Cryptocurrency's Tax Code: A 2014 Relic In A Modern Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency's Tax Code: A 2014 Relic in a Modern Market

The world of cryptocurrency has exploded since its nascent days, evolving from a niche digital curiosity to a multi-trillion dollar market impacting global finance. Yet, the tax code governing this volatile and innovative landscape remains stubbornly rooted in 2014, a relic ill-equipped to handle the complexities of decentralized finance (DeFi), NFTs, and the sheer volume of transactions now commonplace. This outdated framework presents significant challenges for both taxpayers and the Internal Revenue Service (IRS).

The 2014 IRS Guidance: A Foundation Built on Shifting Sands

In 2014, the IRS issued guidance classifying cryptocurrency as property, not currency. This seemingly simple classification has proven incredibly complex in practice. The inherent volatility of cryptocurrencies, coupled with the intricacies of staking, lending, airdrops, and the burgeoning DeFi ecosystem, renders the 2014 guidance inadequate for the modern landscape.

Key Challenges of the Outdated Tax Code:

-

Complex Tax Calculations: Determining the cost basis for each cryptocurrency transaction can be a monumental task, especially for active traders or those involved in complex DeFi interactions. The constant fluctuations in value necessitate meticulous record-keeping, a burden many individual investors struggle to manage.

-

Lack of Clarity on DeFi Interactions: The decentralized nature of DeFi protocols, with their complex smart contracts and automated transactions, presents significant challenges for tax reporting. The IRS has yet to provide clear and comprehensive guidance on how to properly report gains and losses from activities like yield farming, liquidity provision, and decentralized exchange (DEX) trading.

-

NFT Taxation: A Murky Landscape: Non-Fungible Tokens (NFTs) further complicate matters. Are they collectibles, artwork, or something else entirely? The tax implications vary wildly depending on the classification, leading to significant uncertainty and potential for misreporting.

-

Cross-Border Transactions: The global nature of cryptocurrency transactions poses additional difficulties for both taxpayers and tax authorities. Determining residency, reporting requirements, and the application of different tax laws across jurisdictions adds layers of complexity.

The Need for Updated Legislation and Regulatory Clarity:

Experts and industry stakeholders widely agree that the current tax code is unsustainable. The lack of clarity fosters non-compliance, hinders investment, and ultimately undermines the potential economic benefits of this burgeoning industry. The IRS needs to adapt its approach, providing clear, up-to-date guidance that accounts for the rapidly evolving nature of the cryptocurrency market. This includes:

-

Simplified Reporting Mechanisms: The IRS should explore streamlined reporting systems that automate parts of the tax calculation process, reducing the burden on individual taxpayers.

-

Clearer Definitions and Guidance: Comprehensive guidelines are crucial, particularly regarding DeFi interactions and NFT taxation. These guidelines should be easily accessible and understandable, avoiding overly technical jargon.

-

Increased Resources for Enforcement: The IRS needs adequate resources and specialized training to effectively enforce the existing regulations and address the complexities of crypto tax compliance.

The Future of Crypto Taxation:

The future of cryptocurrency taxation hinges on legislative action and proactive regulatory adaptation. Without significant updates, the 2014 tax framework will continue to lag behind the dynamic advancements in the cryptocurrency space. Failure to modernize could stifle innovation, create significant unfairness, and ultimately hinder the potential of this transformative technology. The need for clear, comprehensive, and modern cryptocurrency tax legislation is not just a matter of technical accuracy; it is a crucial element in ensuring responsible growth and fostering a fair and equitable market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency's Tax Code: A 2014 Relic In A Modern Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

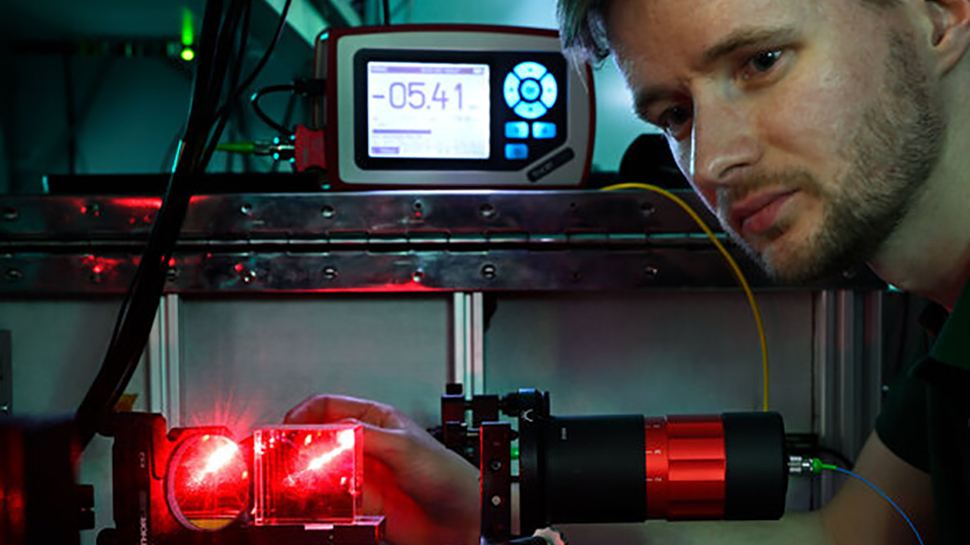

High Capacity Data Transmission Infrared Light Delivers Almost 2 Million Netflix Hd Streams Simultaneously

May 05, 2025

High Capacity Data Transmission Infrared Light Delivers Almost 2 Million Netflix Hd Streams Simultaneously

May 05, 2025 -

Will Sam Altman Or Elon Musk Win The Everything App Race

May 05, 2025

Will Sam Altman Or Elon Musk Win The Everything App Race

May 05, 2025 -

Rethinking Stonehenge Sourcing The Massive 3 Ton Stones

May 05, 2025

Rethinking Stonehenge Sourcing The Massive 3 Ton Stones

May 05, 2025 -

Who Killed Vron In Mob Land Conrads Shocking Confession

May 05, 2025

Who Killed Vron In Mob Land Conrads Shocking Confession

May 05, 2025 -

Whats Open In Brisbane This Labour Day

May 05, 2025

Whats Open In Brisbane This Labour Day

May 05, 2025