black Excellence And A Surprise Rihanna Pregnancy

May 06, 2025 -

Three Altcoins Facing Significant Token Releases In Early May 2025

May 06, 2025

Three Altcoins Facing Significant Token Releases In Early May 2025

May 06, 2025 -

Taiwan East Coast Hit By Earthquake Tremors Felt No Casualties Reported

May 06, 2025

Taiwan East Coast Hit By Earthquake Tremors Felt No Casualties Reported

May 06, 2025 -

Major Altcoin Token Unlocks May 2025s Key Dates

May 06, 2025

Major Altcoin Token Unlocks May 2025s Key Dates

May 06, 2025 -

Analyzing The Thunder Nuggets Nba Playoff Series A Breakdown Of The Key Factors

May 06, 2025

Analyzing The Thunder Nuggets Nba Playoff Series A Breakdown Of The Key Factors

May 06, 2025