Cryptocurrency's Tax System: A 2014 Relic In A Modern Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cryptocurrency's Tax System: A 2014 Relic in a Modern Market

The cryptocurrency market has exploded since its nascent days, transforming from a niche interest to a global phenomenon impacting finance, technology, and even art. Yet, the tax systems governing this volatile and innovative asset class remain largely stuck in 2014 – a relic of a time when Bitcoin was largely unknown and the complexities of DeFi were unimaginable. This outdated framework presents significant challenges for both individual investors and the broader financial landscape.

The 2014 Precedent and its Limitations:

In 2014, the IRS issued guidance classifying cryptocurrency as property, not currency. This seemingly straightforward classification has proven incredibly complex to apply in practice. The implications are far-reaching, impacting everything from capital gains taxes on trading profits to the tax implications of staking, lending, and the myriad activities within the DeFi (Decentralized Finance) space. The problem lies in the significant differences between traditional property and the dynamic nature of crypto assets.

- Volatility: The extreme price fluctuations inherent in cryptocurrencies make accurate tax reporting incredibly challenging. Determining the cost basis for each transaction, especially with frequent trading, can be a logistical nightmare.

- DeFi Complexity: Decentralized finance protocols introduce a layer of complexity absent in traditional markets. Activities like yield farming, liquidity provision, and borrowing/lending generate taxable events that are difficult to track and report using current regulations.

- NFT's and Metaverse Assets: Non-fungible tokens (NFTs) and metaverse assets further complicate matters. Are they collectibles? Are they investments? The lack of clear guidance leaves taxpayers in a precarious position.

- Cross-Border Transactions: The borderless nature of cryptocurrency makes international tax compliance particularly difficult, with differing regulations across jurisdictions creating a minefield for investors.

The Need for Modernization:

The current tax system, built on a 2014 understanding of cryptocurrency, is woefully inadequate for the modern market. This outdated approach creates several critical issues:

- Increased Compliance Burden: The intricate reporting requirements place an undue burden on taxpayers, particularly those with significant crypto holdings or involvement in DeFi.

- Tax Evasion Concerns: The complexity of the system makes it easier for individuals to underreport or avoid paying taxes altogether, leading to significant revenue losses for governments.

- Market Uncertainty: The lack of clarity discourages institutional investment and hinders the overall growth of the cryptocurrency market.

What Needs to Change?

Significant reform is urgently needed to bring cryptocurrency taxation into the 21st century. This requires:

- Clearer Guidelines: The IRS and other tax authorities need to provide more detailed and accessible guidance on the tax implications of various crypto activities, especially within DeFi.

- Streamlined Reporting: Developing user-friendly reporting mechanisms that integrate with cryptocurrency exchanges and wallets would significantly reduce the compliance burden.

- International Collaboration: Harmonizing tax regulations across different countries would simplify compliance for international investors and improve global tax enforcement.

- Technology Integration: Leveraging blockchain technology itself to track transactions and automate tax reporting could offer a more efficient and secure system.

The current cryptocurrency tax system is a significant hurdle to the industry's growth and poses challenges for both taxpayers and governments. Modernizing this outdated framework is not merely desirable; it's essential for fostering innovation, ensuring fair tax collection, and unlocking the full potential of the cryptocurrency market. The longer we wait, the greater the risk of exacerbating the existing problems and creating even bigger challenges in the future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cryptocurrency's Tax System: A 2014 Relic In A Modern Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

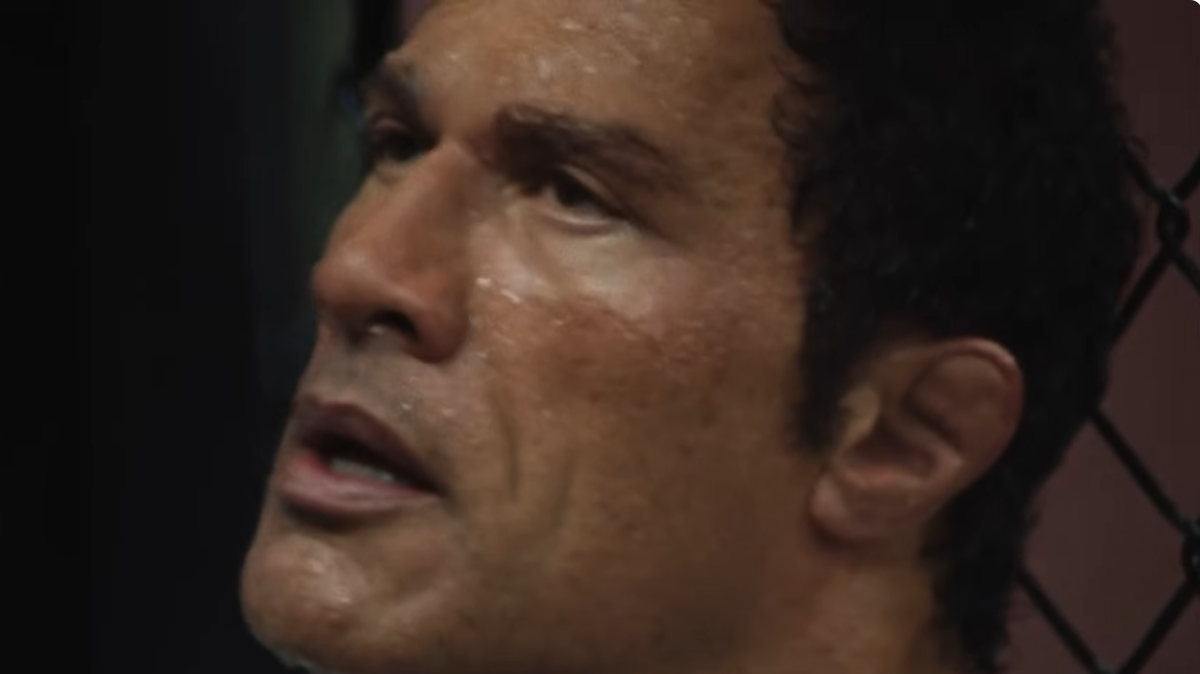

The Rocks Smashing Machine New Trailer Shows Intense Ufc Fight Scenes

Apr 30, 2025

The Rocks Smashing Machine New Trailer Shows Intense Ufc Fight Scenes

Apr 30, 2025 -

National League Cup Final Preview Can Sutton United Upset Leeds

Apr 30, 2025

National League Cup Final Preview Can Sutton United Upset Leeds

Apr 30, 2025 -

Political Violence Aoc Addresses Death Threats Following Baseball Teams Video

Apr 30, 2025

Political Violence Aoc Addresses Death Threats Following Baseball Teams Video

Apr 30, 2025 -

Jeremy Renners Near Fatal Snowplow Accident A Fight For Life

Apr 30, 2025

Jeremy Renners Near Fatal Snowplow Accident A Fight For Life

Apr 30, 2025 -

Dwayne The Rock Johnsons 40 Million Project A New Look And Unexpected Partnership With Usyk

Apr 30, 2025

Dwayne The Rock Johnsons 40 Million Project A New Look And Unexpected Partnership With Usyk

Apr 30, 2025

Latest Posts

-

Al Nassr Face Asian Semi Final Coach Piolis Pre Match Assessment

May 01, 2025

Al Nassr Face Asian Semi Final Coach Piolis Pre Match Assessment

May 01, 2025 -

Sabalenkas Winning Streak Continues Madrid Quarterfinal Berth Secured

May 01, 2025

Sabalenkas Winning Streak Continues Madrid Quarterfinal Berth Secured

May 01, 2025 -

Boeings 737 Max And Other Planes Re Entry Into Service After Chinas Halt

May 01, 2025

Boeings 737 Max And Other Planes Re Entry Into Service After Chinas Halt

May 01, 2025 -

Can Kawasaki Frontale Upset Ronaldos Al Nassr Club World Cup Preview

May 01, 2025

Can Kawasaki Frontale Upset Ronaldos Al Nassr Club World Cup Preview

May 01, 2025 -

Limak Construction Awarded Luton Town Football Clubs Stadium Project

May 01, 2025

Limak Construction Awarded Luton Town Football Clubs Stadium Project

May 01, 2025