Cryptocurrency's Tax Code Lags Behind Its Rapid Evolution

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency's Tax Code Lags Behind Its Rapid Evolution: Navigating the Uncertainties of Digital Asset Taxation

The meteoric rise of cryptocurrencies has left tax laws scrambling to keep pace. While Bitcoin, Ethereum, and thousands of other digital assets have revolutionized finance, the regulatory landscape, particularly concerning taxation, remains a patchwork of outdated rules and ambiguous interpretations. This lag creates significant challenges for both taxpayers and tax authorities alike.

The rapid evolution of the crypto market, characterized by decentralized finance (DeFi), non-fungible tokens (NFTs), and the emergence of new blockchain technologies, has outstripped the capacity of existing tax codes to adequately address the unique complexities involved. This mismatch creates uncertainty, leading to potential non-compliance and hindering the wider adoption of cryptocurrencies.

The Core Problems:

- Lack of Clear Definitions: Many tax codes struggle to define cryptocurrencies accurately. Are they property, currency, or something else entirely? This ambiguity makes it difficult to determine the appropriate tax treatment for various transactions.

- Complex Transaction Tracking: The decentralized nature of blockchain transactions makes tracking and reporting crypto activity challenging. The sheer volume of transactions, coupled with the anonymity offered by some platforms, further complicates matters.

- Difficulty Valuing Crypto Assets: Determining the fair market value of cryptocurrencies at the time of purchase, sale, or exchange can be problematic, particularly for less established assets with volatile price fluctuations. This presents a significant hurdle in accurately calculating capital gains or losses.

- Cross-Border Transactions: International crypto transactions further complicate tax reporting, especially when dealing with different jurisdictions with varying tax regulations.

The Implications:

The lack of clarity in cryptocurrency taxation has several significant implications:

- Increased Risk of Non-Compliance: Taxpayers may inadvertently fail to comply with existing tax laws due to the lack of clear guidelines, leading to penalties and legal repercussions.

- Inhibited Investment: Uncertainty surrounding crypto taxation can deter potential investors who are hesitant to navigate complex and potentially ambiguous rules.

- Challenges for Tax Authorities: Tax agencies struggle to effectively collect taxes on cryptocurrency transactions, leading to potential revenue loss and enforcement difficulties.

What's Being Done (and What Needs to Be Done):

Several countries are attempting to address these issues through legislative changes and updated guidelines. However, the rapid pace of innovation in the crypto space requires a more agile and adaptable approach.

- International Collaboration: Greater international cooperation is crucial to establishing consistent tax standards for cross-border crypto transactions.

- Clearer Regulatory Frameworks: Tax authorities need to provide clear and concise guidelines on the tax treatment of various crypto activities, including staking, DeFi lending, and NFT sales.

- Technological Solutions: Exploring the use of blockchain technology itself to improve tax reporting and compliance could enhance transparency and efficiency.

- Educating Taxpayers: Increased public awareness and education are vital to ensure taxpayers understand their responsibilities concerning crypto taxation.

The future of cryptocurrency taxation hinges on a collaborative effort between lawmakers, tax authorities, and the crypto industry itself. Addressing the existing shortcomings and embracing innovative solutions are crucial steps towards creating a more transparent, efficient, and effective tax system for the digital age. The ongoing evolution of cryptocurrency demands a similarly dynamic approach to tax policy, ensuring that the legal framework keeps pace with technological advancements and fosters responsible growth in this rapidly evolving sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency's Tax Code Lags Behind Its Rapid Evolution. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reality Tv Redemption An Interview With The Masked Singers Mad Scientist

May 08, 2025

Reality Tv Redemption An Interview With The Masked Singers Mad Scientist

May 08, 2025 -

Ligue Des Champions Le Role Crucial De Luis Enrique Selon Achraf Hakimi

May 08, 2025

Ligue Des Champions Le Role Crucial De Luis Enrique Selon Achraf Hakimi

May 08, 2025 -

Can Al Hilal Overcome Al Raed Key Saudi Pro League Clash

May 08, 2025

Can Al Hilal Overcome Al Raed Key Saudi Pro League Clash

May 08, 2025 -

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025

Mark Daigneault Discusses Strategic Fouling And 3 Point Shooting Probabilities

May 08, 2025 -

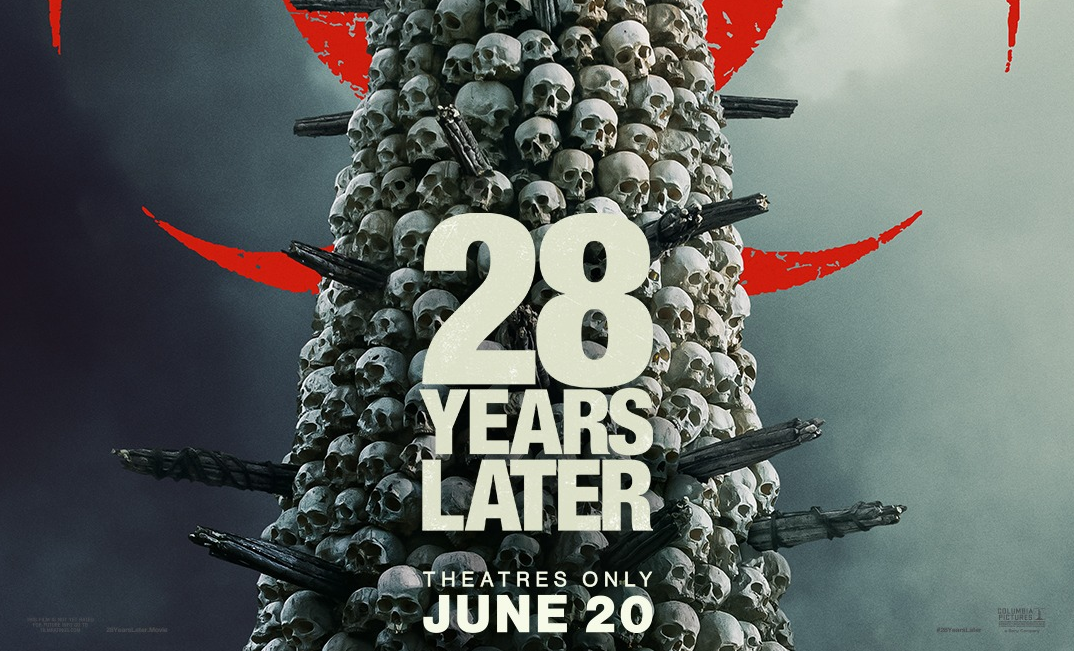

Intriguing New Poster For 28 Years Later Showcases Bone Temple Location

May 08, 2025

Intriguing New Poster For 28 Years Later Showcases Bone Temple Location

May 08, 2025

Latest Posts

-

Impressive Trading Figures Ragnarok Online Web3 Spin Off Exceeds 1 M Ron

May 08, 2025

Impressive Trading Figures Ragnarok Online Web3 Spin Off Exceeds 1 M Ron

May 08, 2025 -

Eerie Silence Descends On Kashmir As India Pakistan Border Tensions Rise

May 08, 2025

Eerie Silence Descends On Kashmir As India Pakistan Border Tensions Rise

May 08, 2025 -

Six Week Window For U S Expats To File Taxes And Claim 1 400

May 08, 2025

Six Week Window For U S Expats To File Taxes And Claim 1 400

May 08, 2025 -

Denver Nuggets Defeat Oklahoma City Thunder In May 7 2025 Matchup

May 08, 2025

Denver Nuggets Defeat Oklahoma City Thunder In May 7 2025 Matchup

May 08, 2025 -

Can The Okc Thunder Overcome Game 1 Setback

May 08, 2025

Can The Okc Thunder Overcome Game 1 Setback

May 08, 2025